Bitcoin’s funding rate turns negative, but have traders turned bearish?

Bitcoin price continues to soften, but $251 million in inflows to the spot Bitcoin ETFs is a show of the markets’ strength.

Bitcoin (BTC) marked its highest daily close in over two years on Feb. 20, but the $52,500 resistance posed a tougher challenge than expected, resulting in a rejection below $51,000 on Feb. 23.

The Bitcoin futures contracts’ funding rate briefly showed an excess of demand for short positions on Feb. 22, sparking speculation of potential further bearish momentum.

Considering Bitcoin posted a 33.5% year-to-date gain in 2024, bears have little cause for celebration, but some analysts believe that the $1 trillion market capitalization at $50,930 may represent a local top. While this level lacks inherent significance beyond being a round number, it has garnered attention from mainstream media, potentially instigating fear among investors.

Spot Bitcoin ETF inflow will likely dictate BTC’s price

Various rationales have been put forth by analysts and traders to explain a potential Bitcoin correction, ranging from Relative Strength Index (RSI) divergences, detachment from Bitcoin-related stocks, and a historical lack of bullish momentum 60 days ahead of the halving, to the fact that around 2.5% of the supply was likely purchased near the $51,500 level.

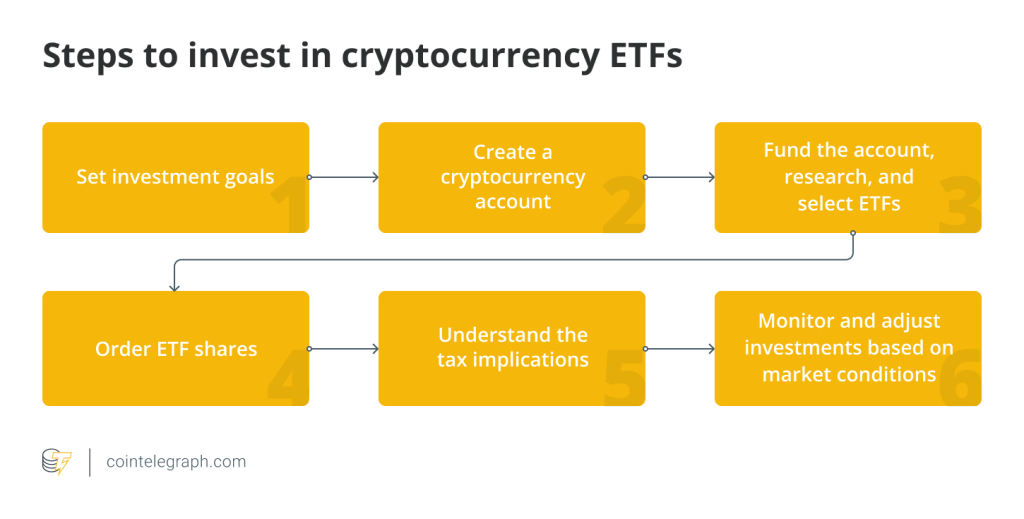

However, none of these hypotheses should carry weight if the net inflow to the spot Bitcoin exchange-traded fund (ETF) persists. On Feb. 22, the net inflow on U.S.-listed Bitcoin ETFs amounted to $251 million, reversing the $36 million outflow observed on the previous day.

Predicting demand for Bitcoin ETFs is nearly impossible, so attention should shift to trading metrics to assess if traders are leaning bearish after multiple failed attempts to sustain prices above $52,500. Perpetual contracts, also referred to as inverse swaps, incorporate an embedded rate recalculated every eight hours. In essence, a negative rate indicates a preference for higher leverage being utilized by shorts (sellers).

Notice that Bitcoin’s 8-hour funding rate briefly turned negative on Feb. 22 and last stood above 0.02% (or 1.3% per month), signaling a lack of demand for leverage longs (buyers). However, fluctuations in funding rates are not uncommon as market makers pursue profit through rate arbitrage, taking advantage of specific snapshot times.

Related: How to buy USD Coin (USDC) in the United States

Retail investors’ demand for Bitcoin is a lagging indicator

To confirm whether the absence of demand for leverage longs accurately reflects the market’s condition, one must cross-reference the data with other indicators, such as the demand for stablecoins in China, a significant signal for retail entry or exit from crypto markets.

The USD Coin (USDC) stablecoin premium versus the official yuan rate in China has maintained a robust level above 2% since Feb. 12, recently reaching a peak of 3.5%. This serves as a reliable proxy for retail money entering cryptocurrencies. However, it cannot be denied that the last time the BTC 8-hour funding rate stood above 0.03% (1.9% per month) was on Jan. 2. Consequently, retail traders using leverage missed the entire 30% gain from $40,000 to $52,200 in the 30 days leading to Feb. 20.

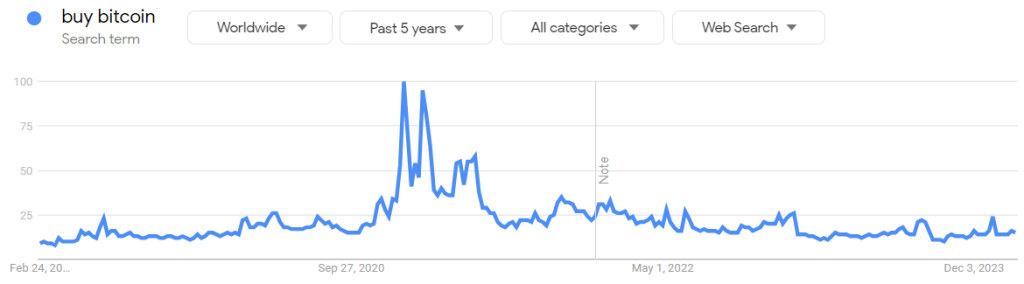

Google search trends for ‘buy Bitcoin’ confirm the lack of interest from retail traders despite the recent price gains. On the flip side, this data provides evidence that the potential entrance of a new wave of investors driven by FOMO remains possible.

The peak interest in the past 5 years occurred in the week ending Jan. 9, 2021, after Bitcoin’s price had already surged by 150% in two months. This underscores the idea that the absence of demand for leverage longs using Bitcoin perpetual futures doesn’t necessarily indicate bearish sentiment or a lack of interest from retail. In the end, the slightly negative futures funding rate for Bitcoin futures shouldn’t overly concern bullish investors.

Responses