Riot, TeraWulf and CleanSpark best-positioned miners for Bitcoin halving — CoinShares

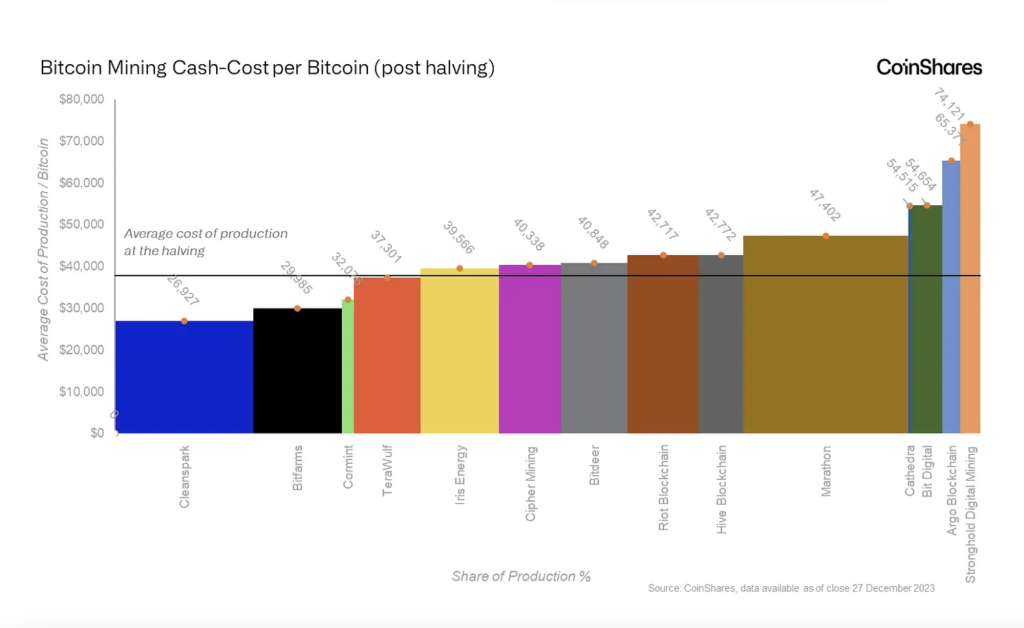

CoinShares projects the average cost of production for crypto miners post-halving at $37,856 per Bitcoin.

Bitcoin mining firms Riot, TeraWulf, and CleanSpark are the best-positioned within the industry to handle the significant cost increases expected following the Bitcoin halving event in April, according to analysis by asset manager CoinShares.

As a result of halving, CoinShares predicts that the cost of production and cash costs will increase from approximately $16,800 and $25,000 per Bitcoin in the third quarter of 2023 to $27,900 and $37,800, respectively. The average cost of production post-halving for crypto miners is projected to be $37,856.

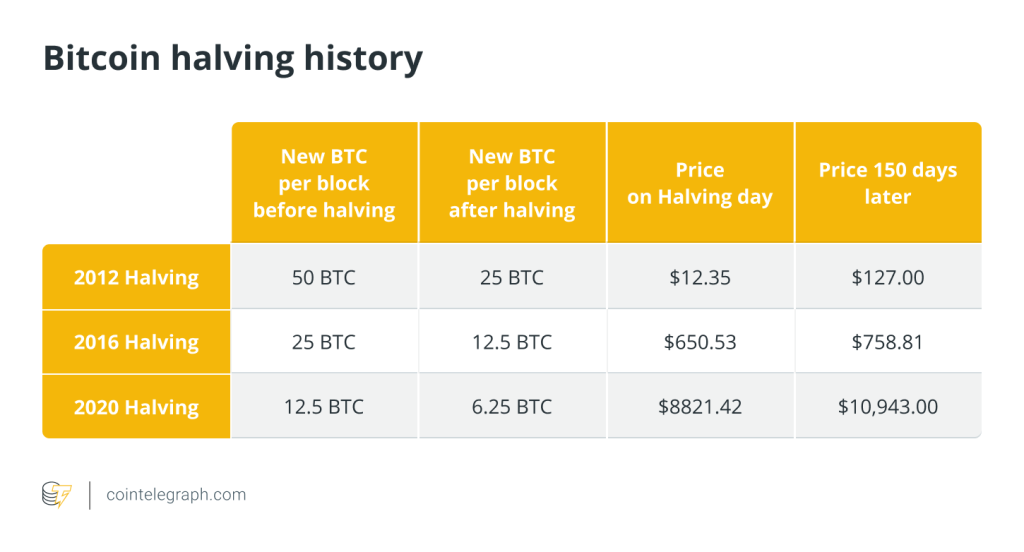

The halving reduces the block reward given to miners by half, thereby slowing down the rate of new Bitcoin creation as part of the network supply control deflationary policy. The next halving, estimated to take place in April 2024, will reduce the Bitcoin block reward to 3.125 BTC. The cost of mining, however, remains the same or may even increase due to miners’ expansion of operations to remain profitable.

“[…] we think Riot, TeraWulf and Cleanspark are best positioned going into the halving. One of the main problems miners have is large SG&A [selling, general, and administrative expenses] costs. For miners to break even, the halving will likely force them to cut SG&A costs, otherwise they could continue to run at an operating loss and having to resort to liquidating their HODL balances and other current assets.”

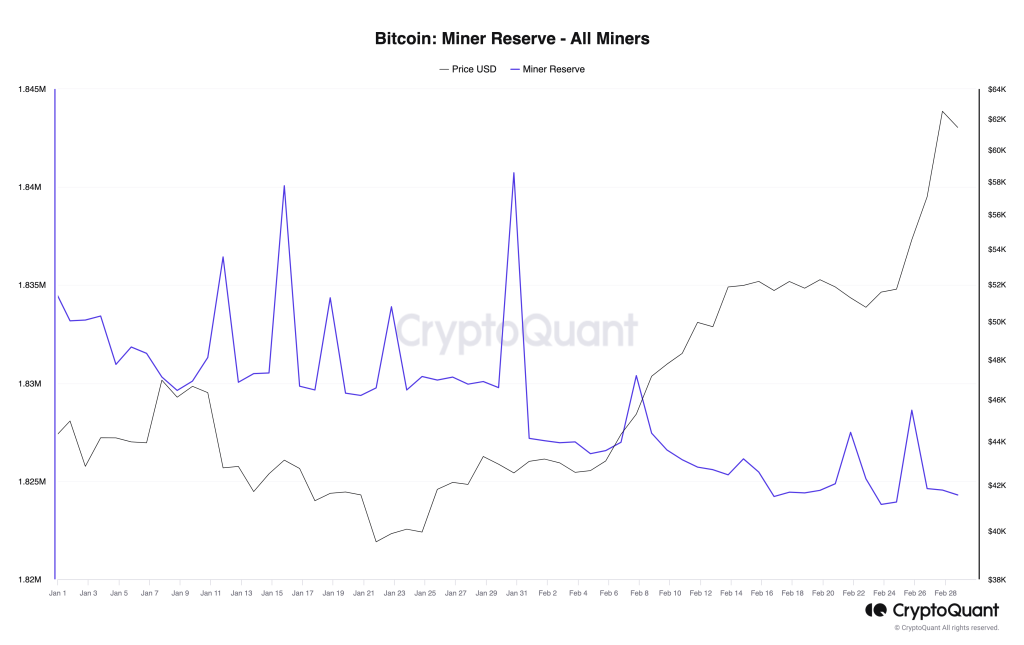

CoinShares analysis assumes Bitcoin price at $40,000 post-halving, noting that below this point, mining firms will “likely eat into their runway,” meaning miners would end up using financial reserves or operational buffers to remain in business.

In this scenario, Riot appears to be the best positioned to navigate the halving event “due to their cost structure and long runway.” However, the company is not shielded from challenges if the Bitcoin price falls below $40,000.

“Overall, unless the price of Bitcoin remains above $40,000, we believe that only Bitfarms, Iris, CleanSpark, TeraWulf and Cormint will continue to operate profitably.”

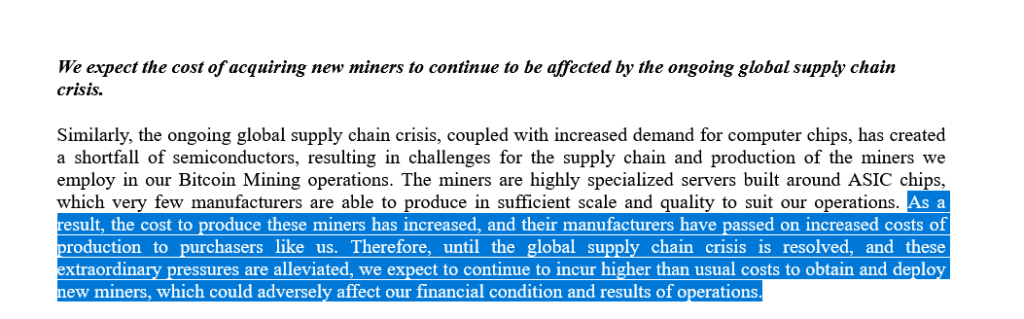

CoinShares points out that while most miners are improving their fleet efficiency — measuring energy consumption against mining output — the direct cost structure is not improving since they “will need to increase their power draw and energy consumed to mine the same amount of Bitcoin.”

According to CoinShares’ analysis, electricity costs per Bitcoin pre- and post-halving form about 68% and 71% of miners’ total cost structure.

“The more rigs a miner has for self-mining, the larger the data centre needed on a megawatt basis. This large capital expenditure is either funded by cash, equity or debt, of which the latter can hurt miners’ all-in cost of production due to higher interest expense and put them at risk during Bitcoin downturns,” reads the analysis using Core Scientific as an example.

In an effort to return to solvency, Core Scientific closed an oversubscribed $55-million equity financing round on Jan. 8. The mining company intends to relist on Nasdaq after bankruptcy proceedings are completed.

Magazine: This is your brain on crypto — Substance abuse grows among crypto traders

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] Here you will find 4332 more Info on that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] Here you can find 87210 more Information to that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] Here you can find 50748 more Info to that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] Here you will find 36121 additional Info to that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] There you can find 6861 more Info to that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2561/ […]

… [Trackback]

[…] Here you can find 13237 additional Information on that Topic: x.superex.com/news/bitcoin/2561/ […]