Crypto recaptures $2T market cap as Bitcoin climbs above $57,000

The cryptocurrency market has more than doubled in recent months, led by Bitcoin’s surge.

The total crypto market capitalization has reclaimed the $2 trillion level for the first time since April 2022 as positive market sentiment and consistent inflows into spot Bitcoin (BTC) exchange-traded funds (ETFs) pushed BTC’s price higher.

A rally in Bitcoin’s price brought the world’s largest cryptocurrency by market cap to a multiyear high of $57,513, while Ether (ETH) enjoyed a 7% pump to rest at $3,270 at the time of writing.

Other top altcoins were also flashing green, with Solana’s SOL (SOL) gaining 9% over the last 24 hours to hit $110. XRP (XRP), Cardano’s ADA (ADA) and Avalanche’s AVAX (AVAX) were up 5.3%, 7%, and 6.5%, respectively, over the same period. The 10th-placed Dogecoin (DOGE) enjoyed double-digit gains, climbing 15% to $0.09779.

Their combined efforts have culminated in a 7.7% rally to the global crypto market value, lifting it to a 22-month high of $2.14 trillion, according to data from CoinMarketCap.

To put it into perspective, the crypto market is now some $33 billion bigger than Amazon and $42 billion larger than Google parent Alphabet.

The crypto market has more than doubled within a few months

Crypto enthusiasts on the X were quick to celebrate the return to the $2 trillion mark, with some, such as The Kobeissi Letter, asking whether “new all-time highs are ahead for Bitcoin.”

BREAKING: #Bitcoin is now trading above $56,000 for the first time since November 2021.

Bitcoin is up over 250% from its 2022 low, adding $700 billion in value in less than 2 years.

The total market cap of the crypto market is now at $2.25 trillion, more than double its recent… pic.twitter.com/bwWrASbbRY

— The Kobeissi Letter (@KobeissiLetter) February 27, 2024

Commentators at The Kobeissi Letter noted that total crypto market capitalization has “more than doubled from its recent low” of $978 billion reached on Sept. 11, 2023.

Independent technical analyst Crypto Damus spotted the crypto market cap at $2.06 trillion, saying it was approaching a critical resistance level.

He shared the following chart with his over 36,000 followers on X, wondering what new price discoveries would be with just 50% to go until the $3 trillion all-time high is regained.

Popular analyst Voice of Crypto posted a chart showing all the major cryptocurrencies trading in the green, terming the move above $2 trillion in total market cap as “extraordinary.”

Daily Market Report

The #crypto market’s performance has been extraordinary today, considering how the total market cap is above the $2 trillion mark, and now sits at around $2.13 trillion. Take a look at all this green.#VOC #VoiceOfCrypto #BTC #ETH #cryptocurrency pic.twitter.com/yfXJh2LJlP

— Voice of Crypto (@VoiceofCrypto2) February 27, 2024

Positive market sentiments back crypto prices

The rallying market is basking in bullish market sentiment, given that the Fear & Greed Index is showing “extreme greed” at 79 on Feb. 27, according to data from Alternative.

The index was last in the “extreme greed” zone in November 2021, when the price of the pioneer cryptocurrency reached an all-time high of $69,000.

During strong rallies, the index will likely remain in the “extreme greed” zone for an extended period. However, Alternative warns, “When investors are getting too greedy, that means the market is due for a correction.”

Related: Spot Bitcoin ETFs accumulate 300K BTC as net inflow rises to $6B

Market analyst Bitcoin Suisse posted the chart below showing the market sentiment also in the “extreme greed” territory at 79, saying:

“Crypto and equities are continuing to trade at multi-year or all-time highs, and both are currently in extreme greed levels when it comes to market sentiment.”

Crypto market rally driven by inflows into crypto products

The rally in the wider crypto market is led by Bitcoin, which has seen strong demand on the back of spot ETFs. At the same time, outflows from the Grayscale Bitcoin Trust (GBTC) hit the lowest volume ever of $22 million.

Data from Farside Investors shows slowing outflows from GBTC for the third consecutive day on Feb. 26. The converted Bitcoin ETF ended the trading week on Feb. 23 with a net outflow of $44.2 million, which further halved on Feb. 26.

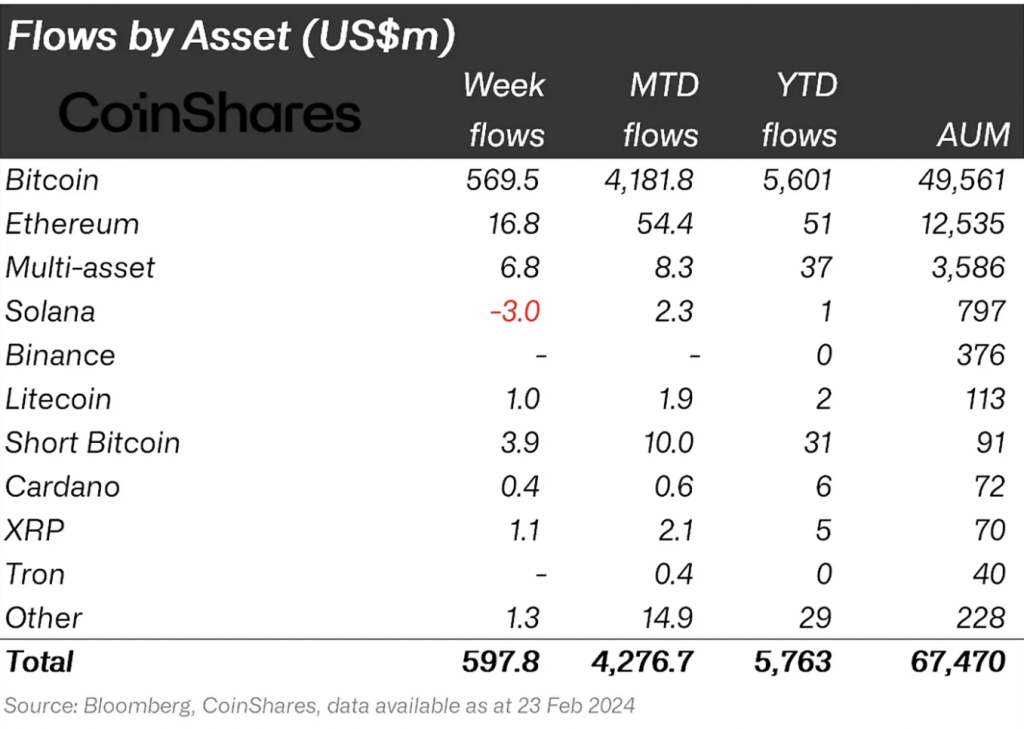

According to CoinShares’ reporting, BTC investment products recorded 99% of all crypto fund inflows last week. Bitcoin welcomed $569.5 million in fund inflows, bringing the total global assets under management to $67.5 billion.

Additionally, Bitcoin ETFs continue to see inflows totaling $5.5 billion since their market debut on Jan. 11, according to data from Yahoo Finance. Overall, the crypto products have taken in a net of $5.8 billion since they began trading, according to CoinShares.

The Bitcoin ETFs are also rallying alongside BTC’s price, with BlackRock’s iShares Bitcoin ETF at position “#5 of the 3,400 ETFs & well ahead of @Vanguard_Group‘s top ETF, $VOO” according to ETF analyst HODL15Capital.

Massive trading volume for Bitcoin ETFs today$IBIT is #5 of the 3,400 ETFs & well ahead of @Vanguard_Group ‘s top ETF, $VOO $FBTC is also very strong. Let’s go $BTC pic.twitter.com/dbgJoleki9

— HODL15Capital (@HODL15Capital) February 27, 2024

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses