Crypto fund outflows reach $24.7M as GBTC selling impacts Bitcoin price

CoinShares’ report noted that Bitcoin outflows rose last week, while trading volume for spot BTC ETFs totaled $11.8 billion.

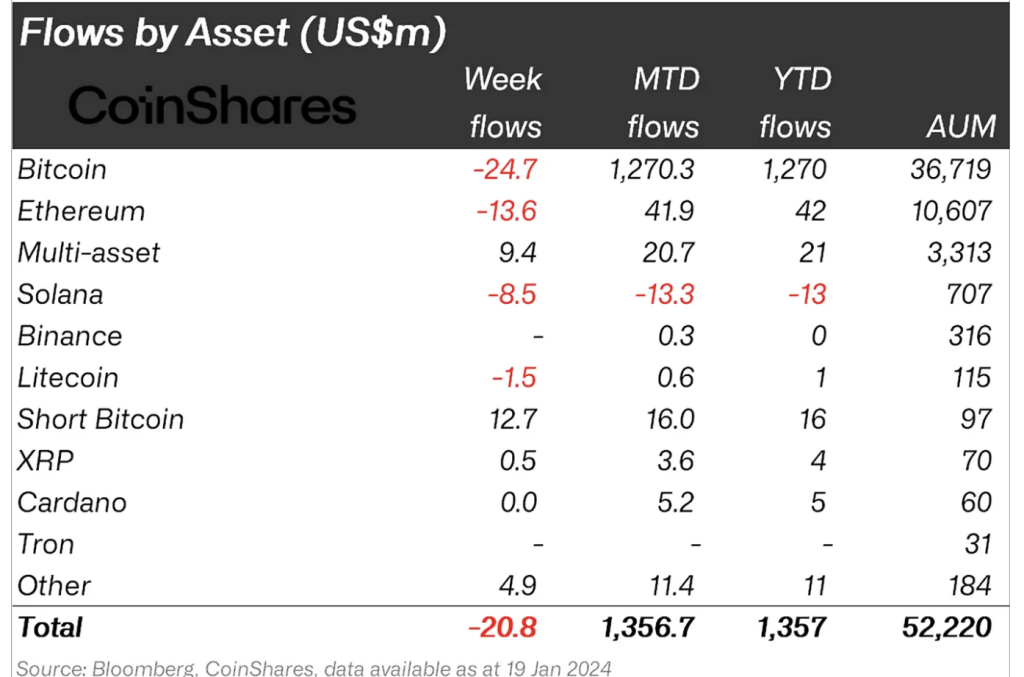

The latest report from European cryptocurrency investment firm CoinShares shows that there were minor outflows from institutional Bitcoin (BTC) investment products over the past seven days.

According to CoinShares’ “Digital Asset Fund Flows Weekly” report published on Jan. 22, institutional investors are reducing Bitcoin exposure, with BTC investment products seeing total outflows of $24.7 million this past week.

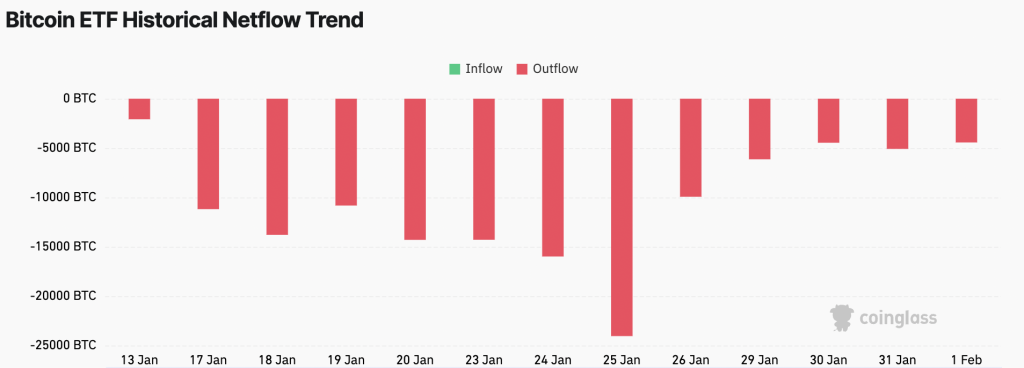

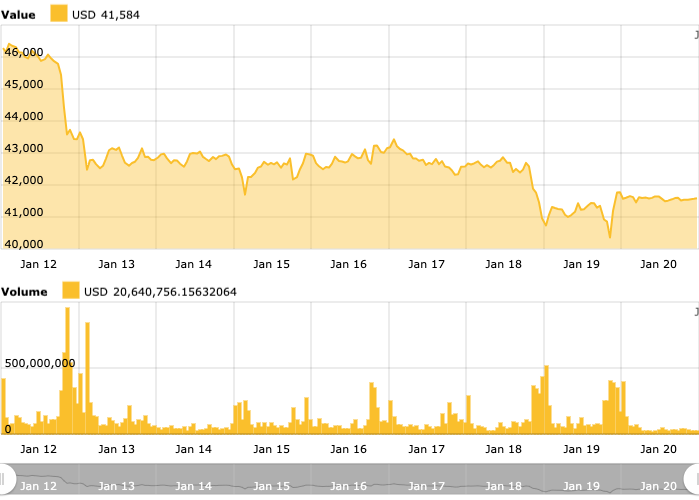

The data follows heavy selling amid a spot Bitcoin exchange-traded fund (ETF)-driven crypto market meltdown, with institutions having withdrawn nearly $21 million from crypto products between Jan. 11 and 19 before outflows briefly slowed toward the end of last week.

Trade volume for ETF products is also sharply increasing, totaling $11.8 billion over the last week. This represented 63% of all Bitcoin volumes on trusted exchanges, highlighting that exchange-traded product activity currently dominates overall trading activity.

Digital asset investment saw minor outflows last week, totalling US$21m.

Trading volumes in #Bitcoin are very high, totalling US$11.8bn.

– Issuer dynamics –

Higher cost issuers: US$2.9bn outflows

Newly issued ETFs: US$4.13bn inflows (since launch)

Net inflows into US ETFs… pic.twitter.com/sYZAD2hRfB— CoinShares (@CoinSharesCo) January 22, 2024

Despite digital asset investment products witnessing minor outflows last week, CoinShares highlighted that current higher-cost spot issuers in the United States saw massive outflows to the advantage of new issuers.

Relates: Are BTC longs waiting for sub-$40K? 5 things to know in Bitcoin this week

CoinShares head of research James Butterfill said:

“Incumbent, higher cost issuers suffered in the U.S., seeing U.S. $2.9bn of outflows, while newly issued ETFs have now seen a total of US$4.13bn inflows since launch.”

“Investors saw recent price weakness as an opportunity to add to short-Bitcoin investment products, seeing U.S. $13m inflows,” the CoinShares report added.

The declining institutional demand for BTC coincided with decreasing institutional appetites for Ether (ETH) — after it witnessed outflows of $13.6 million this past week.

This data from CoinShares highlights the impacts of spot Bitcoin ETFs on the cryptocurrency sector, with the total market capitalization dropping 3.4% over the last 24 hours to $1.59 trillion.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] There you will find 2648 more Information to that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] There you can find 47938 more Info on that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] Here you will find 51791 additional Information on that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] There you will find 37247 additional Information on that Topic: x.superex.com/news/bitcoin/3284/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3284/ […]