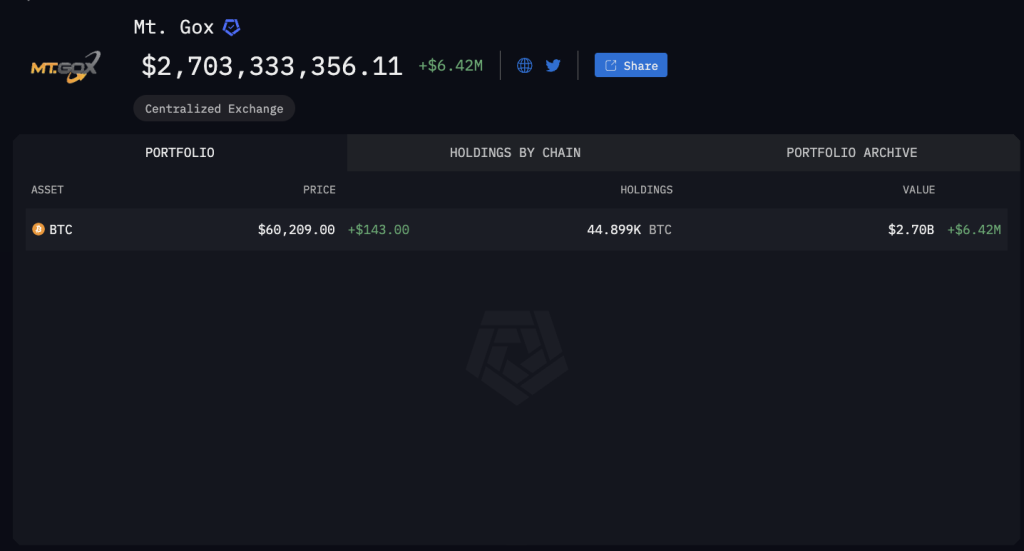

Bitcoin exchange inflow has fallen sharply in August — CryptoQuant

Exchange inflow gauges potential selling pressure, with high inflow suggesting high sell pressure and low inflow suggesting low pressure.

Despite transfers from the Mt. Gox bankruptcy estate and worries of a US government sell-off, Bitcoin (BTC) exchange inflows—the total number of BTC sent to exchanges— have dropped significantly since early August.

According to data from CryptoQuant, nearly 94,000 Bitcoin was transferred to exchanges on Aug. 4, followed by approximately 49,000 BTC sent to exchanges on Aug. 5, and roughly 51,000 BTC deposited to exchange wallets on Aug. 6.

Bitcoin exchange inflow. Source: CryptoQuant

Exchange inflows trended down for the rest of the month, with the most recent data for Aug. 20, showing 31,000 BTC sent to exchanges and indicating reduced selling pressure in the market.

Mt. Gox shifting funds contributing to selling pressure?

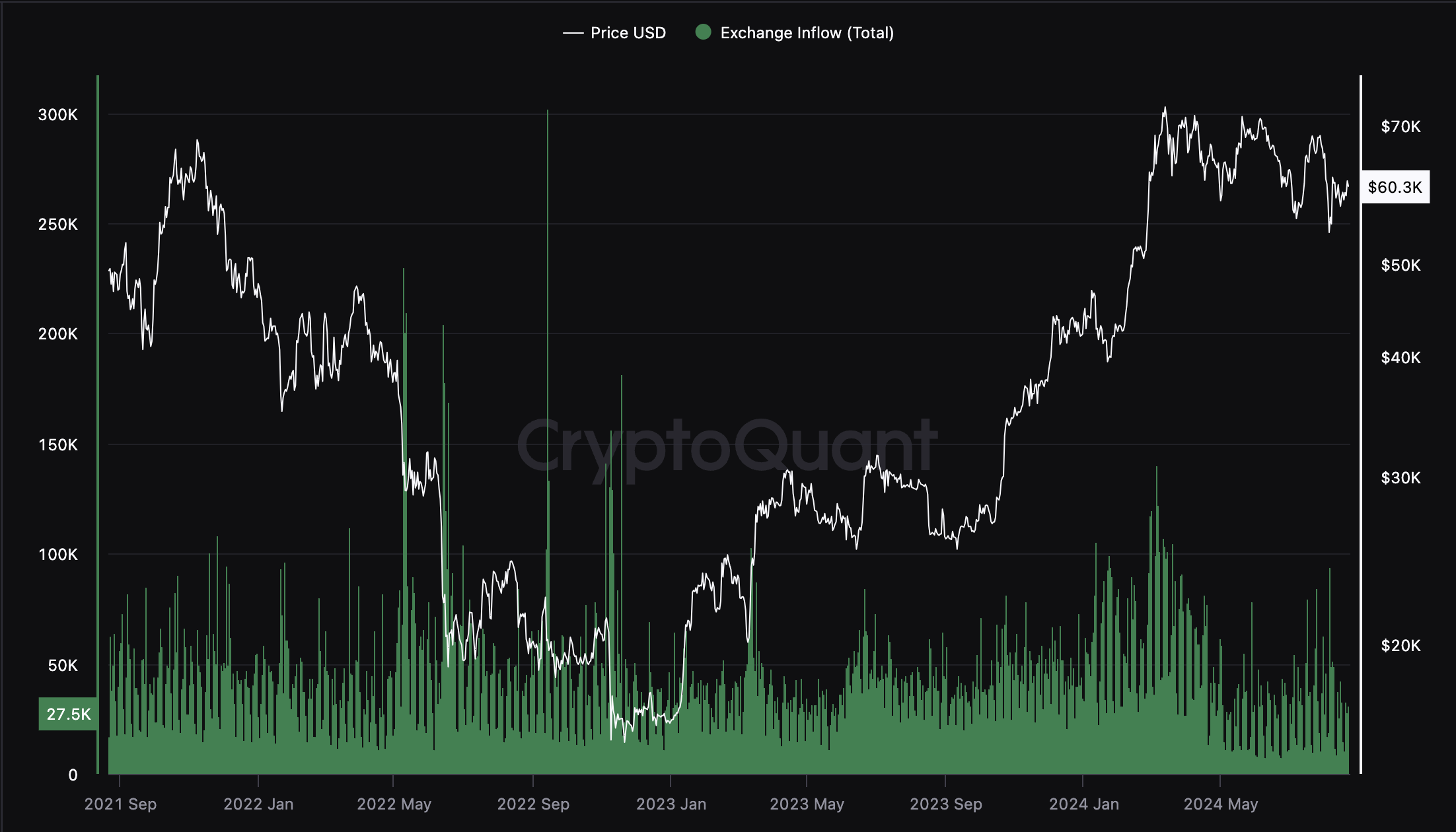

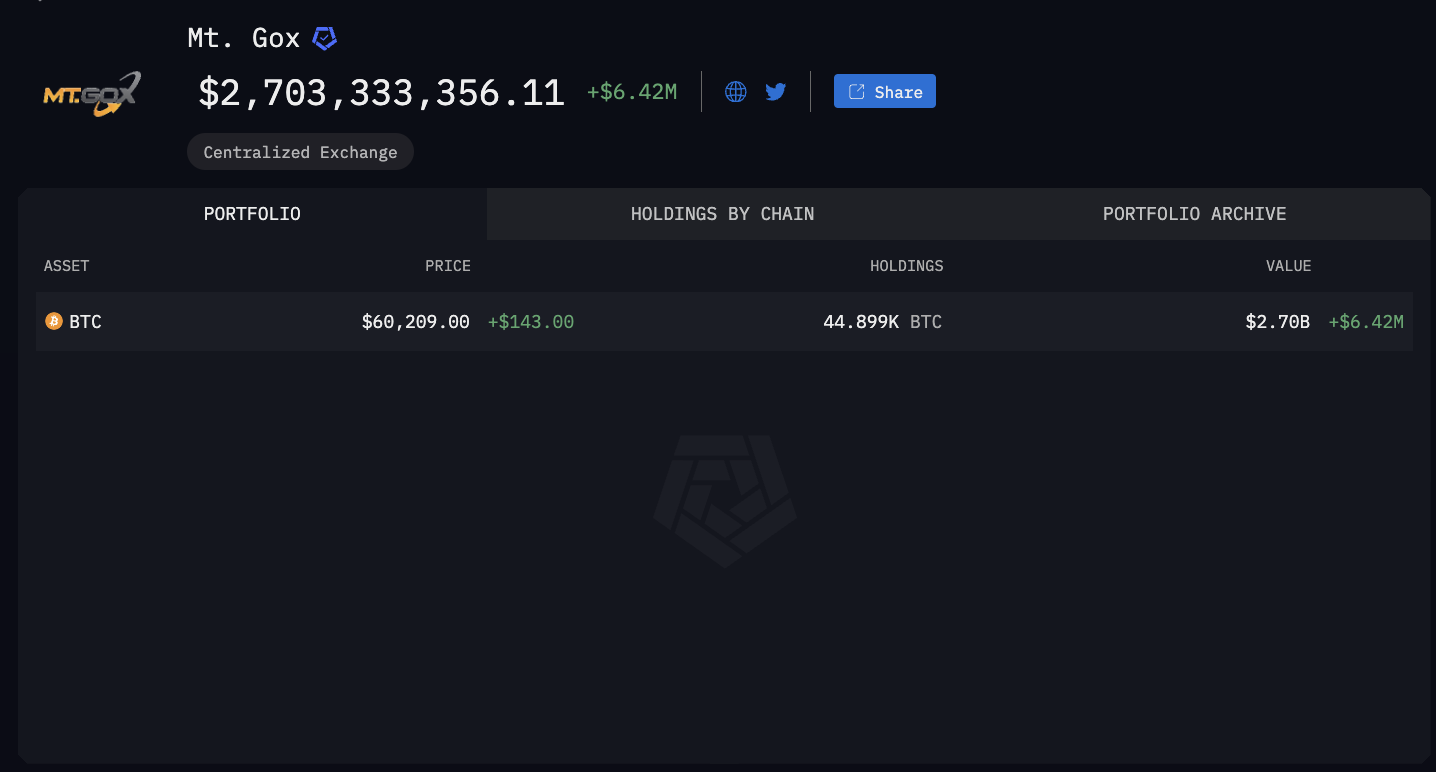

On Aug. 20, Mt. Gox moved 12,000 BTC, valued at roughly $709 million, to unknown wallets, marking the first time the defunct exchange has shifted funds in more than three weeks. According to data from Arkham Intelligence, wallets associated with the Mt. Gox exchange still hold 44,899 BTC, valued at roughly $2.7 billion at the time of writing.

Current Mt. Gox holdings. Source: Arkham Intelligence

The potential impact of the Mt. Gox distribution has been hotly debated by analysts for weeks. Recent data indicates that Mt. Gox creditors are generally holding their Bitcoin, and a mass sell-off from the creditors has not taken place.

Related: Bitcoin ‘ripe for short squeeze’ as bulls pressure $62K BTC price wall

Bitpanda deputy CEO Lukas Enzersdorfer-Konrad explained to Cointelegraph that this could be explained by the demographics of the Mt. Gox creditors, who represent early adopters of the decentralized tech and waited 10 years for their reimbursement.

Rumors of US government sell-off

Rumors of a potential US government sell-off began to circulate after the government shifted 10,000 Bitcoin to an unmarked wallet address on Aug. 14. Like the recent Mt. Gox transfer, this US government transaction marked a high-profile transfer.

However, some analysts correctly pointed out that the transfer may not indicate plans to offload the Bitcoin. Ryan Lee, chief analyst of Bitget Research, recently told Cointelegraph that the transfer of Bitcoin could be custody-related and does not necessarily mean that the US government plans to sell those holdings.

Magazine: Bitcoin Halving will pump games, Shrapnel’s ‘simple’ secret revealed: Web3 Gamer

Responses