Historically accurate ‘decaying peaks’ study sees Bitcoin price at $164K by 2025

The same study correctly predicted Bitcoin price to reach $65,732 in 2021, a mere $1,050 price difference from the previous all-time high.

Bitcoin (BTC) reached an all-time high value of $73,881 by March 2024, producing 68% returns in Q1. Since then, it has struggled to break the price range between $70,000 and $60,000. However, based on a new study, BTC might still see 174% gains by the end of 2024.

Bitcoin is currently showing bullish resolve above $60,000 after its weekly chart presented a bullish morning star pattern. Over the past day, BTC is up by 3.5%.

Bitcoin study predicts high targets between 2025-2026

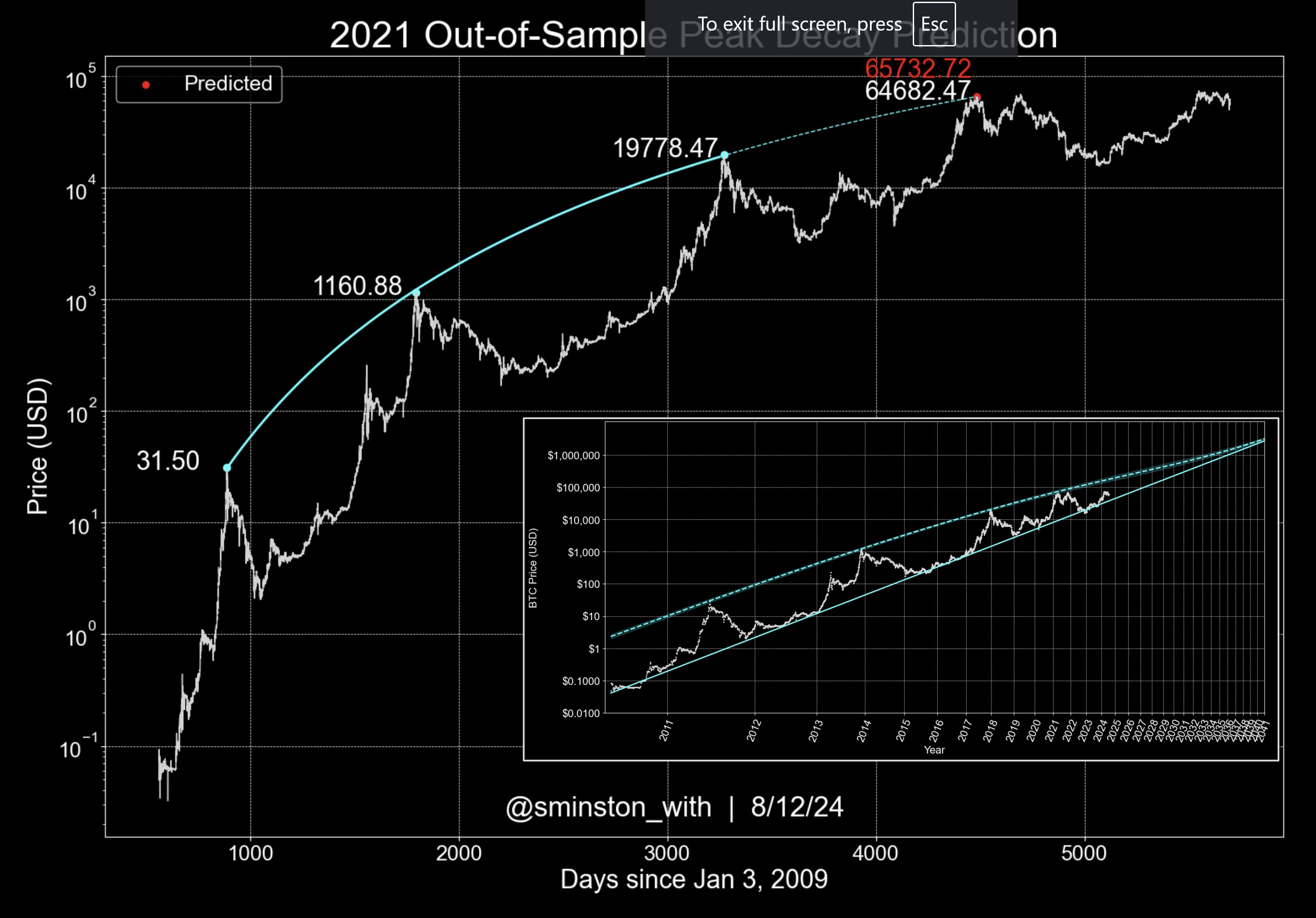

Sminston With, a Bitcoin researcher, shared a study on X.com where he analyzed the previous Bitcoin bull cycle tops in 2011, 2013 and 2017. The idea was to evaluate each decaying peak based on the BTC price residuals at each cycle high.

A decaying period in an investment cycle means the diminishing returns of a strategy over time after the opportunity has been widely adopted or exercised. The decaying period reaches a peak when the rate of decline in an asset’s value accelerates, and the time left to realise a profit from the trade speeds up.

The researcher explained that he conducted an “exponential decay fit,” considering the prices of 2011, 2013, and 2017, to predict the BTC high of 2021. The objective was to understand if the data set was cohesive enough to predict the top and if the results were positive. With stated,

“The results are pretty striking: it predicted $65,732.72, where the actual peak price was $64,682.47, a price difference of about $1,050.”

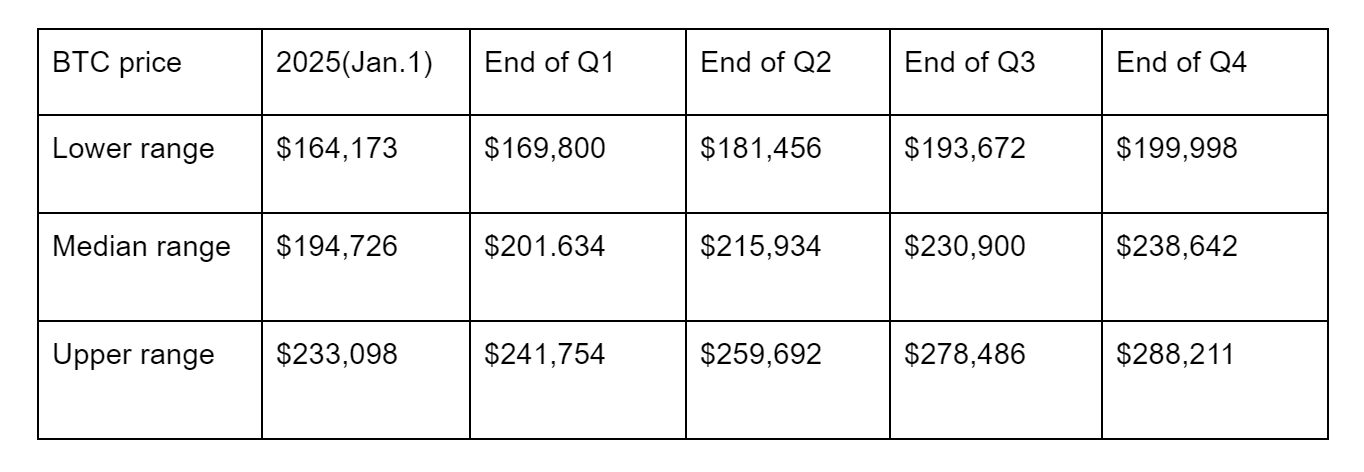

The results were pretty staggering when asked about a potential price prediction for the 24/25 cycle. The quarter-on-quarter target between 2024 and 2025 is listed below.

This study should be taken with a “big grain of salt” as it comprises a data set of only four market cycles, the researcher cautioned.

Bitcoin power law confluences on 6-figure target

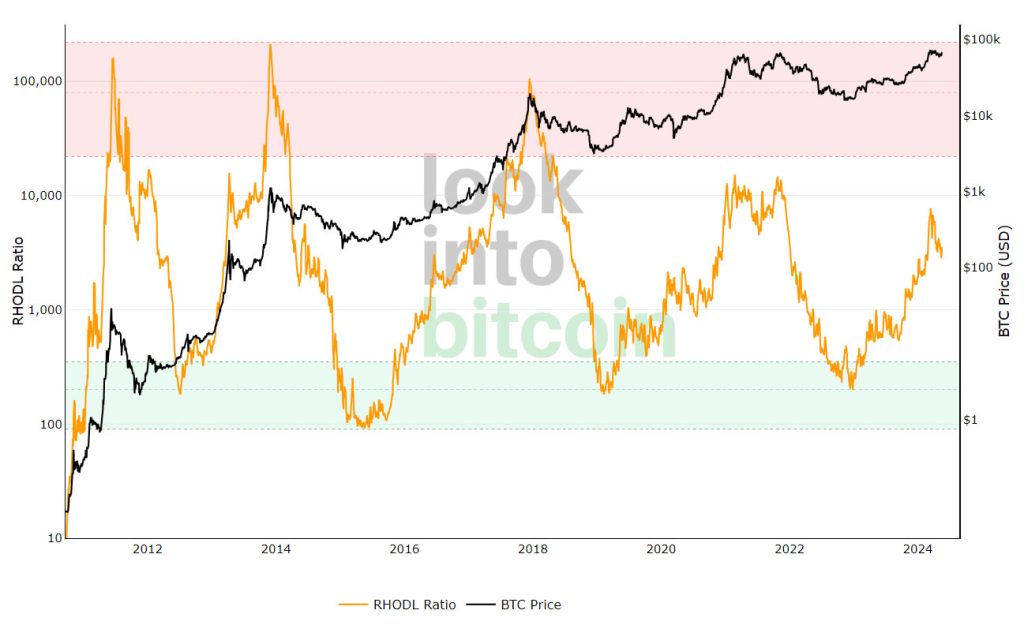

While the above study anticipates positive returns in the upcoming months, a confluence can also be seen with other mathematical models. The Bitcoin power law, for example, which is based on the same exponential decay concept, indicates that Bitcoin has yet to reach a new peak.

As illustrated in the chart below, BTC remains under the linear regression line(green) and hasn’t crossed above this range in the current bull cycle. On each previous occasion during 2013, 2017 and 2021, BTC’s value peaked when it exceeded the linear line value (green line).

At the moment, Bitcoin’s regression line value is around $88,000, and by the beginning of 2025, it will reach a value of $100,000. So, if history repeats, Bitcoin’s next price peak can be expected to be above $100,000.

BTC price faces stiff resistance at $62K

Bitcoin has recovered 14% since Aug. 6 but faces stiff resistance between $62,000 and $63,800. The 50 and 100-day exponential moving averages( blue and purple lines, respectively) offer additional potential support levels in this range.

However, one bullish reversal illustrated by BTC is the recovery above the 200-EMA in quick succession. This indicates the continued presence of bullish bidding and the absence of a bearish stronghold.

With the markets exhibiting caution in the lead-up to the U.S. CPI data release, Bitcoin should ideally maintain a position above $60,000 to build bullish momentum for a possible breakout above the $62,000 resistance level.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

-INDEX-IN-3-MINUTES@2x-1024x576-4.png)

Responses