Bitcoin Spot ETFs gain investor interest despite August outflows

The positive inflows into ETFs from major players like Fidelity and BlackRock highlight the growing confidence in these investment vehicles.

Bitcoin spot exchange-traded funds (ETFs) have continued to attract investor interest despite previous weekly significant outflows experienced earlier in August.

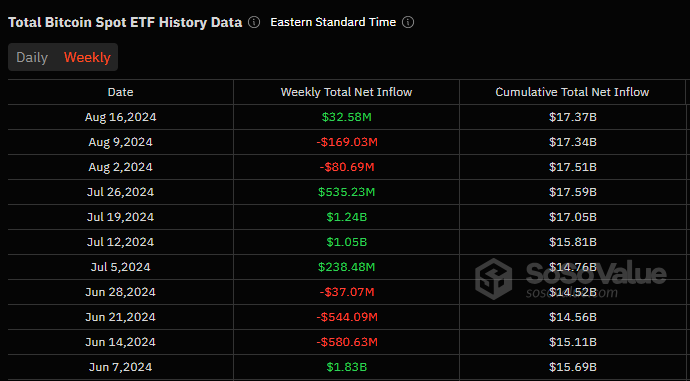

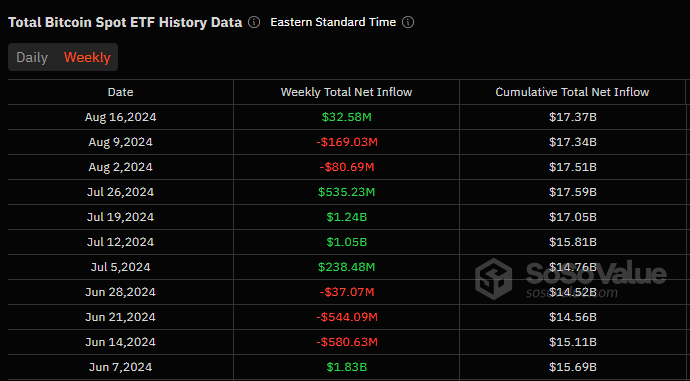

On Aug. 16, data from SoSoValue revealed that the total weekly net inflow for spot Bitcoin ETFs reached $32.58 million, a sharp contrast to the outflows seen in the previous weeks. On Aug. 2, the net outflow for spot Bitcoin ETFs was $80.69 million, while on Aug. 9, the outflow reached a substantial $169.03 million.

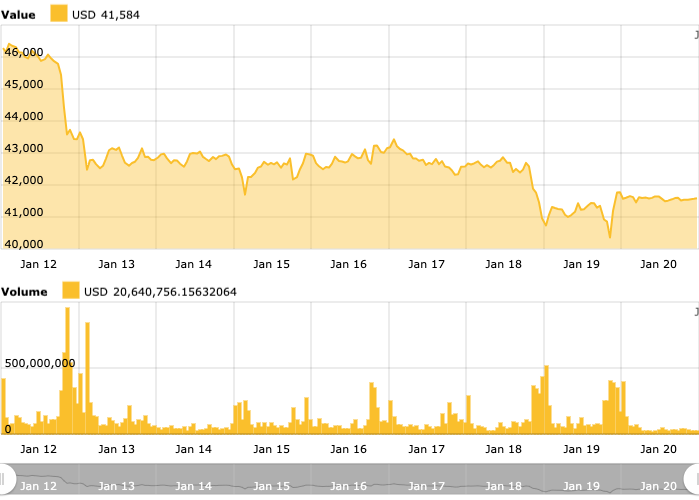

Mixed signals in the Bitcoin market

However, the total net inflow for spot Bitcoin ETFs on Aug. 16 reached $36.015 million, contrasting sharply with GBTC’s net outflow of $72.9033 million on the same day. While GBTC has been experiencing a continuous fund hemorrhage, spot Bitcoin ETFs are witnessing robust inflows, signaling a possible shift in investor preference.

Sosovalue data depicting an overview of Aug. 16 to June 7 market volatility. Source: Sosovalue

According to the data, the historical net outflow from GBTC stands at a staggering $19.646 billion. In contrast, the Grayscale Bitcoin Mini Trust ETF BTC saw no net outflow on Aug. 16, maintaining its total net inflow at $288 million.

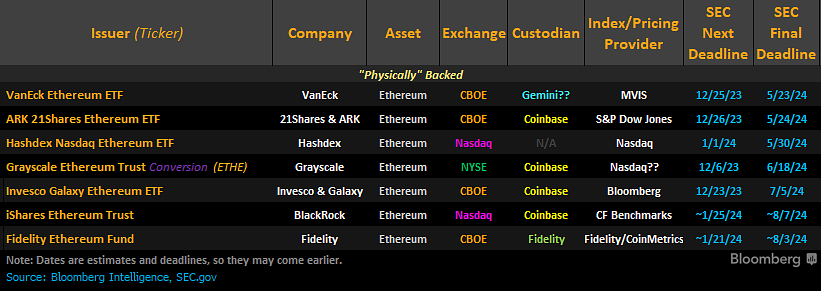

This indicates that while the main Grayscale product is facing challenges, its mini trust is holding steady. The decline in GBTC’s fortunes coincides with the New York Stock Exchange’s (NYSE) Arca’s decision to pull back on a proposed rule change that would have enabled the trading of GBTC and similar cryptocurrency exchange-traded funds (ETFs).

Fidelity and BlackRock lead

Among the spot Bitcoin ETFs, Fidelity’s ETF FBTC recorded the highest net inflow on Aug. 16, with an impressive $61.3469 million. This brings FBTC’s total historical net inflow to $9.804 billion, indicating a position as a favored choice among investors.

Related: Advisor holdings in Bitcoin ETFs rise, hedge fund stakes dip — Coinbase

BlackRock’s ETF IBIT also saw a significant net inflow of $20.3854 million on the same day, bringing its historical total to $20.388 billion.

The continued positive inflows into spot Bitcoin ETFs come at a time when their total net asset value stands at $54.353 billion. The ETF net asset ratio, which represents the market value of ETFs as a percentage of the total market value of Bitcoin, is currently at 4.65%.

Historical cumulative net inflows have reached $17.370 billion, further illustrating the growing acceptance and integration of Bitcoin ETFs in the investment landscape. An Aug. 14 SEC filing reveals that Morgan Stanley holds $188 million worth of shares in a Bitcoin exchange-traded fund (ETF).

Magazine: AI may already use more power than Bitcoin — and it threatens Bitcoin mining

… [Trackback]

[…] Informations on that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Here you can find 328 more Info on that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/11309/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/11309/ […]