Guessing game on when GBTC bleeding stops helps push Bitcoin below $39K

The GBTC “mass exodus” may be showing signs of slowing, but that hasn’t stopped Bitcoin from falling to two-month lows on Jan. 23.

A multibillion-dollar guessing game over an investor exodus from Grayscale’s Bitcoin Trust (GBTC) has pushed the price of Bitcoin (BTC) below $39,000 for the first time in nearly two months.

Since its successful conversion to a spot Bitcoin exchange-traded fund (ETF) on Jan. 11, GBTC has posted over $3.4 billion in outflows, with Grayscale subsequently depositing billions in Bitcoin to crypto exchange Coinbase Prime — likely for sale.

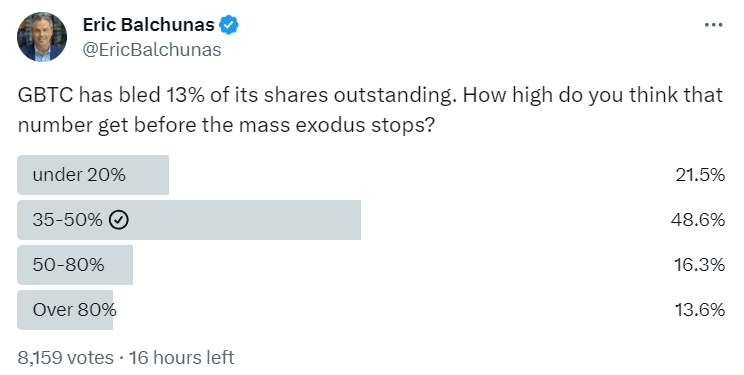

However, there are fears that the GBTC exodus still has a longer road to travel. According to Bloomberg ETF analyst Eric Balchunas, GBTC recorded an outflow of $515 million on Jan. 23 and has now bled 13% of its shares outstanding. He noted, however, that the latest figures suggest the outflow could be slowing.

Once again the “experts” told you the GBTC outflows had ended and once again they were wrong. #Bitcoin

— Magoo PhD (@HodlMagoo) January 23, 2024

In a poll on X, Balchunas asked users how much further bleeding would occur before the “mass exodus ended.” Nearly half of the respondents said this could go to between 35-50% — though both Balchunas and fellow Bloomberg ETF analyst James Seyffart estimated this would happen at around 25% of shares outstanding.

Grayscale’s website shows there are currently 600.5 million shares outstanding, with a total of 536,694.9 Bitcoin in trust. Meanwhile, data from CC15Capital shows 82,525 Bitcoin has left GBTC since Jan. 10.

Stop panic selling your #Bitcoin just because you see panic-inducing tweets about $GBTC coins being sent to Coinbase every morning around 9:30am.

All $BTC sold by @Grayscale so far has been scooped up by the other (lower-fee) ETFs pic.twitter.com/1H3S5FFbnU

— CC15Capital (@Capital15C) January 24, 2024

The recent bout of outflows has been attributed to defunct crypto exchange FTX, which reportedly sold two-thirds of 22.3 million shares in GBTC over three days of trading. The crypto exchange is understood to still have around 8 million shares, roughly $281 million worth yet to sell.

Related: Spot Bitcoin ETFs’ on-chain addresses found by Arkham

Meanwhile, some observers worry that Bitcoin from Mt. Gox may soon start to move after the Mt. Gox trustee reportedly reached out to creditors to complete identity verification for crypto exchange accounts, which are set to be used to repay Bitcoin and Bitcoin Cash (BCH) — another potential pressure on the price of Bitcoin.

Bitcoin is currently trading at $39,949, up 0.60% on the day, according to data from CoinMarketCap. The Crypto Fear & Greed Index has hit a 100-day low with a score of 48 on Jan. 24.

… [Trackback]

[…] Here you can find 66801 additional Info on that Topic: x.superex.com/news/bitcoin/3381/ […]

… [Trackback]

[…] Here you can find 47395 additional Info to that Topic: x.superex.com/news/bitcoin/3381/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3381/ […]

… [Trackback]

[…] Here you can find 36652 more Information on that Topic: x.superex.com/news/bitcoin/3381/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/3381/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/bitcoin/3381/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/3381/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/3381/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3381/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/bitcoin/3381/ […]

… [Trackback]

[…] Here you can find 86325 additional Information to that Topic: x.superex.com/news/bitcoin/3381/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3381/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/bitcoin/3381/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3381/ […]