Why are Bitcoin Ordinal Inscription tokens ORDI, SATS crashing?

Inscription tokens ORDI and SATS have underperformed the broader crypto market so far in 2024 and are still showing potential for further downside.

The cryptocurrency market has seen a notable drop in several digital assets in January, with Inscription tokens (aka BRC-20 tokens) like ORDI and SATS among the most affected.

The reasons behind the underperformance of these unique tokens include several other important factors in addition to Bitcoin’s (BTC) recent price fluctuations.

Bitcoin ETF “sell the news” event

Notably, the price of ORDI and SATS have fallen by approximately 34.50% and 50%, respectively, so far in 2024.

The decline has appeared primarily due to a mounting “sell-the-news” sentiment across the crypto market led by Bitcoin. As of Jan. 25, the correlation coefficient between ORDI and BTC was 0.66; it has remained positive throughout recent history.

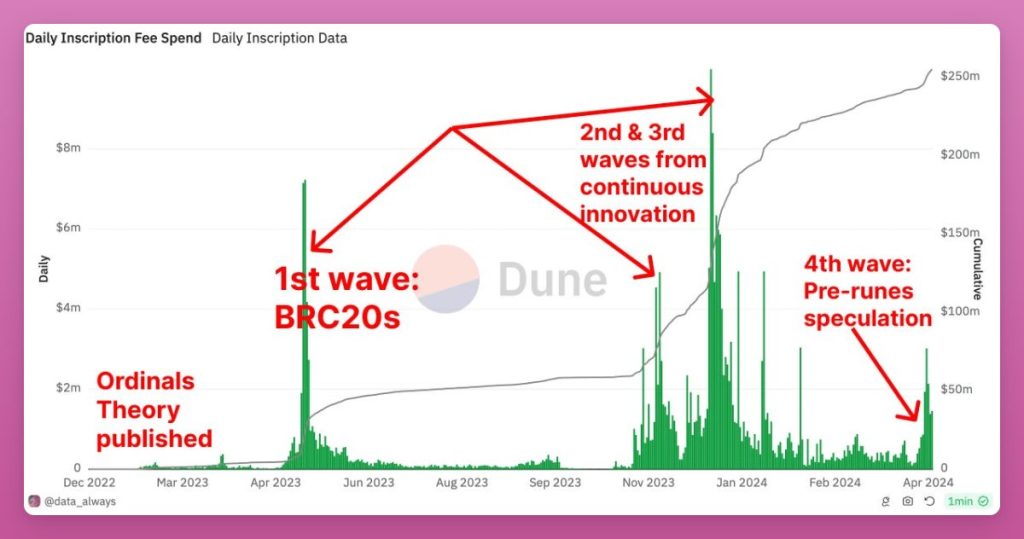

Furthermore, this bearish momentum has aligned with a noticeable decrease in inscription fees, and Bitcoin block size share, highlighting a diminishing demand for Bitcoin ordinals.

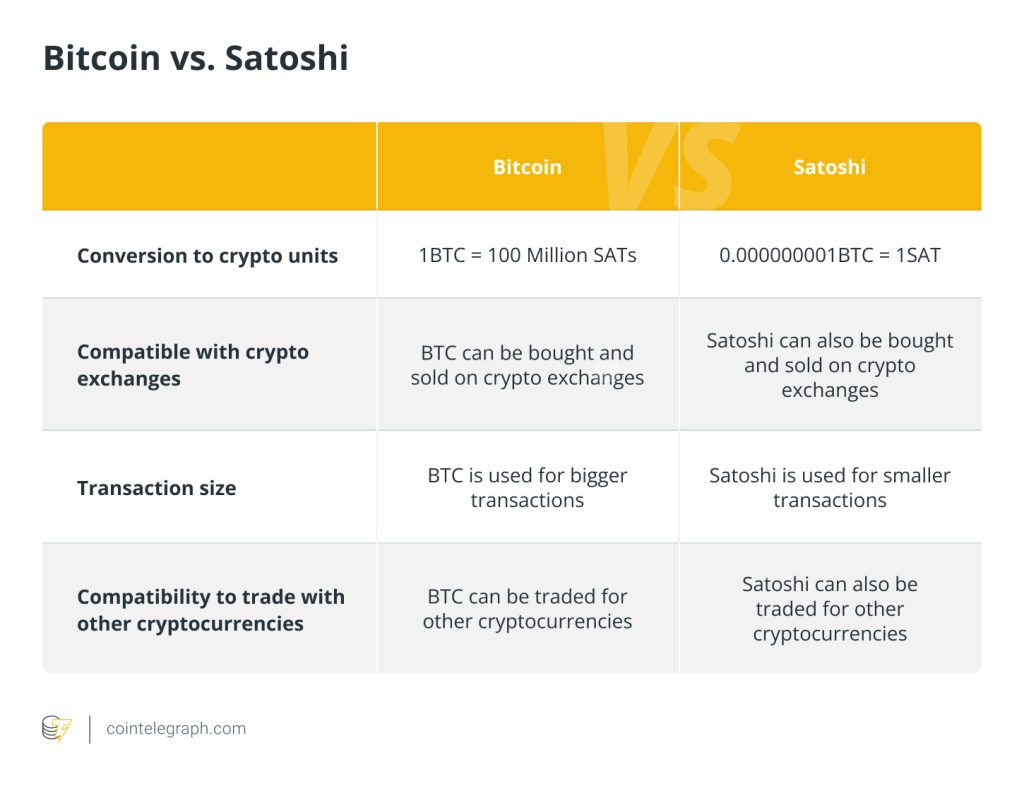

The price movements of inscription tokens tend to closely align with BTC itself, largely because Bitcoin Ordinals uses Bitcoin’s blockchain.

ORDI, for example, involves inscribing data directly onto the Bitcoin blockchain, creating a unique form of digital artifact that exists within Bitcoin’s transaction outputs.

Technical conditions

In addition to broader market trends, bearish divergence signals were key in recent ORDI and SATS price drops.

For instance, the ORDI/USDT daily chart exhibited a classic bearish divergence pattern between Dec. 5, 2023, and Jan. 2, 2024. Simply put, ORDI’s price was forming higher highs but its relative strength index (RSI) was making lower highs.

The following 45% pullback was consistent with the bearish divergence signal, where the discrepancy between the RSI and the price action precedes a price correction.

Similarly, SATS’s price retreated by over 60% after signaling bearish divergence between its rising prices and falling RSI.

Overall, the bearish divergence on the ORDI and SATS chart warranted attention from traders, as it indicated a potential trend reversal or at least a pause in the prevailing uptrend.

ORDI, SATS price analysis

From a technical standpoint, ORDI has more room to decline in the coming days or weeks.

Notably, the cryptocurrency has been undergoing an ascending triangle reversal breakdown. This refers to a situation where an ascending triangle pattern fails to act as a continuation pattern and instead leads to a trend reversal.

Related: Bitwise Bitcoin ETF wallet attracts inscriptions and rare sats donations

ORDI’s breakdown target comes to be around $38.50 by February, measured after calculating the maximum distance between the triangle’s upper and lower trendline and subtracting the outcome from the breakdown point, as shown above.

Interestingly, the $38.50 target coincides with the 0.618 Fibonacci retracement line.

On the other hand, SATS has dropped toward its resistance-turned-support level of $0.00000036. Simultaneously, its RSI has dropped below 30, an oversold territory. Both indicators hint at a potential rebound move toward 0.00000043 by February.

Conversely, a break below the $0.00000036-support risks crashing SATS price toward its 0.786 Fib line of $0.0000029.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] There you will find 93171 additional Information on that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] There you can find 65137 more Info on that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] There you will find 71334 additional Info to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/bitcoin/3616/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/3616/ […]