BlackRock, Fidelity ETFs see largest debut month of any ETF in 30 years

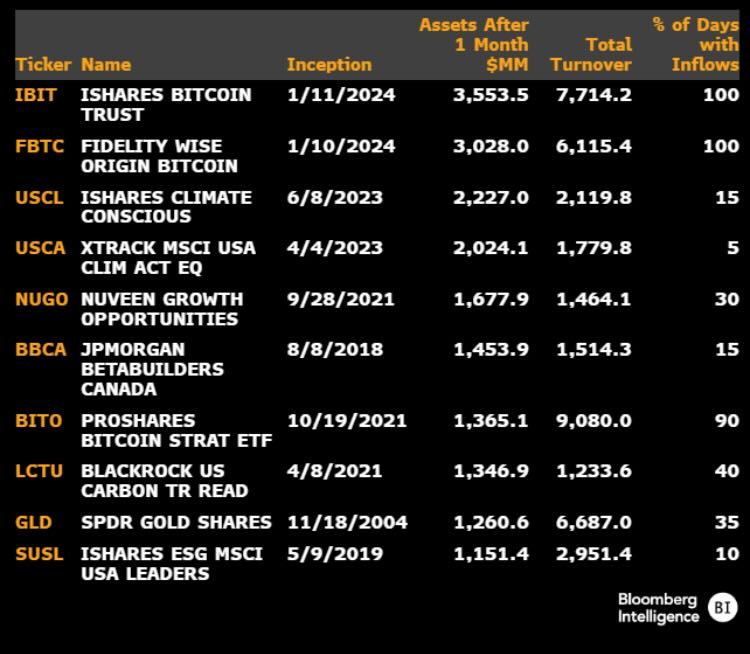

Out of 5,535 “newborn” ETFs that launched in the United States over the last 30 years, only two have acquired over $3 billion in assets in the first month.

BlackRock and Fidelity’s spot Bitcoin exchange-traded funds have tallied more assets in their first month of trading than any ETF launched in the United States over the last 30 years.

Bloomberg Intelligence data shows BlackRock’s IBIT and Fidelity’s FBTC have each secured more than $3 billion in assets in the first 17 trading days, the only ones to do so out of a list of over 5,500 ETFs.

IBIT and FBTC are in a “league of [their] own,” said Bloomberg ETF analyst Eric Balchunas in a Feb. 8 post on X.

Here's a look at the Top 25 ETFs by assets after 1 month on the market (out of 5,535 total launches in 30yrs). $IBIT and $FBTC in league of own w/ over $3b each and they still have two days to go. $ARKB and $BITB also made list. pic.twitter.com/Yyi1nxukUk

— Eric Balchunas (@EricBalchunas) February 8, 2024

Before the launch of spot Bitcoin ETFs, BlackRock’s iShares Climate Conscious & Transition MSCI USA ETF — which launched on June 8, 2023 — was the leader with the most AUM in its debut month at $2.2 billion.

Balchunas said BlackRock and Fidelity’s Bitcoin ETF results are even more impressive as most other ETFs that ranked on the list were “BYOA” or “Bring Your Own Assets” type of ETFs — meaning one investor was behind all of the ETF’s assets under management.

BlackRock and Fidelity’s ETFs on the other hand, have seen inflows every single trading day since launch, which Balchunas described as: “Literally unprecedented.”

The ARK 21Shares’s spot Bitcoin ETF (ARKB) and Bitwise (BITB) spot Bitcoin ETFs also made the top 25, landing 20th and 22nd, respectively. ProShares Bitcoin Strategy ETF — which launched as a futures product in October 2021 — also made the list in seventh place.

Balchunas noted that the Bloomberg Intelligence data filtered out ETFs that underwent a conversion, such as Grayscale’s GBTC, and about 100 mutual funds that converted to ETFs.

“There won’t be any demand.”

Spot bitcoin ETFs now represent *4* of top 25 ETF launches after 1mo on market in 30+yr industry history.

IBIT & FBTC now #1 & #2 overall. https://t.co/Z6yrbgWRGk

— Nate Geraci (@NateGeraci) February 8, 2024

Balchunas acknowledged the mass outflows from Grayscale’s Bitcoin ETF have been a “factor” in flow performance of the spot Bitcoin ETFs and that some of those ETFs may have had seed funding, But that that’s not enough to “write any of this off.”

“I think the real unseen force here is competition. 10 ETFs launching on same day w/ some stud issuers just made everyone hustle their ass off.”

Related: ‘Substitution’ of gold for Bitcoin is now underway, says Cathie Wood

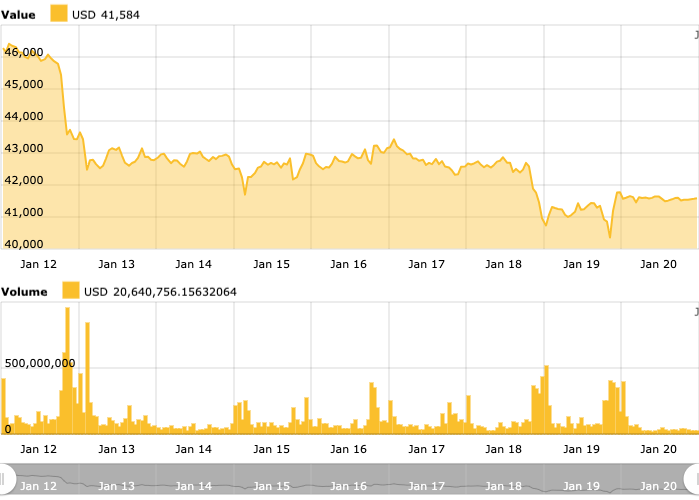

Meanwhile, IBIT and FBTC’s performance also stands out against some of the largest ETFs by flows this year.

According to Bloomberg data, BlackRock’s Bitcoin ETF sits in fifth place, citing from Feb. 5 figures. FBTC isn’t far behind either, sitting in eighth position.

Only three broad index funds tracking the S&P 500 and Vanguard’s Total Stock Market ETF have surpassed IBIT.

Responses