Bitcoin trader who called $48K BTC price top flags new bearish signal

Bitcoin does not perform well once this key BTC price moving average crossover occurs, Decentrader’s FilbFilb shows.

Bitcoin (BTC) may have more to lose if one BTC price chart pattern plays out as usual, warns veteran analyst Filbfilb.

In his latest update on X (formerly Twitter) on Jan. 19, the founder of trading suite Decentrader sounded the alarm over Bitcoin’s descent to monthly lows.

Bitcoin’s 3-day chart suggests start of downside

BTC price action fell to $40,600 overnight, marking almost a 20% retreat from last week’s local highs, data from Cointelegraph Markets Pro and TradingView confirms.

While subsequently rebounding above $41,000, market strength is convincing few traders and analysts in the short term.

Filbfilb is among them, with 3-day timeframes of particular concern.

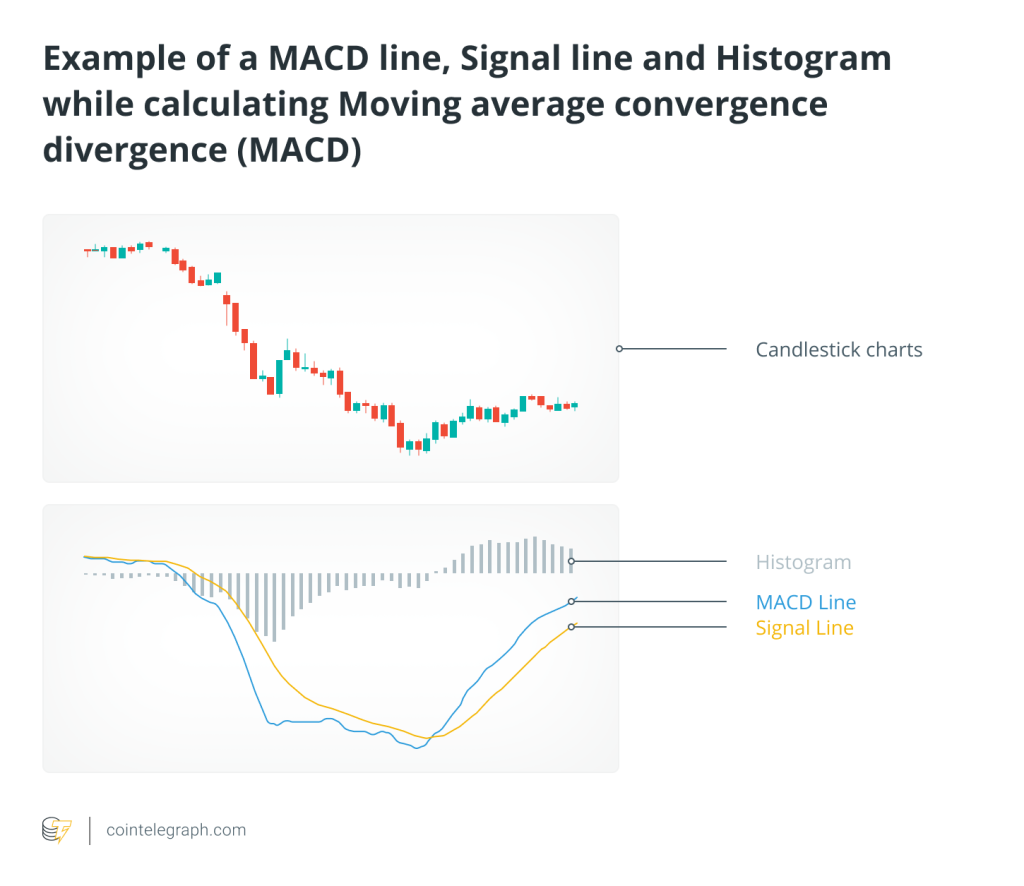

Uploading a comparative chart, he showed that when the 3-day chart crosses below the daily 50-period simple moving average (DMA), further downside tends to result. The chart extended to Bitcoin’s current all-time high of $69,000 seen in November 2021.

“3 Day red with a break below 50 DMA. There are a few examples of this happening in the past,” he commented.

Previously, Filbfilb successfully estimated Bitcoin topping out at $48,000 around the announcement of the United States spot Bitcoin exchange-traded funds (ETFs). A similar BTC price target is in place for April’s block subsidy halving.

Bitcoin traders stay cautious

The overnight dip meanwhile sent BTC/USD below its 2024 opening price.

Related: Did a $5B Bitcoin whale sale spark the post-ETF BTC price crash?

Analyzing liquidity conditions, financial commentator Tedtalksmacro flagged $40,000 as the next crucial level to hold.

BTC bids thickening up now after that dump and offers have lightened considerably, 44k seller is still there though…

463 BTC bid at $40,000 (~$18.5M USD) at Binance. https://t.co/yAdqIHM1nX pic.twitter.com/n2hBesoY4C

— ted (@tedtalksmacro) January 18, 2024

As Cointelegraph reported, various market participants view the mid-$30,000 range as a potential bounce zone to come.

“I think we need 1 more (smaller) leg down before we can bounce. Last nights bounce not convincing me…,” popular trader Crypto Ed, creator of trading group CryptoTA, wrote on the day, preceding in-depth analysis.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] There you can find 69278 additional Info on that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] Here you will find 60446 additional Information to that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] There you will find 86727 more Information to that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3040/ […]

… [Trackback]

[…] There you will find 22562 more Info on that Topic: x.superex.com/news/bitcoin/3040/ […]