Fidelity Ether ETF delayed as more leveraged Bitcoin ETF bids flood in

Fidelity’s spot Ethereum ETF bid was delayed on the same day another five leveraged Bitcoin ETFs were filed for SEC approval.

The United States securities regulator has delayed its decision on asset manager Fidelity’s Ether (ETH) exchange-traded fund (ETF) bid, while another five leveraged Bitcoin (BTC) ETFs have just been filed with the regulator for approval.

The Securities and Exchange Commission said on Jan. 18 that it was extending its deliberation period by another 45 days “so that it has sufficient time to consider the proposed rule change and the issues raised.”

The SEC marked March 5 as the next date for a decision. Bloomberg ETF analyst James Seyffart said in a Jan. 18 X (Twitter) post he “completely expected” the delay.

Fidelity #ethereum ETF delayed just now. Completely expected. Dates that really matter are late May in my view. https://t.co/8mvhcPRaS7

— James Seyffart (@JSeyff) January 18, 2024

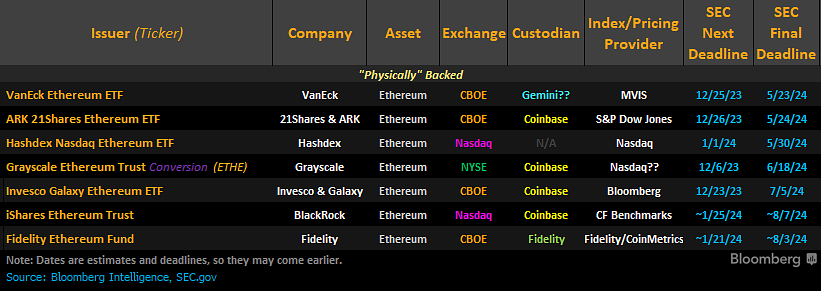

“Dates that really matter are late May in my view,” he added, referring to the SEC’s May 23 final deadline for approving or denying VanEck’s Ether ETF. Some analysts predict the SEC could approve a number of pending spot Ether ETF bids simultaneously as it did for spot Bitcoin ETFs.

New deadline to obsess over just dropped

May 23rd is the final deadline for decision on VanEck’s spot ETH ETF pic.twitter.com/dgi5EVbPeQ

— Will (@WClementeIII) January 10, 2024

Meanwhile, Direxion filed for five Bitcoin ETFs with the SEC on Jan. 18 joining rivals ProShares — which filed for five leveraged Bitcoin-tracking ETFs on Jan. 16 — and REX Shares, which filed for six leveraged Bitcoin ETFs on Jan. 3.

T-Rex files 6 leveraged and inverse Bitcoin ETFs

T-Rex 1.5X Inverse Spot Bitcoin Daily Target ETF

T-Rex 1.5X Long Spot Bitcoin Daily Target ETF

T-Rex 1.75X Inverse Spot Bitcoin Daily Target ETF

T-Rex 1.75X Long Spot Bitcoin Daily Target ETF

T-Rex 2X Inverse Spot Bitcoin Daily… pic.twitter.com/eLFTiS1Gq9— ETF Hearsay by Henry Jim (@ETFhearsay) January 3, 2024

Direxion’s filing shows plans for 1x, 1.5x and 2x long leveraged Bitcoin funds and one of each again for short leveraged funds.

“Leveraged Bitcoin ETFs may soon outnumber long only,” Bloomberg ETF analyst Eric Balchunas wrote in a Jan. 18 X post in response to the filing. “Pretty sure that’s never happened [before].”

leveraged bitcoin ETFs may soon outnumber long only, pretty sure that's never happened bf

— Eric Balchunas (@EricBalchunas) January 18, 2024

Related: Spot Bitcoin ETFs one week on: BTC sells off, but ETFs reap success

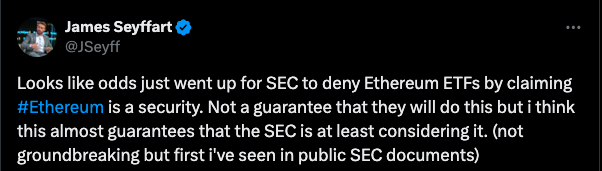

Opinions are split on the likelihood of the SEC approving spot Ether ETFs at all.

Balchunas told Cointelegraph earlier this month that he’s pinning a 70% chance of approval by May for spot Ether ETFs based on the SEC’s final deadline for VanEck’s fund.

However, Morgan Creek Capital co-founder and CEO Mark Yusko told Cointelegraph the SEC is still hostile toward crypto despite approving Bitcoin ETFs.

He added the regulator may also class ETH as a security, unlike Bitcoin, which SEC chair Gary Gensler previously said he considers a commodity.

Asia Express: Hong Kong Bitcoin ETF FOMO, Thailand approves $14B airdrop

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Here you can find 42721 more Information on that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Here you can find 56315 additional Info on that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Here you will find 29067 additional Information on that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] There you can find 85495 additional Information to that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/2943/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/2943/ […]