Coinbase to soon charge conversion fees above $75M monthly volume

An exception will be made for Tier 1 and Tier 2 Coinbase Exchange Liquidity Program members.

The largest United States-based crypto exchange, Coinbase, has introduced commission fees for conversions from USDC to USD, exceeding $75 million. An exception will be made for Tier 1 and Tier 2 Coinbase Exchange Liquidity Program members.

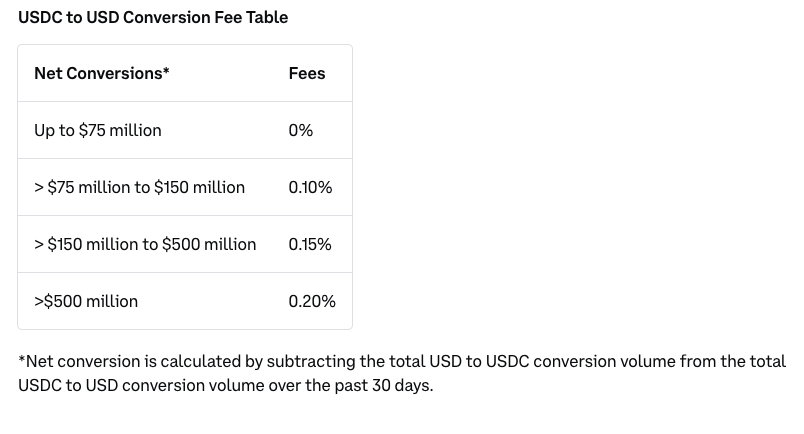

The announcement of conversion fees appeared on the Coinbase help page on Jan. 30. According to the page, from Feb. 5, Coinbase will begin assessing a fee on USDC to USD net conversions over $75 million per rolling 30-day period.

A customer will pay 0.10% for a monthly volume between $75 million and $150 million. The fee for transaction volume between $150 million and $500 million will be 0.15%, while the maximum rate of 0.20% will be applied to volume exceeding $500 million. All the fees will be assessed directly from the USDC to USD conversion amount.

As explained by Coinbase in the announcement, net conversion is calculated by subtracting the total USD to USDC conversion volume from the total USDC to USD conversion volume over the past 30 days.

Related: Coinbase addresses Geth dominance concerns with client diversity

On Jan.23, JPMorgan analysts downgraded Coinbase’s stock to an “underweight” rating, citing the falling price of Bitcoin and listing shares of spot BTC exchange-traded funds. On Jan. 25, the company’s stock price reached a monthly low of $121. It sits at $132.82 at the time of writing, still almost 20% lower than at the beginning of the month.

Nevertheless, the exchange remains one of the principal advocates for the crypto market in the United States. On Jan. 22, Coinbase publicly replied to the U.S. Treasury Department’s Financial Crimes Enforcement Network’s (FinCEN) proposition to tighten the scrutiny over crypto mixers, calling it “a waste of time.”

Coinbase’s nonprofit advocacy organization, Stand with Crypto, has been actively tracking the crypto stance among U.S. lawmakers, recently counting up to 18 crypto-friendly Senators.

The company is also leading its own legal battle against the Securities and Exchange Commission (SEC). The SEC filed a lawsuit against Coinbase on June 6, 2023, alleging the crypto exchange violated federal securities laws. However, according to analysts, Coinbase has a 70% chance of securing a complete dismissal of the lawsuit.

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] There you will find 38625 more Info on that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] There you can find 13263 additional Info to that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/bitcoin/3868/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/bitcoin/3868/ […]