Crypto greed index hits highest level since Bitcoin’s $69K ATH

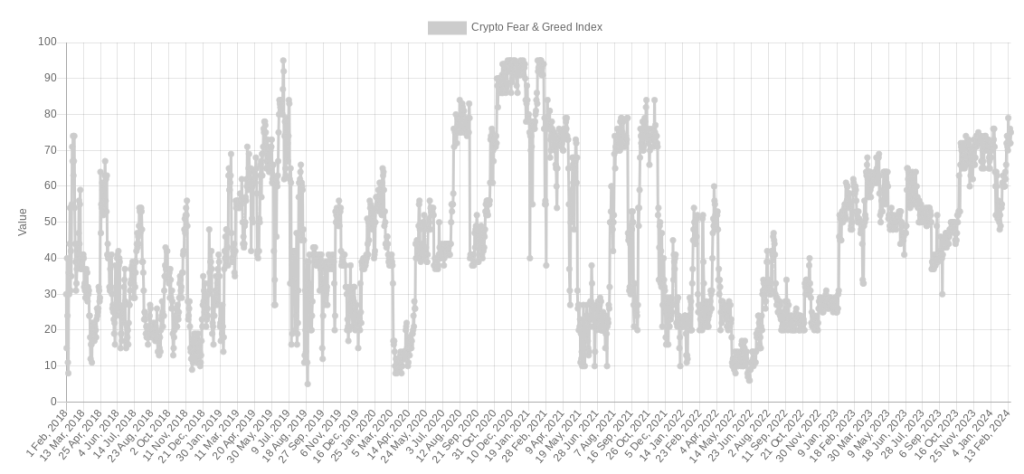

The last time the Crypto Fear and Greed Index scored 79 was in mid-November 2021 when Bitcoin was on track to hit $69,000.

The Crypto Fear and Greed Index, a major tool tracking the market sentiment in cryptocurrency markets, has hit highs not seen since Bitcoin (BTC) reached its all-time highs (ATH).

According to data on the website Alternative.me, the Crypto Fear and Greed Index surged as high as 79 on Feb. 13, reaching its highest level since mid-November 2021, when Bitcoin price peaked at $69,000.

The latest spike of greed in the Crypto Fear and Greed Index came shortly after Bitcoin passed $50,000 on Feb. 12. The cryptocurrency has been seeing a solid rally over the past few months, adding about 13% to its value year-to-date, according to data from CoinGecko.

Hitting 79 points for the first time in more than two years means the Crypto Fear and Greed Index has moved into the “extreme greed” zone, which happens when the value of the index exceeds 74.

The Crypto Fear and Greed Index previously touched extreme green at 76 on Jan. 11 amid the hype of the spot Bitcoin (BTC) exchange-traded funds (ETF) launch in the United States.

The ongoing Bitcoin rally and the new spike of greed comes a month after the U.S. spot Bitcoin ETF launch, potentially signaling that short-term selling associated with the ETF approval news is now over. In late 2023, ARK Invest CEO Cathie Wood predicted that some investors would “sell the news” of spot Bitcoin ETF approval in the short term.

“That would be very short-term because what we think is going to happen here is that the SEC is going to be giving the spot Bitcoin ETF the green light for institutional investors to participate,” Wood stated.

Related: Bitcoin looks to surpass Meta in total value as crypto climbs

The Crypto Fear and Greed Index is calculated based on signals that impact the behavior of traders and investors, including Google Trends, surveys, market momentum, market dominance, social media and market volatility. The index comprises 25% of the market volatility level, 25% of market momentum, and 15% of social media trends and other indicators.

Despite the Crypto Fear and Greed Index providing insights into the state of the crypto market, individual traders or investors are recommended to still do their research concerning the tools suitable for their investment goals.

Responses