Fidelity Bitcoin ETF rakes in reported $208M, offsetting Grayscale outflows alone

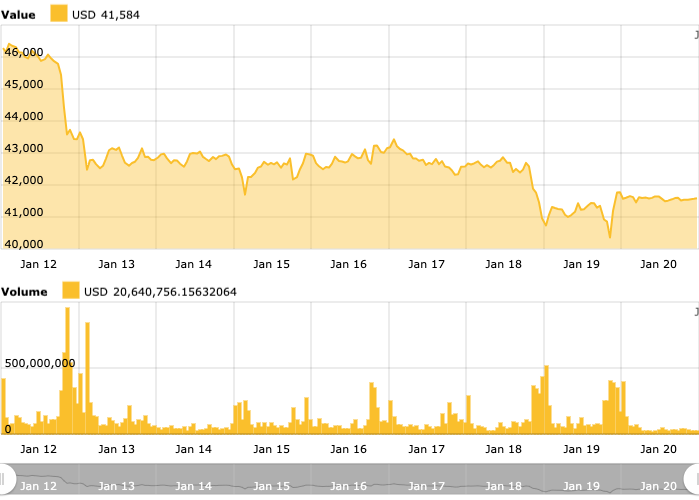

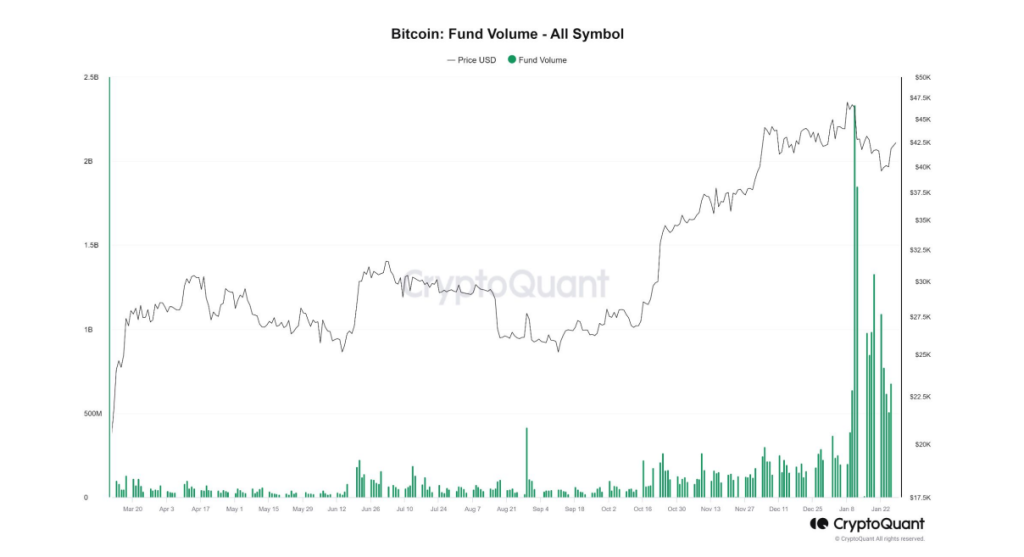

Outflows from Grayscale’s Bitcoin fund slowed for the fifth day in a row, while Fidelity’s spot Bitcoin ETF saw one of its stronger inflow days since launch.

Fidelity’s spot Bitcoin (BTC) exchange-traded fund (ETF) has reportedly managed to pull in $208 million in daily inflows on Jan. 29, outstripping outflows from Grayscale Bitcoin Trust for the first time outside their launch day.

According to provisional data from Farside Investors, Fidelity’s FBTC raked in $208 million in inflows on Monday, compared to the $192 million outflowed from the GBTC — the lowest daily outflows outside of its re-launch, per BitMEX Research data.

The latest GBTC outflows mark a nearly 25% drop from $255 million on Jan. 26, and a 70% drop from the fund’s peak daily outflows of $641 million on Jan. 22.

It’s also the second-lowest outflow day for Grayscale’s fund, besides the $95 million that left the fund on Jan. 11 — the day it was converted to a spot Bitcoin (BTC) exchange-traded fund (ETF).

Crypto traders are eagerly watching for signs of slowed GBTC outflows caused by the fund’s investors taking the chance to cash out of their once-underwater positions.

JPMorgan analysts noted on Jan. 25 that GBTC outflows have caused downward price pressure on Bitcoin but added that “should be largely behind us.”

Meanwhile, Jan. 29 figures show the nine new U.S. spot Bitcoin ETFs hit a combined $994.1 million in volume, close to doubling that of GBTC, which saw $570 million in volume, according to data shared to X by Bloomberg ETF analyst James Seyffart.

And @Grayscale's $GBTC maintains its liquidity crown — trading $570 million and ~$110 million more than second place $IBIT today https://t.co/WIAWKwDnqY pic.twitter.com/ma0CE5szLa

— James Seyffart (@JSeyff) January 29, 2024

BlackRock’s iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC) saw the largest volume share behind the GBTC, pulling in respective daily volumes of $460.9 million and $315.4 million — 78% of the combined volume posted by the nine new ETFs.

The crowded market for spot Bitcoin ETFs has even reportedly seen fund issuers cut fees to attract investors — both in the U.S. and abroad.

Related: $5B flight from GBTC likely led to outflows in other regions: CoinShares

Invesco and Galaxy Asset Management were the latest to drop fees on their joint ETF — Invesco Galaxy Bitcoin ETF (BTCO) — saying on Jan. 29 that its eventual expense ratio will be 0.25%, down from 0.39%.

The fee drop brings it down to the same level as BlackRock, Fidelity, Valkyrie, and VanEck. BTCO has zero fees for the first six months or until it hits $5 billion in assets, after which the new lower fee will go into effect.

This is what the fee table looks like now: pic.twitter.com/LPvd6YwGWJ

— James Seyffart (@JSeyff) January 29, 2024

The stateside fee war may have also affected Europe’s ETFs, with speculation that traders are fleeing from Europe-based products to the U.S., according to research from CoinShares.

Last week, on Jan. 23, Invesco also slashed fees on its Europe-based Bitcoin ETF from 0.99% to 0.39% and was joined by WisdomTree, which cut fees from 0.95% to 0.35%.

CoinShares followed on Jan. 25, cutting fees on its flagship Bitcoin ETF from 0.98% to 0.35%.

Asia Express: OKX token’s $6.5B flash crash, crypto exec ‘Mr Bang’ on the run

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Here you can find 69472 additional Info on that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] There you will find 32374 more Information on that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] There you will find 86746 more Info on that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Here you will find 50245 more Info to that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Here you can find 93346 additional Information on that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3848/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3848/ […]