Crypto sentiment index hits 100-day low as Bitcoin ETFs fail to buoy price

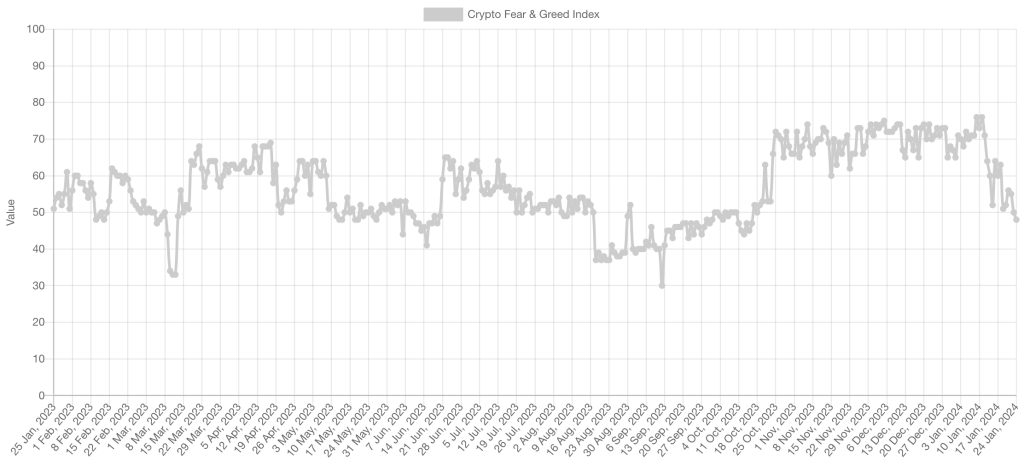

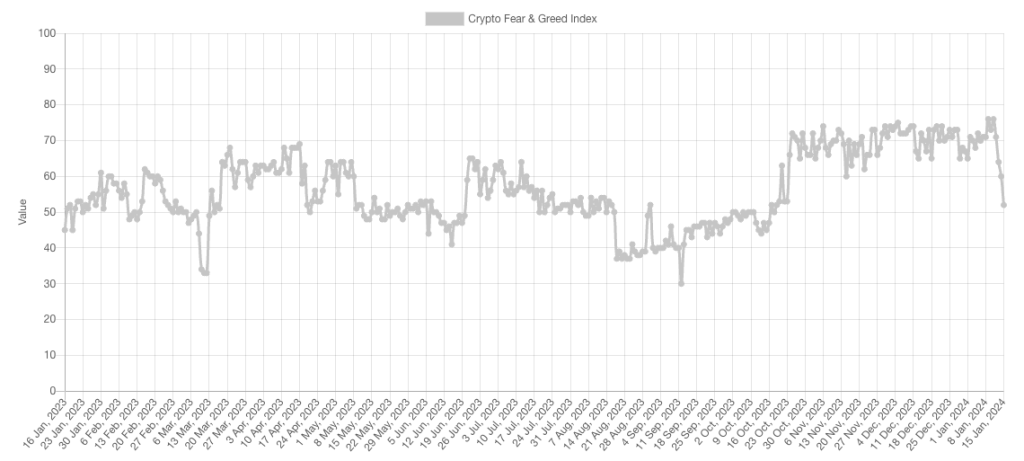

The Crypto Fear & Greed Index has dropped to 48, indicating a 100-day low point for crypto market sentiment.

The Crypto Fear & Greed Index has hit a 100-day low as Bitcoin (BTC) continues to drop following the approval of spot exchange-traded funds (ETFs) in the United States.

On Jan. 24, the index dropped to a score of 48, placing it within the “Neutral” sentiment range — a two-point drop from the day prior and a 15-point drop from the same day last week when sentiment flashed “Greed.”

It marks a 100-day low point for the index, which saw a score of 47 on Oct. 16, 2023, when Bitcoin was trading just above $28,500, per Cointelegraph Markets Pro.

The index gathers and weighs data from six market key performance indicators to score crypto market sentiment each day: volatility (25%), market momentum and volume (25%), social media (15%), surveys (15%), Bitcoin’s dominance (10%) and trends (10%).

Related: JPMorgan downgrades Coinbase stock to ‘underweight’ following spot Bitcoin ETF approvals

Bitcoin reached a two-year high of nearly $47,000 on Jan. 8, days before multiple spot Bitcoin ETFs were approved in the U.S., and has seen a price decline to under $40,000 since the roster of new ETF products was approved.

One ETF in particular, the Grayscale Bitcoin Trust (GBTC), has seen over $2 billion in outflows since its conversion to an ETF and has caused days of net outflows from the 10 spot Bitcoin ETFs.

The index shows sentiment was firmly in “Greed” territory from late October as the market looked to spot ETF approvals with optimism.

It reached a score of 76 on Jan. 1, the day after the approval of several Bitcoin funds, and its highest score since hitting 77 on Nov. 11, 2021 — the day after Bitcoin’s over $69,000 all-time high.

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Here you can find 45361 additional Information on that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Here you will find 7255 more Information on that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] There you will find 46337 more Info to that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] There you will find 12718 more Information to that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] There you can find 70030 additional Info on that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Here you can find 96985 more Information on that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] There you will find 21375 more Info to that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3379/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/bitcoin/3379/ […]