Bitcoin ETFs post $76 million in net outflows on ‘bad’ seventh day of trading

Despite “unceasing” outflows from Grayscale, the outlook for spot Bitcoin ETFs remains positive, with more than $1.1 billion in total inflows across the board, says Bloomberg ETF analyst James Seyffart.

Spot Bitcoin (BTC) exchange-traded funds (ETFs) have seen $76 million in net outflows on the seventh day of trading, according to new data from Bloomberg ETF analyst James Seyffart.

In a Jan. 23 post to X, Seyffart wrote that it had been a “bad day” overall for Bitcoin ETFs in the “Cointucky Derby,” noting that Grayscale still comprises the largest net outflows for the ETFs.

Update: BlackRock's numbers are in for the #Bitcoin ETF Cointucky derby. Third biggest inflow day for $IBIT yet at $272 million. Only -$76 million in net outflows for the day. https://t.co/ySE0edbz4c pic.twitter.com/RzgH6qn5Md

— James Seyffart (@JSeyff) January 23, 2024

“$640 million flow out today. Outflows aren’t slowing — they’re picking up. This is the largest outflow yet for GBTC. Total out so far is $3.45 billion,” added Seyffart.

Speaking to Cointelegraph, Seyffart said that overall, the flows into the spot Bitcoin ETFs remained positive, with BlackRock enjoying its third-largest days of positive flows so far, netting a total of $272 million in inflows on the day.

“On a net basis we have seen over $1.1 billion flow into spot bitcoin ETFs, even after accounting for the GBTC outflows,” he said.

While Seyffart admitted that the outflows from GBTC appeared to be “unceasing,” at this time, he expects the GBTC-led dumping to cool off in the coming fortnight.

Much of the outflows from Grayscale’s recently converted GBTC fund have been tied to outsized selling from the FTX estate.

Related: Alameda Research drops suit against Grayscale as GBTC sees outflows

According to a Jan. 22 report — which cited sources familiar with the matter — the FTX estate had offloaded roughly two-thirds of its 22.8 million GBTC shares by Jan. 22. The sale of the shares is estimated to account for roughly $600 million of the total net $3.4 billion in GBTC-related outflows.

Since $GBTC conversion to #BitcoinETF investors have sold > $2 Billion

FTX bankruptcy liquidation has led to > $1 Billion in selling $BTC

GBTC discount to NAV arbitrage trade led to > $1 Billion selling to lock in profits.

All of that selling in a relatively short time and… pic.twitter.com/e0I0ms3y3D

— CJK (@CJKonstantinos) January 22, 2024

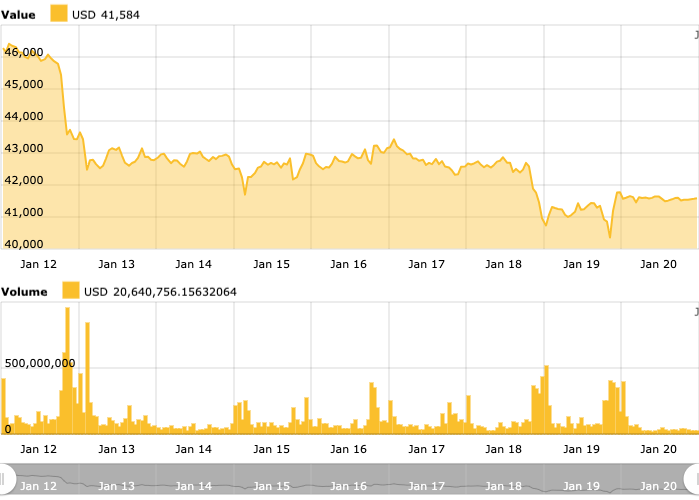

The price of Bitcoin has fallen significantly since the ten spot ETFs were approved on Jan. 10, falling from a high of $49,100 to as low as $39,500 on Jan. 23. Bitcoin is currently holding steady at just above the $40,000 mark, per TradingView data.

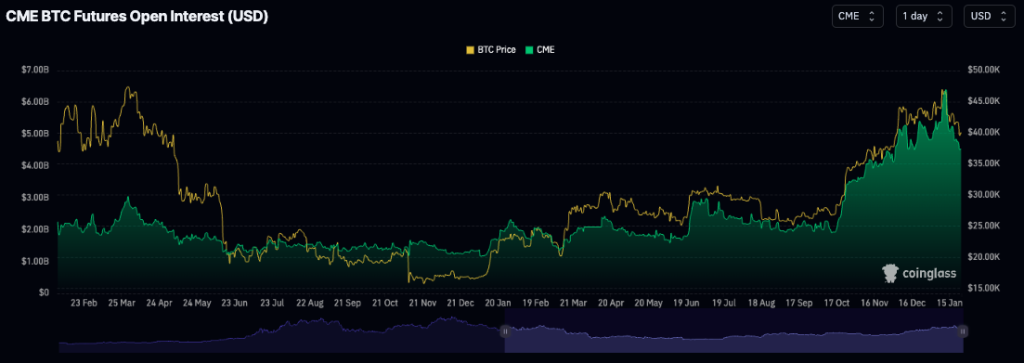

Notably, Bitcoin’s downward price action comes amid a sudden and sharp decline in open interest on Bitcoin futures on the Chicago Mercantile Exchange (CME), suggesting a decline in enthusiasm among institutional investors to gain leveraged exposure to Bitcoin.

According to data from CoinGlass, open interest on CME fell from a near-record high of $6.4 billion on Jan. 12 to $4.4 billion at the time of publication.

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] There you will find 50220 more Information on that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] There you can find 7411 more Information on that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] There you will find 4399 additional Info to that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] There you can find 53476 more Info to that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3324/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3324/ […]