3 reasons why Bitcoin hitting $38.5K marked the 'ETF dip'

Bitcoin is witnessing changing tides when it comes to ETF flows after a turbulent first two weeks — can BTC price strength ready to recover?

Bitcoin (BTC) saw two-month lows this week, but evidence suggests that the BTC price bottom may be in.

Data from Cointelegraph Markets Pro and TradingView continues to track an ongoing bounce on BTC/USD after a trip to $38,500.

Dust is settling on the first two weeks’ trading of the United States’ first spot Bitcoin exchange-traded funds (ETFs). Outflows from the Grayscale Bitcoin Trust (GBTC) appear to be cooling, and optimism over a general reduction in institutional selling pressure is slowly rising.

On-chain metrics are likewise hinting at “oversold” market conditions, and with Bitcoin now down 20% versus its local highs, a more sustained BTC Price recovery could be on the cards.

Nothing, however is certain — even long-term holders, hodling through bullish and bearish market trends alike, have displayed capitulatory behavior this month.

Cointelegraph takes a look at these topics as consensus gradually forms on whether Bitcoin has bottomed.

GBTC: Light at the end of the tunnel?

The topic of the moment when it comes to BTC price trends is the United States’ first spot Bitcoin exchange-traded funds (ETFs).

While seeing billions of dollars in inflows since their Jan. 11 launch, the ETFs have so far presided over 20% downside for BTC/USD.

Market participants have tied the phenomenon to one ETF in particular: the Grayscale Bitcoin Trust (GBTC). Its conversion to an ETF has allowed investors “trapped” for years to exit — and while they might possibly invest in another spot Bitcoin product, regulations require at least a one-month cooling-off period.

Pssst,

GBTC can’t print bitcoin.

This sale is highly limited and unsustainable.

— hodlonaut 80 IQ 13%er ⚡ (@hodlonaut) January 23, 2024

Vast tranches of BTC have been sent by Grayscale to custodian Coinbase, but critics argue that this has little to do with the downward pressure that Bitcoin has been seeing since.

Rather, sales by defunct exchange FTX, as well as derivatives liquidations, may be to blame.

The former is finite and may have already concluded — and with GBTC outflows themselves decreasing day by day, this week’s low on BTC/USD may remain in place.

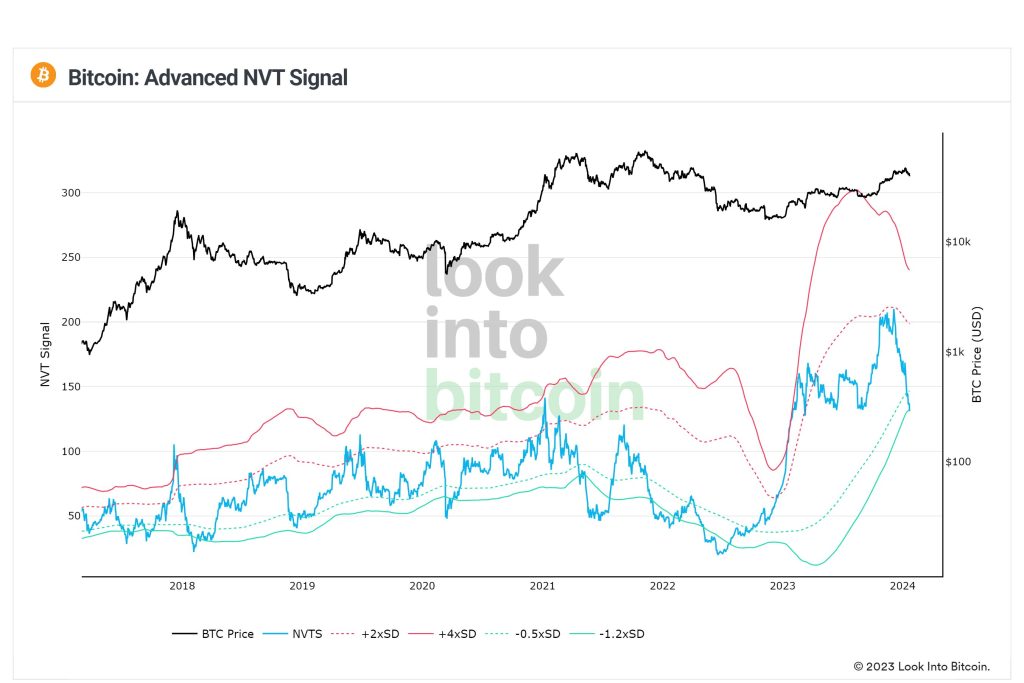

NVT mimics 2022 bear market floor

A classic Bitcoin on-chain metric delivered a surprise as BTC price fell toward $38,000.

The Advanced Network Value to Transaction (NVT) Signal currently shows that the value of recent transactions is correspondingly low when taken as a portion of the overall Bitcoin market cap.

NVT Signal seeks to compare the total value of transactions over a 90-day lookback period to the Bitcoin market cap at a given time.

Advanced NVT adds standard deviation bands, helping to pinpoint when BTC is relatively overbought or oversold.

The latest drop has fueled a retreat to the lowest standard deviation band, suggesting that $38,500 is an unnaturally low price point.

As noted by Philip Swift, creator of on-chain statistics resource Look Into Bitcoin, the NVT comedown is Bitcoin’s first since the pit of the 2022 bear market.

“Interesting to see that Advanced NVT has dropped into the green oversold bands for the first time in this bull market,” he wrote in part of a dedicated X post.

Bitcoin hodlers give “capitulation signs”

When it comes to capitulation events, this week’s lows tested the conviction of both speculators and seasoned hodlers.

Related: Bitcoin price risks $30K over ‘supercharged’ inflation — Arthur Hayes

On-chain data proves it: even long-term holders (LTHs), defined as entities hodling for 155 days or more, sent coins to exchanges at a loss.

Long term holders sent over $430M worth of #Bitcoin at a loss to exchanges, on Jan 22, the day #Bitcoin went below $39,000.

More capitulation signs. Getting closer. pic.twitter.com/La2a2GIz81

— James Van Straten (@jvs_btc) January 25, 2024

This constitutes something of a follow-up move to that seen as BTC/USD retreated from its two-year highs of $49,000 immediately after the ETF launch. Then, it was short-term holders (STHs) at the forefront of selling, likewise with much BTC moved for less than it was acquired for.

Commenting on the scale of moves, James Van Straten, research and data analyst at crypto insights firm CryptoSlate, struck a cautious tone. LTHs, he reasoned, might be on a cliff edge, with a more intense round of capitulation still possible.

“This situation ominously mirrors the pre-Luna collapse capitulation witnessed in May 2022. Back then, a nearly identical amount was sent to exchanges at a loss, followed by a more severe loss of over $600 million just a week later, right before Bitcoin’s value shockingly plummeted below $20,000,” he suggested in a research post.

“The repetition of such losses could point towards increasing evidence of capitulation among Bitcoin’s long-term stakeholders.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] Here you will find 77439 additional Info on that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] There you will find 50393 more Info on that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] There you will find 81724 additional Information on that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] There you can find 17444 more Info on that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3618/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/3618/ […]