SEC seeks comments on Bitwise, Grayscale Bitcoin ETF options

The U.S. SEC is seeking comments on a proposed rule change that would allow investors to trade options on Bitwise and Grayscale Bitcoin ETFs.

The United States Securities and Exchange Commission (SEC) is seeking comments on a proposed rule change that allows the listing and trading of options for Bitcoin exchange-traded funds (ETFs).

According to a Feb. 23 notice, the NYSE requested a rule change to permit the listing and trading options on the Bitwise Bitcoin ETF (BITC), the Grayscale Bitcoin Trust (GBTC), and “any trust that holds Bitcoin.”

If approved, the options will trade “in the same manner as options on other ETFs (including commodities ETFs) on the Exchange,” reads the notice. This includes regulations such as listing criteria, expiration dates, strike prices, minimum price changes, position and exercise limits, margin requirements, and procedures for customer accounts and trading suspensions.

BlackRock is also seeking approval for a similar policy change. The asset manager filed for rule revisions to listed options on its Bitcoin ETF in collaboration with the Chicago Board Options Exchange (CBOE). Bloomberg ETF analyst James Seyffart predicts the SEC’s decision could come by September 2024 at the latest.

The SEC has already acknowledged the 19b-4’s requesting the ability to trade options on spot #Bitcoin ETFs. This is faster than SEC typically moves. Options could be approved before end of February if SEC wants to move fast?…

AT ABSOLUTE EARLIEST options still ~27+ days away pic.twitter.com/ohbvHgP2uO

— James Seyffart (@JSeyff) January 19, 2024

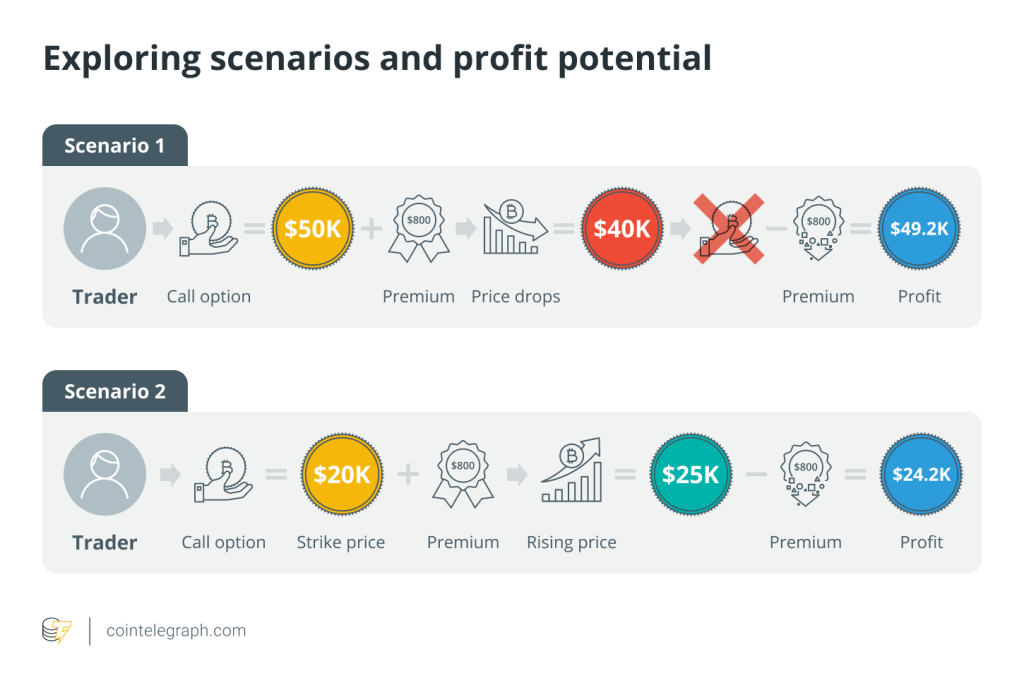

Options are used for portfolio hedging, income, or speculative purposes. Options are financial derivatives products that give buyers the right, but not the obligation, to buy or sell a certain asset at a specified price at a certain date.

In the context of Bitcoin ETFs, options would allow investors to hedge or speculate on the price movements of a BTC ETF rather than the Bitcoin itself. The SEC has approved other commodity ETFs held by trusts before, including, including the SPDR Gold Trust, iShares COMEX Gold Trust, iShares Silver Trust, and ETFS Gold Trust.

“In addition, the Exchange represents that its existing surveillance procedures are adequate to properly monitor the trading of options on Bitcoin ETPs in all trading sessions and to deter and detect violations of Exchange rules. The Exchange further represents that it will implement new surveillance procedures, as necessary, to effectively monitor the trading of options on Bitcoin ETPs.”

Grayscale CEO Michael Sonnenshein has been publicly advocating for regulators to approve the crypto derivatives products. According to the executive, options are good for investors as they support “price discovery and can help investors better navigate market conditions or achieve desired outcomes, such as generating income.”

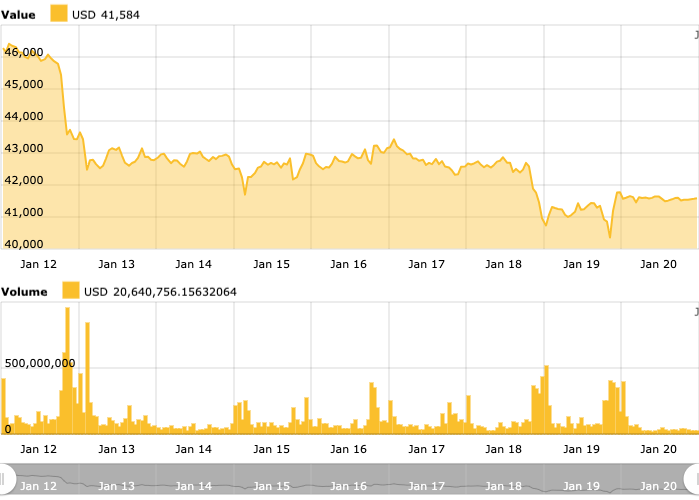

Similarly to other investments and financial products, options trading carries risks that may not be suitable for all investors. The SEC approved the trading of spot Bitcoin ETFs on Wall Street on Jan. 10, following years of denials.

Magazine: Bitcoin ETF guru Eric Balchunas has the last laugh at doubters: X Hall of Flame

Responses