Grayscale launches investment fund for MakerDAO token

Grayscale also launched funds for protocols Bittensor and Sui in August.

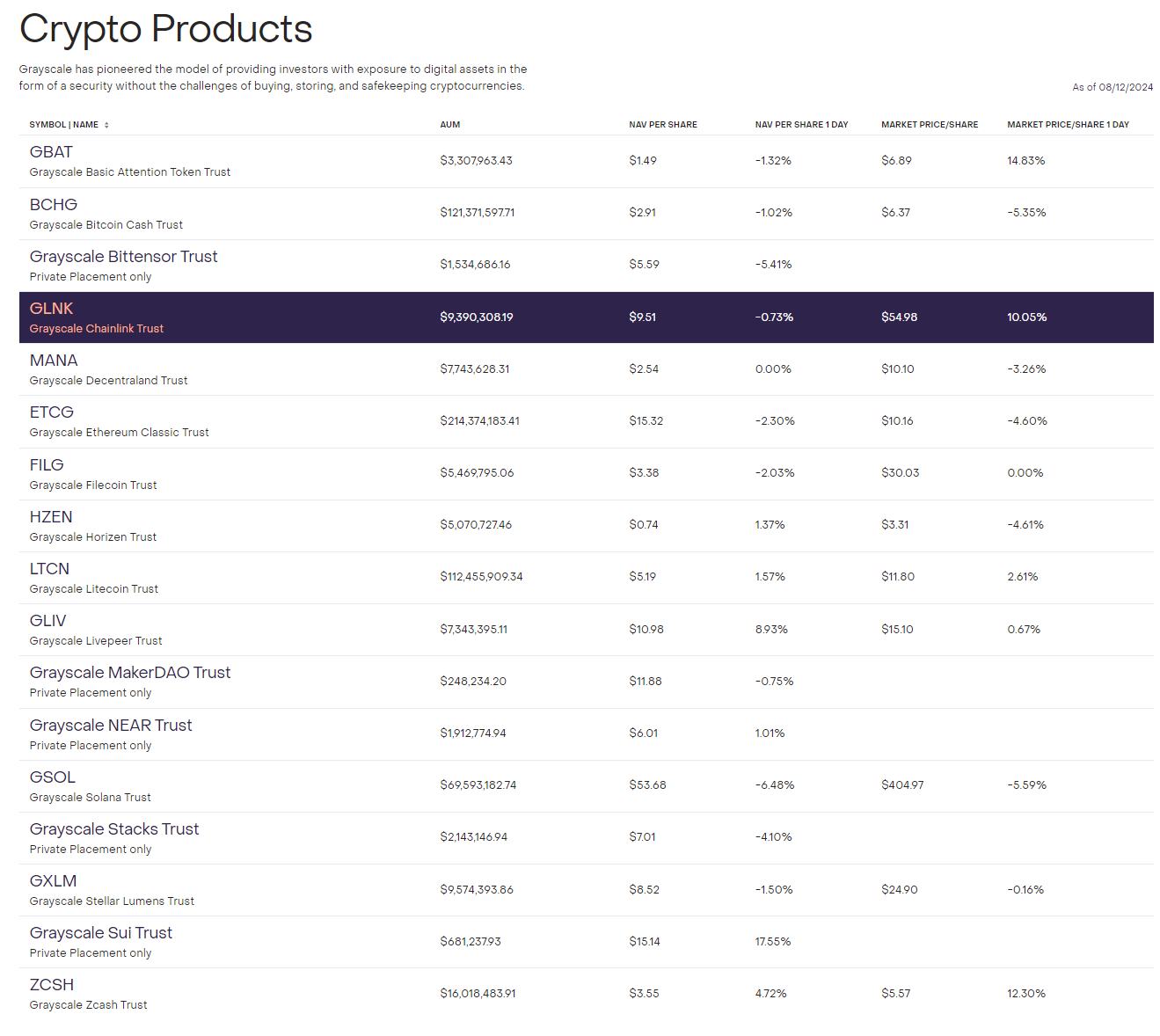

Asset manager Grayscale Investments launched a new investment fund for MakerDAO’s governance token, MKR, according to an Aug. 13 press release.

The Grayscale MakerDao Trust “offers investors the opportunity to gain exposure to MKR, the utility and governance token for the Ethereum-based, autonomous organization MakerDAO,” according to the announcement.

The fund — which is not exchange-traded and is only available to qualified investors — adds to Grayscale’s suite of single-asset crypto investment products. On Aug. 7, Grayscale launched two other trusts for investing in Bittensor and Sui’s native protocol tokens.

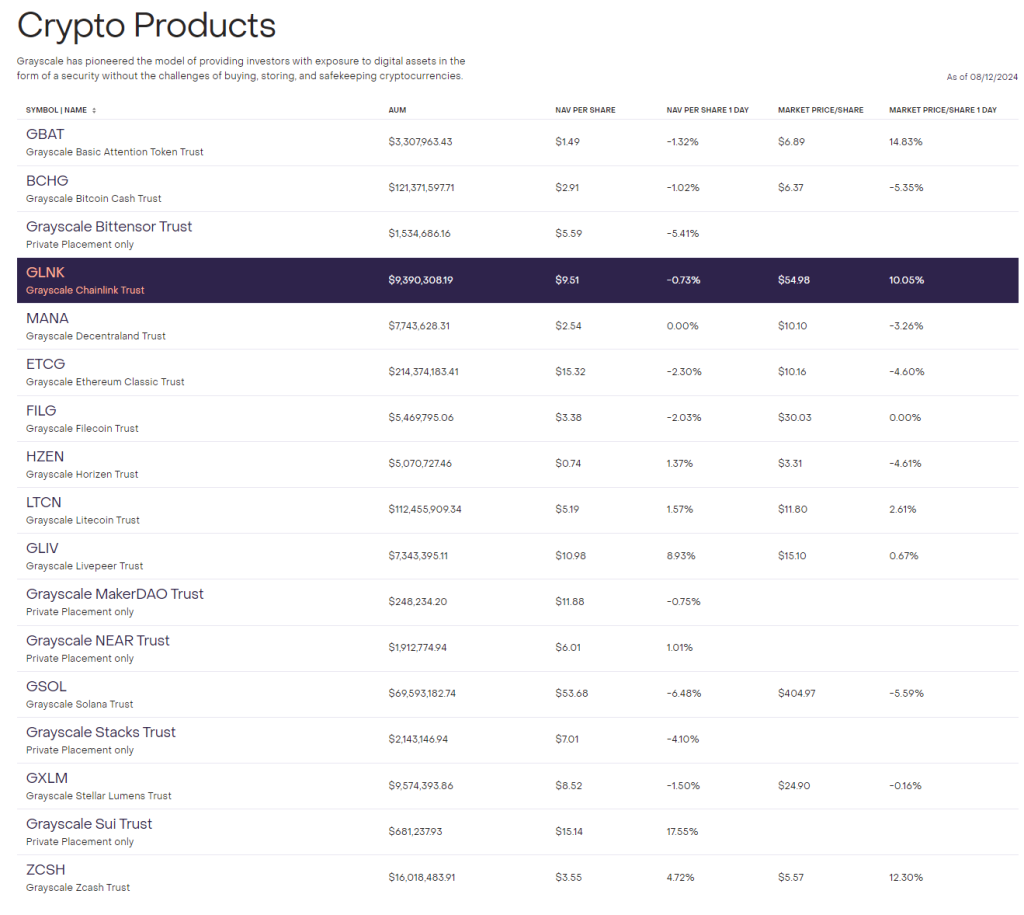

Grayscale is the world’s largest crypto fund manager, with upwards of $25 billion in assets under management (AUM) as of Aug. 1. It is best known for its Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs), including Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE).

Related: Crypto ETFs will expand to new asset types, indexes — Grayscale executive

Grayscale also operates private single-asset funds for other protocol tokens, such as Basic Attention Token (BAT) and Chainlink (LINK).

MakerDAO is a decentralized finance (DeFi) protocol and issuer of the United States dollar-pegged stablecoin, DAI. It also operates an ecosystem of onchain credit products. In July, MakerDAO announced plans to invest $1 billion in tokenized US treasury bonds.

Grayscale’s MakerDAO Trust “allows investors to experience the growth of the entire MakerDAO ecosystem,” Rayhaneh Sharif-Askary, Grayscale’s head of product & research, said in a statement.

“Grayscale is committed to expanding our suite of products and providing innovative investment opportunities,” Sharif-Askary added.

During an Aug. 12 webinar, Dave Lavalle, Grayscale’s global head of ETFs, predicted that the market for cryptocurrency ETFs will expand to encompass new types of digital assets as well as diversified crypto indexes.

“We’re going to see a number of more single asset products, and then also certainly some index based and diversified products,” Lavalle said.

Responses