Bitcoin Spot ETFs net $11M inflow, despite GBTC loss

Despite significant outflows from the Grayscale Bitcoin Trust, the overall spot Bitcoin ETF market saw positive inflows.

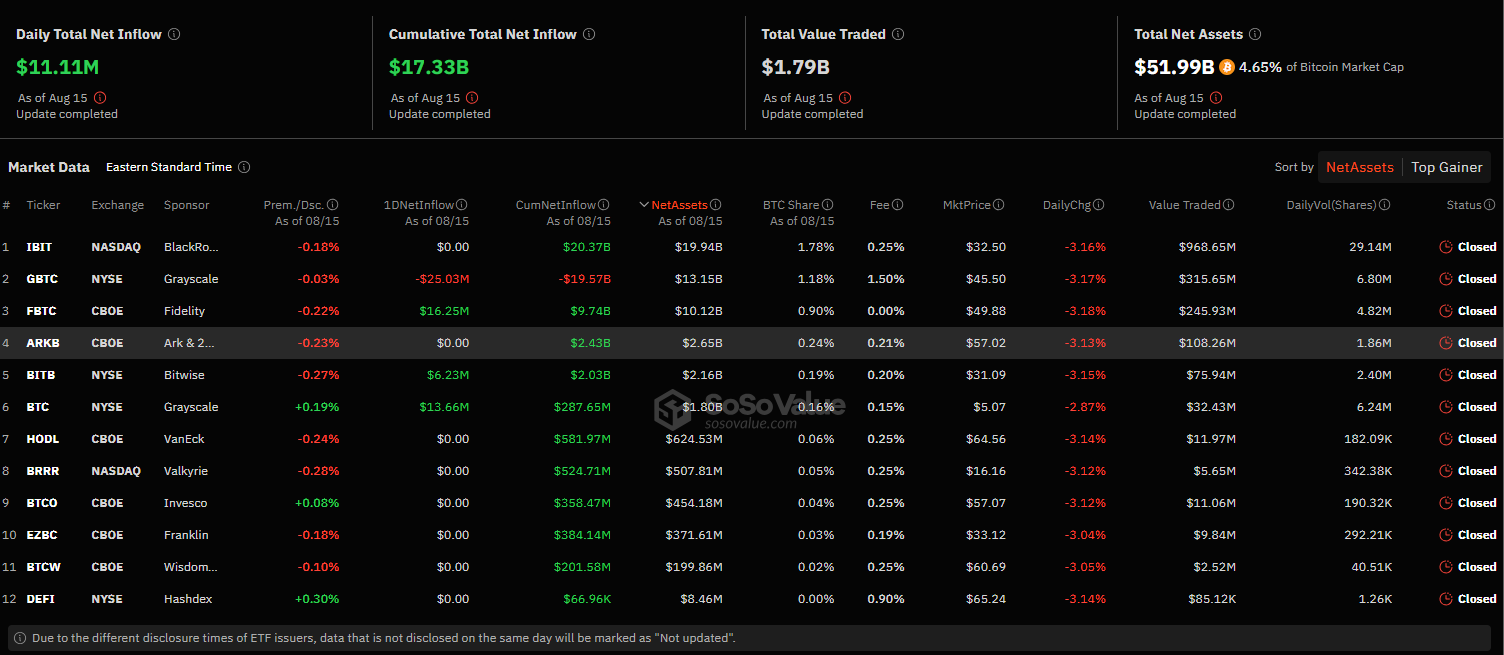

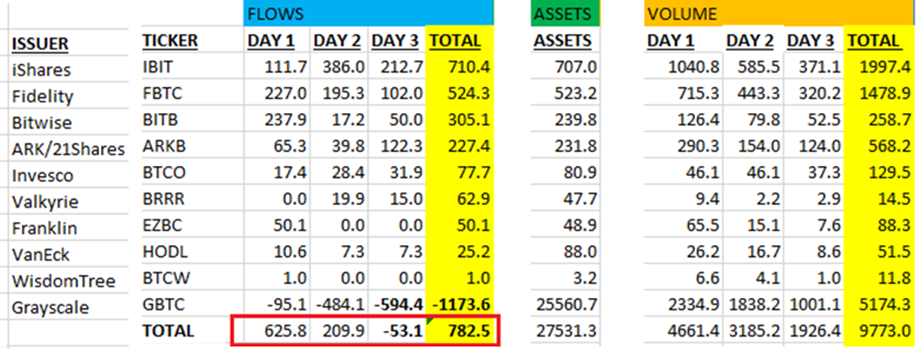

On Aug. 15, Bitcoin spot exchange-traded funds (ETFs) recorded a net inflow of $11.11 million, indicating continued investor interest despite outflows from Grayscale Bitcoin Trust (GBTC).

According to Sosovalue data, while the overall spot Bitcoin ETF market experienced positive inflows, GBTC witnessed a significant $25.03 million outflows during the same period.

This downturn for GBTC aligns with the New York Stock Exchange’s (NYSE) Arca electronic exchange, which withdrew a rule change proposed that would have allowed trading of GBTC and other crypto ETFs.

Sosovalue data depicting .11 million in daily total net inflows on Aug. 15. Source: Sosovalue

Related: First leveraged MicroStrategy ETF launches in US

Bitcoin ETF net assets hit $52 billion

According to Sosovalue data, the combined net inflow of Bitcoin (BTC) spot ETFs has reached $17.33 billion, contributing to a total net asset value of $51.99 billion.

The $52 billion milestone represents approximately 4.65% of the total BTC market capitalization and reveals the growing interest in the digital asset.

The rise in net assets also signals an increasing demand from institutional and retail investors who view spot Bitcoin ETFs as a viable and regulated option for digital asset exposure.

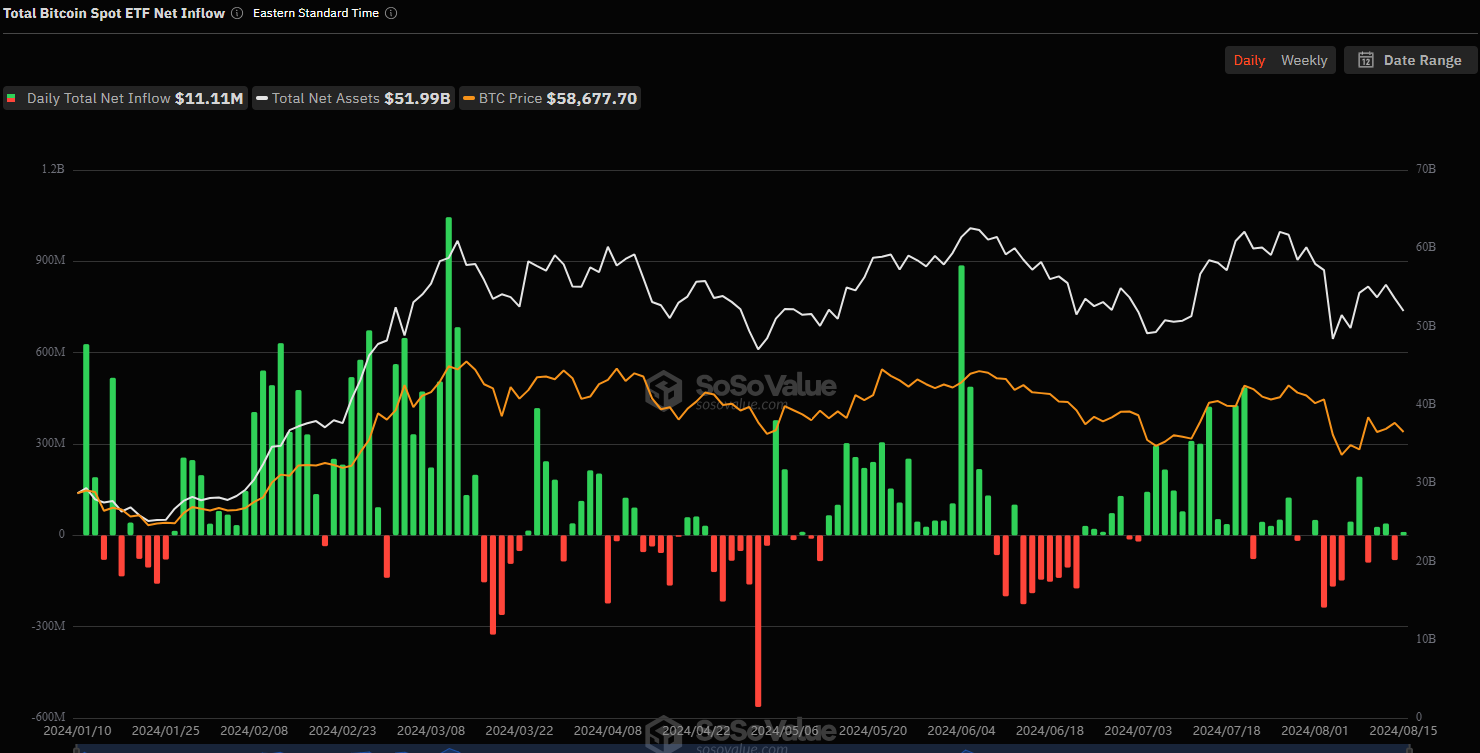

Sosovalue data showing .99 billion in total net assets. Source: Sosovalue

Related: Two-thirds of institutional Bitcoin ETF holders held or bought more in Q2

Market sentiment and volatility

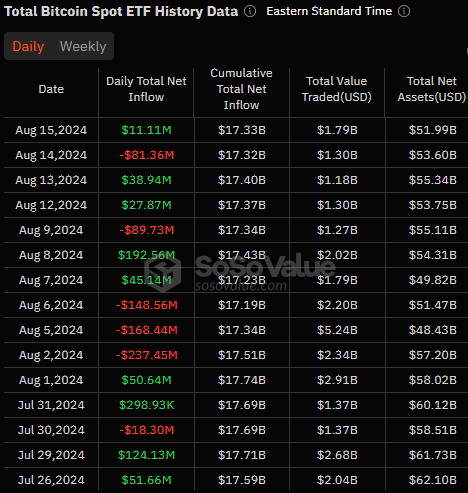

Although the $11.11 million daily total net inflow on Aug. 15 indicates a positive shift in investor sentiment, the last seven days paint a different picture.

According to Sosovalue data, spot Bitcoin ETF outflows totaled $81.36 million on Aug. 14, starkly different from the influx of funds just one day later.

The data suggests that investors could be taking profits and reallocating aspects of their portfolios following BTC price dips and hikes as they appear during crypto market volatility.

Sosovalue data depicting an overview of July 26 to Aug. 15 market volatility. Source: Sosovalue

Related: Solana ETFs will not see significant demand — Sygnum research head

Morgan Stanley disclosed $188 million in Bitcoin ETFs

In an Aug. 14 filing to the United States Securities and Exchange Commission (SEC), the US investment banking firm Morgan Stanley reported $188 million in BTC ETF shares.

As of June 30, the investment banking firm held more than 5.5 million shares of BlackRock’s iShares Bitcoin Trust (IBIT) ETFs in the second quarter of 2024.

The public revealing of the $188 million in IBIT shares preceded the firm announcement that it would enable its financial advisers to recommend BTC ETFs to clients.

Magazine: AI may already use more power than Bitcoin — and it threatens Bitcoin mining

Responses