Coinbase cbBTC token may revolutionize Bitcoin DeFi adoption

Coinbase’s step marks the latest significant institutional entrant to the field of BTCFi.

Coinbase, the world’s second-largest cryptocurrency exchange, could significantly boost the adoption of Bitcoin-native decentralized finance (DeFi).

The exchange has recently teased the development of a new Wrapped Bitcoin (BTC), called Coinbase BTC (cbBTC), creating widespread excitement among crypto investors.

cbBTC announcement. Source: Coinbase

The new token could significantly bolster the adoption of Bitcoin-native DeFi, according to Rena Shah, the chief operating officer of Trust Machines, a software firm building Bitcoin solutions. Shah told Cointelegraph:

“The opportunity for cbBTC, based solely on current Coinbase users, is a massive onboarding opportunity for Bitcoin DeFi…”

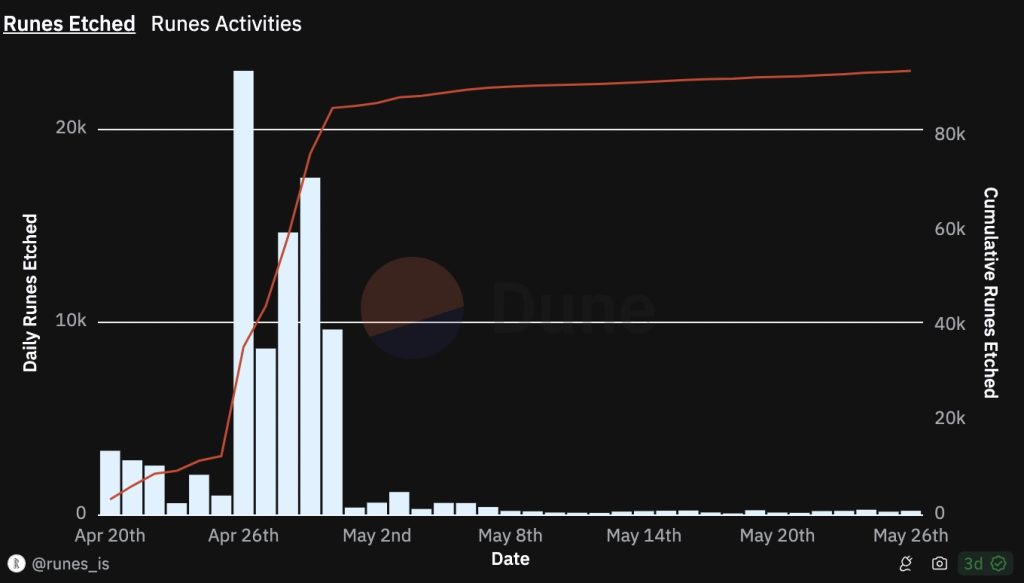

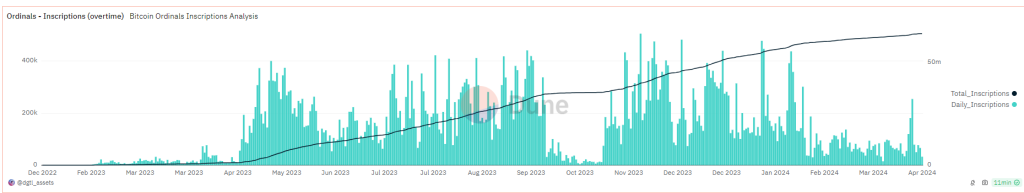

Coinbase’s move is a major development for Bitcoin DeFi, or BTCFi, a wider developer movement aiming to add more utility to the Bitcoin network. Interest in BTCFi rose with the debut of Runes, a new protocol for issuing fungible tokens on the Bitcoin network that launched on April 20, the day of the halving.

The news comes three months after the industry witnessed the launch of the first Bitcoin-backed synthetic dollar, USDh, which debuted with a 25% yield for investors.

Related: Key Bitcoin bull signal flashes for first time in nearly 2 years, hinting at 2x price surge

Coinbase cbBTC adoption depends on DApp usage

Coinbase’s upcoming wrapped token will significantly benefit from the mainstream trust placed in the cryptocurrency exchange.

However, the token’s adoption will mainly depend on the demand generated from the decentralized applications (DApps) and use cases offered by the coin, explained Shah:

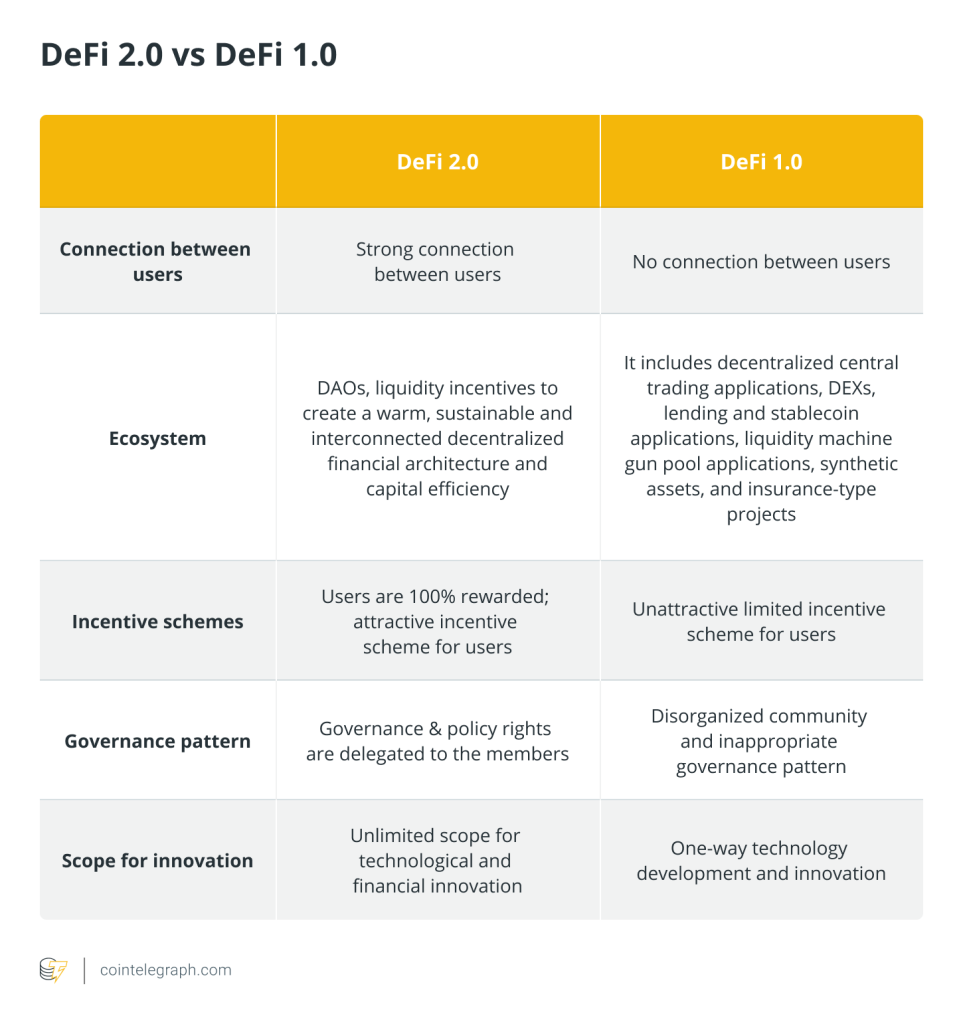

“The value proposition made by these EVM wrappers isn’t compelling enough for Bitcoin native audiences, and I predict those who enter through them will soon see the benefit in more decentralized approaches that keep the secure and immutable nature of Bitcoin intact.”

According to Shah, the use cases will also be influenced by the number of developers flocking to cbBTC, which will ultimately depend on the token’s attributes since builders want more decentralized and non-custodial solutions.

Related: Arthur Hayes’ Maelstrom announces Bitcoin grant program of up to $250K per developer

Bitcoin liquidity could catalyze real DeFi growth

The DeFi space could significantly grow from the liquidity of the Bitcoin ecosystem.

This realization was the main reason for developing Wrapped Bitcoin (wBTC), according to Loi Luu, a core wBTC contributor, who wrote in an Aug. 13 X post:

“DeFi’s total value locked (TVL) was only in the tens of millions. We realized that to really help DeFi grow, we needed to bring Bitcoin liquidity into the ecosystem.”

While wBTC is an ERC-20 token native to the Ethereum network, many consider it one of the first significant BTCFi developments, adding more utility and capital efficiency to BTC.

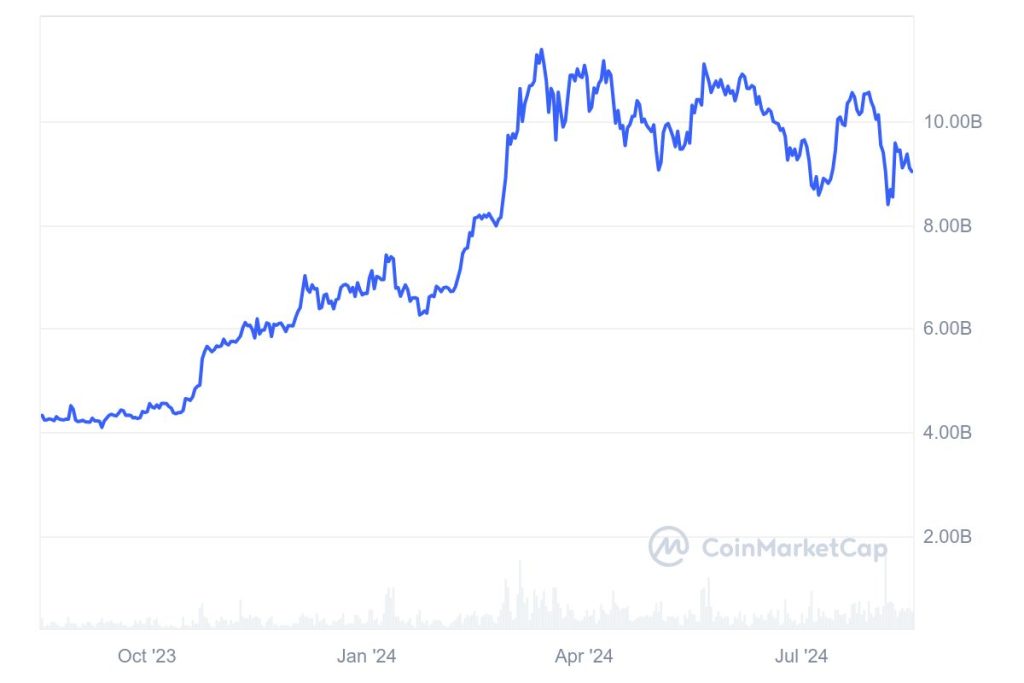

WBTC market cap. Source: CoinMarketCap

According to CoinMarketCap data, Wrapped Bitcoin has a market capitalization of over $9 billion, which rose over 100% over the past year.

Magazine: How Chinese traders and miners get around China’s crypto ban

Responses