Spot Bitcoin ETFs one week on: BTC sells off, but ETFs reap success

Grayscale’s spot Bitcoin ETF sold more than 27,000 BTC in the first days of trading, but other issuers bought 40,000 BTC combined.

The historic launch of spot Bitcoin (BTC) exchange-traded funds (ETF) in the United States has triggered a sell-off in crypto, but in the ETF industry, the funds have been successful in the first week of trading, analysts agree.

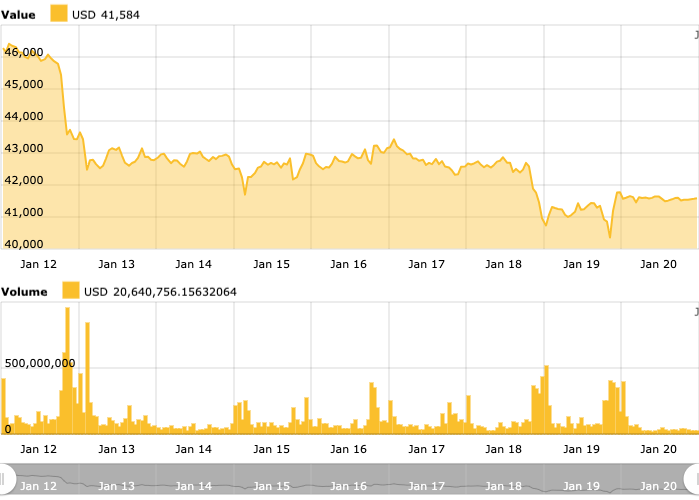

Since the first day of spot Bitcoin ETF trading on Jan. 11, Bitcoin has tumbled 6.6% from nearly $49,000 to $42,876 at the time of writing, according to data from CoinGecko. The sharp decline came mostly in the first two days of trading, while the intra-week low was $41,753.

Despite spot Bitcoin ETFs failing to fuel BTC price spike in the first week of trading — which was expected by some prominent investors — the funds themselves have seen a successful start so far, according to industry analysts.

Spot Bitcoin ETF volumes go bananas in the first days of trading

The debut of spot Bitcoin ETFs in the U.S. was one of the most successful ETF launches in terms of trading volumes, with 10 funds reaching $10 billion in combined volume in the first three days.

According to Bloomberg ETF analyst Eric Balchunas, spot Bitcoin ETFs have seen unprecedented activity and volumes since launch. Balchunas claimed that all 500 ETFs launched in 2023 had reached $450 million in combined volume so far, which is 2,100% less than the spot ETFs did in just three days.

“It is hard to get volume. Harder than flows even and definitely harder than assets. Because volume has to form naturally in the marketplace, can’t really be faked. And it gives an ETF staying power,” Balchunas wrote on X.

Most trading volumes came from the Grayscale Bitcoin Trust ETF (GBTC), which accounted for about 50% of the combined $10 billion volume in the first three days. According to Yahoo Finance data, GBTC has traded more than $6.3 billion so far, handling around $2 billion per day in the first two days of trading.

GBTC has seen massive selling following the ETF launch, with the fund seeing $1.2 billion in net outflows in the first three days of trading.

GBTC sells 27,000 BTC, but other ETFs buy more

While GBTC has been offloading massive amounts of Bitcoin in the first days of trading, other spot BTC ETFs have been growing their BTC holdings.

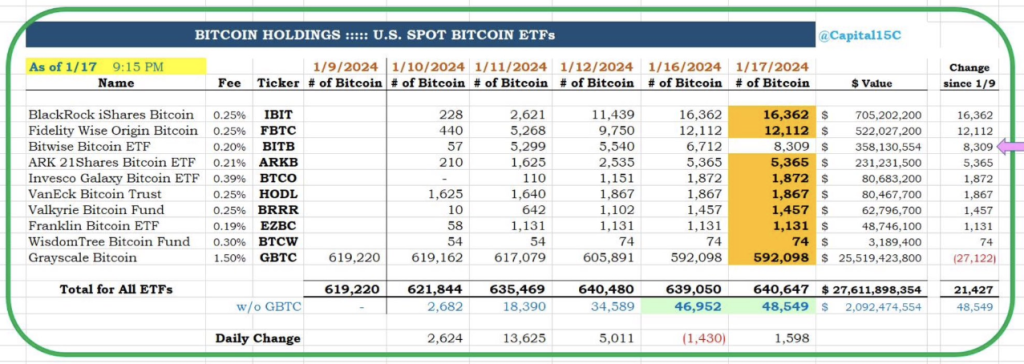

In the first four days after launch, GTBC sold a total of 27,122 BTC, or 4.4% of its total initial holdings of 619,200 BTC, Bitcoin investor Capital15C reported on X. On the other hand, other ETF issuers, including BlackRock, Fidelity and ARK Invest bought at least 40,000 BTC combined.

BlackRock’s iShares Bitcoin Trust (IBIT), the second largest spot Bitcoin ETF by holdings, increased its assets from 2,621 BTC on Jan. 11 to as much as 25,067 BTC on Jan. 17.

According to the latest available data from ETF issuers, the spot ETFs hold 651,819 BTC combined, or 3.32% of all 19.6 million bitcoins that have been ever issued.

What’s next for spot Bitcoin ETFs?

The launch of spot Bitcoin ETFs in the U.S. has been seen by many as a “sell-the-news” moment, with some analysts suggesting that more pressure could come from the futures market.

“We’re likely seeing a short-term positioning adjustment and not a long-term trend reversal. But unwinding an increase of more than 13,000 futures contracts is likely to create some churn in the price action in the coming weeks,” Fidelity’s director of global macro Jurrien Timmer wrote on X.

Related: Bitcoin greed index plummets to ‘neutral’ as ETFs fail to buoy prices

According to VanEck’s head of digital assets research, Matthew Sigel, the latest short-term correction could have been triggered by Bitcoin miners selling coins more actively recently. Coupled with the upcoming Bitcoin halving — expected to occur in April 2024 — the entrance of institutions is likely to send Bitcoin to all-time highs after the U.S. Presidential elections in the fourth quarter of 2024, Sigel told Cointelegraph. He stated:

“We are pleased to see the ETFs trading with such liquidity, tight spreads, and small discounts to NAVs. We expect institutional investors to accelerate their purchases over coming quarters as their asset allocation models, including Bitcoin, are released to the market.”

According to Standard Chartered, spot Bitcoin ETFs could attract inflows of $50-100 billion in 2024, with BTC price potentially hitting $200,000 by the end of 2025.

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Here you can find 95890 more Information to that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] There you will find 27892 more Information on that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/2937/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/bitcoin/2937/ […]