More 'extreme fear' than FTX crash — 5 things to know in Bitcoin this week

Bitcoin market sentiment is as erratic as BTC price action itself as a week of macro volatility catalysts gets underway.

Bitcoin (BTC) continues a wild August with more volatility as the week opens with a dip below $60,000.

After a spectacular reclaim of the ground lost after an equally spectacular collapse to six-month lows, BTC price action is fighting to restore its bullish narrative.

Who will take control in the coming days?

The stage is already set for the ongoing battle between bulls and bears — but there are plenty of volatility catalysts waiting to provide some surprises.

Chief among them comes from outside the crypto sphere in the form of macroeconomic data from the United States.

The July print of the Consumer Price Index (CPI) is top on analysts’ radar amid controversy over how the Federal Reserve is handling global market instability.

Due on Aug. 14, CPI will come a day after the Producer Price Index (PPI), while jobless claims will round out the week.

For traders, meanwhile, a double “death cross” on BTC/USD provides a grim reminder of how even bull markets can have their ugly moments.

Bitcoin network fundamentals are also reacting to recent market turmoil, with mining difficulty set for its first drop in six weeks.

With Bitcoin and altcoins in a state of flux, Cointelegraph takes a closer look at the key factors currently influencing the market.

BTC price action “all over the place”

After a flat weekend, Bitcoin upped the volatility into the weekly close, with last-minute downside attributed to manipulatory actions by large-volume traders.

The close itself thus came in at just above $58,700, per data from Cointelegraph Markets Pro and TradingView, marking only a slight rebound versus the $10,000 losses from two weeks prior.

The Aug. 12 Asia trading session continued the volatile theme, with local lows of $57,700 appearing on Bitstamp.

“Lower timeframes are all over the place, but the weekly chart tells a different story,” popular trader Jelle responded on X.

“165 days of mid-cycle consolidation. This cycle ain’t over.”

“We went a little higher than expected but 55k support retest is next. Will look for a long setup in that area,” fellow trader Roman told X followers in part of his latest market coverage.

Credible Crypto noted that bid liquidity on exchange order books currently stood slightly higher than “untapped lows” near the $55,000 zone.

“Lots of people watching the green long zone between 54.5-56.5k as we have local demand there and equal, untapped lows,” he wrote in part of an X post alongside an explanatory chart.

“That being said heatmaps are showing stacked bids right above that region- front running the ‘ideal’ long zone.”

Credible Crypto acknowledged a reset of open interest into the weekly close drawdown.

“Would not surprise me if we front run the 54.5-56.5k zone and reverse before that,” he concluded.

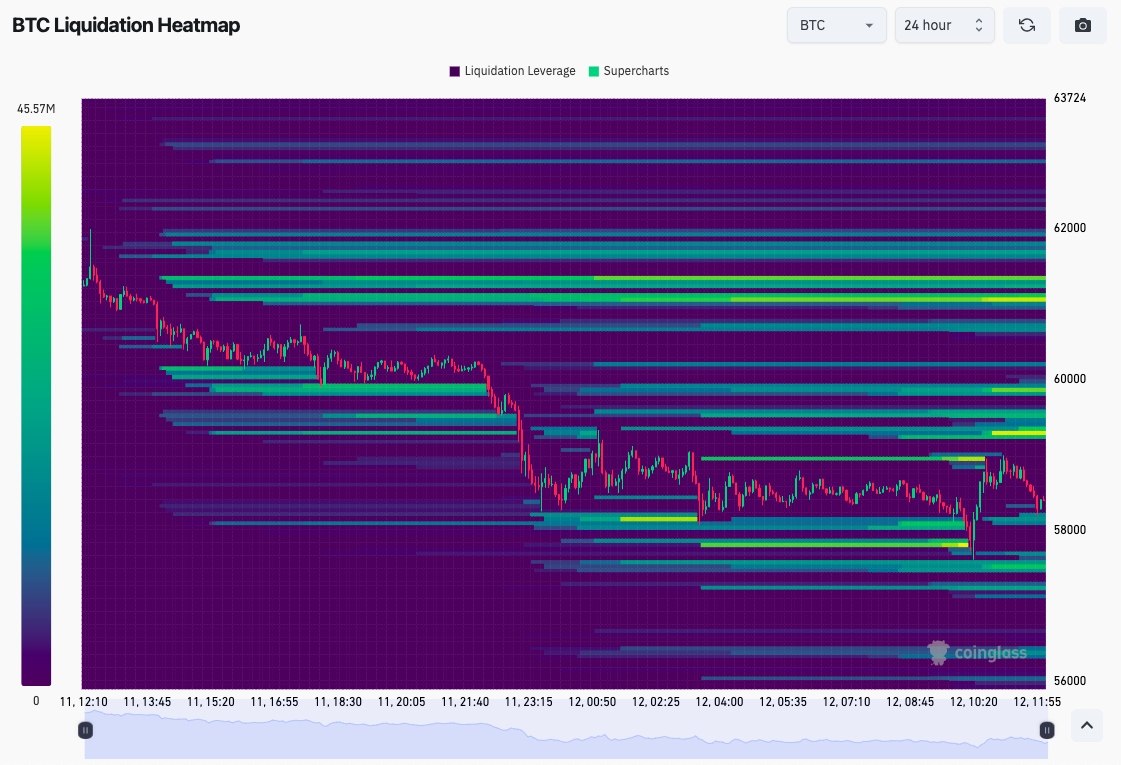

The latest data from monitoring resource CoinGlass meanwhile showed buyer liquidity appearing at $57,700 and lower on Aug. 12. Heavy ask ladders remained overhead, focused on $61,000.

Bitcoin bulls battle two death crosses

Bitcoin has managed to cement two separate “death crosses” over the past week, a problematic situation that has not gone unnoticed by the trading community.

As Cointelegraph reported, these involve four trendlines: the 21, 50, 100 and 200-day simple moving averages (SMAs).

In recent days, the downward-sloping 21-day SMA has crossed below the 100-day equivalent — a move then repeated by the 50-day and 200-day pair.

“Bitcoin Bulls were not able to avoid the second Death Cross,” Keith Alan, co-founder of trading resource Material Indicators, confirmed in X commentary on Aug. 11 while uploading a snippet of video analysis.

In this, Alan nonetheless described the death crosses as “not the be all and end all” for the market, with bullish volatility still able to cancel out the consequences.

“Again, they’re lagging indicators, so you have to wait and see,” he said.

Earlier, popular trader Benjamin Cowen argued that a daily close above $62,000 would be necessary to avoid further death cross problems going forward.

CPI week arrives as VIX volatility stays unsettled

This week’s CPI and PPI prints could arguably not come at a worse time for risk asset traders.

Any surprises will add to a complex picture of US inflation, with the Fed already under pressure to lower interest rates at its next meeting in September.

Last week’s turmoil, centered on Japan, only increased the onus on the Fed to respond, but so far, the status quo remains the same — the highest rates in more than twenty years.

“We have a busy week ahead,” trading resource The Kobeissi Letter summarized in one of its latest X threads.

Kobeissi noted that the VIX volatility index remains elevated after hitting its third-highest levels in history last week.

However, CPI itself is forecast to continue falling, which should empower the Fed to consider the all-important rate cut.

Charlie Billelo, chief market strategist at wealth management firm Creative Planning, focused on fuel as a potential contributing factor to the Fed’s dovish stance.

“Gas prices in the US have moved down to $3.45 per gallon (national average) from $3.82/gallon a year ago (10% decline),” he noted last week.

“If this holds, will likely be a factor in pushing down headline CPI for August (Cleveland Fed is currently forecasting 2.7%), solidifying the Fed’s rate cut.”

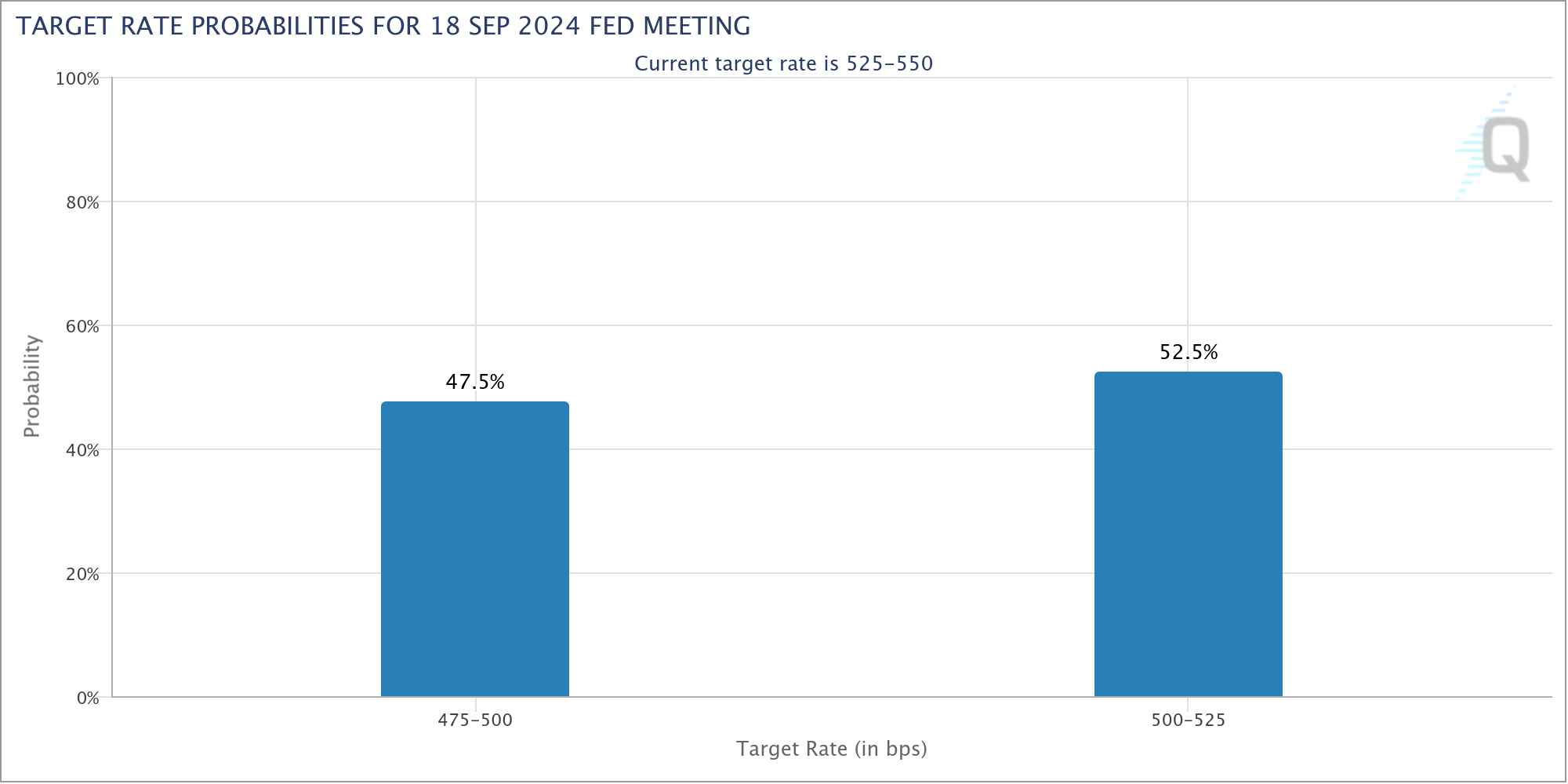

The latest data from CME Group’s FedWatch Tool showed markets pricing in near equal chances of a 0.25% and 0.5% cut in September as of Aug. 12. At the height of the volatility around Japan, the odds heavily favored the latter.

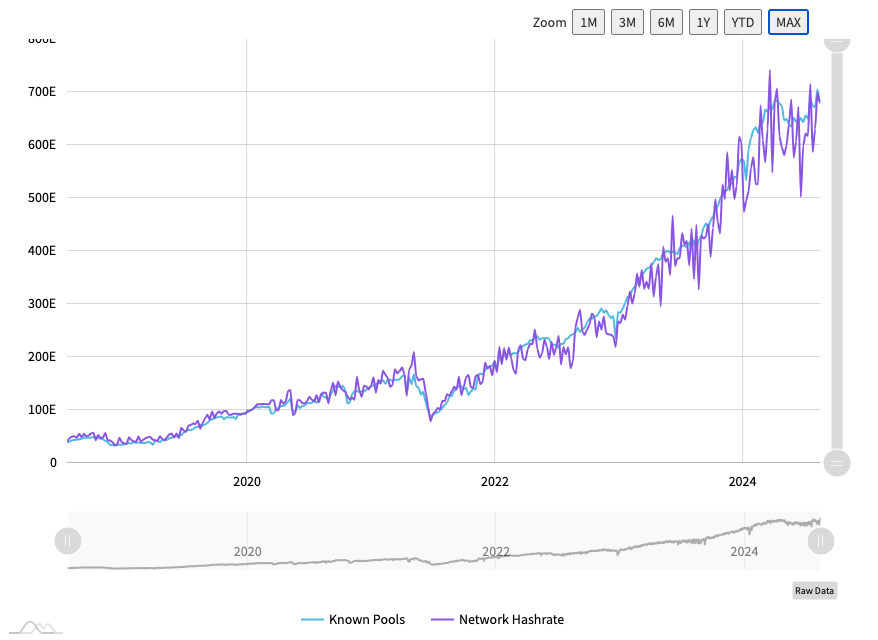

Mining difficulty due a modest retracement

It is now time for Bitcoin network fundamentals to respond to the past two weeks’ market mayhem.

In that time, six-month lows for BTC/USD have transformed into a retest of $63,000, with the pair now somewhere in between.

Accordingly, mining difficulty is expected to deliver a modest decrease at its next automated readjustment on Aug. 14. Estimates from monitoring resource BTC.com put this at around 3.5% at the time of writing.

This will be the first difficulty drop in six weeks, yet somewhat average for 2024, which has seen several downticks of over 5%.

Hashrate, meanwhile, continues to circle record highs, raw data from MiningPoolStats confirms. This underscores an increasingly resilient mining sector already getting to grips with the post-halving landscape.

Analyzing US mining firm data, Ki Young Ju, CEO of crypto analytics platform CryptoQuant, highlighted the average cost of mining 1 BTC still being around $15,000 lower than current spot price.

“US mining companies’ average mining cost per Bitcoin is around $43K. Marathon Digital’s Q2 2024 report shows an average mining cost of $42,969 per BTC,” he noted last week.

“This can be calculated using their operational hash rate, cost per petahash per day, and average daily Bitcoin mined.”

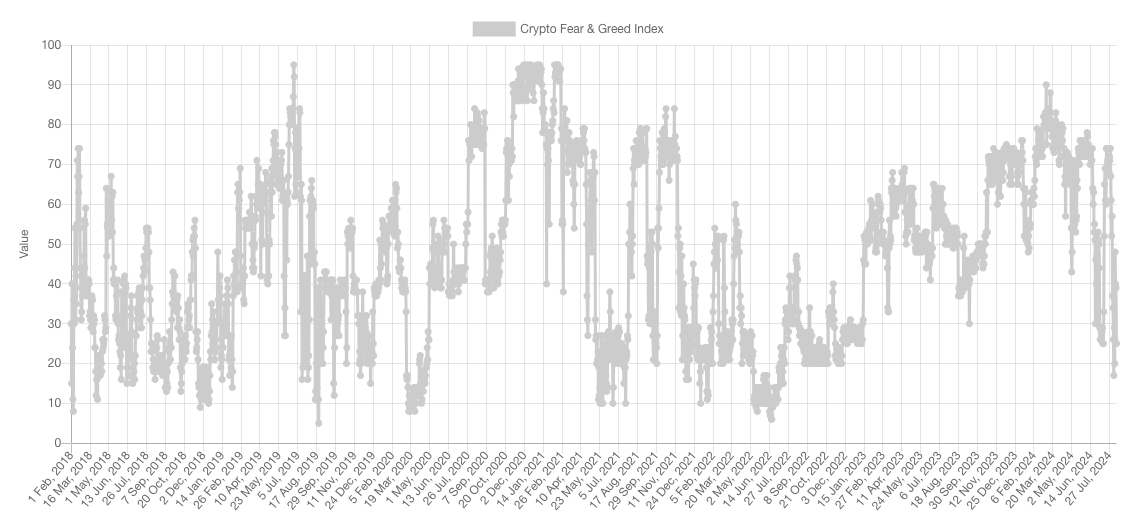

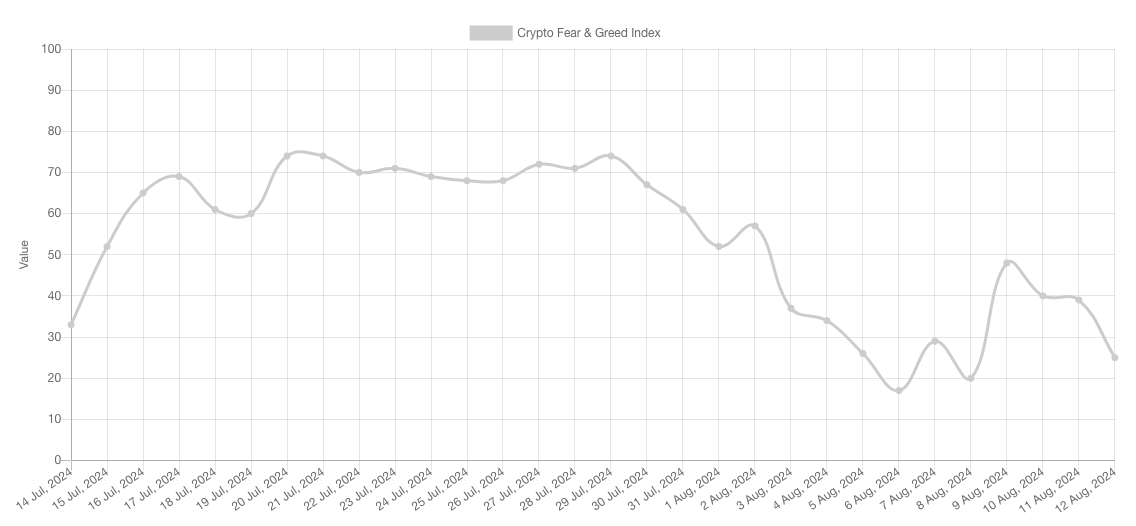

Crypto embraces multi-year sentiment lows

As crypto markets present a state of flux, so too does the mood among traders.

Related: Bitcoin price drops below $59K as institutions stop buying stablecoins

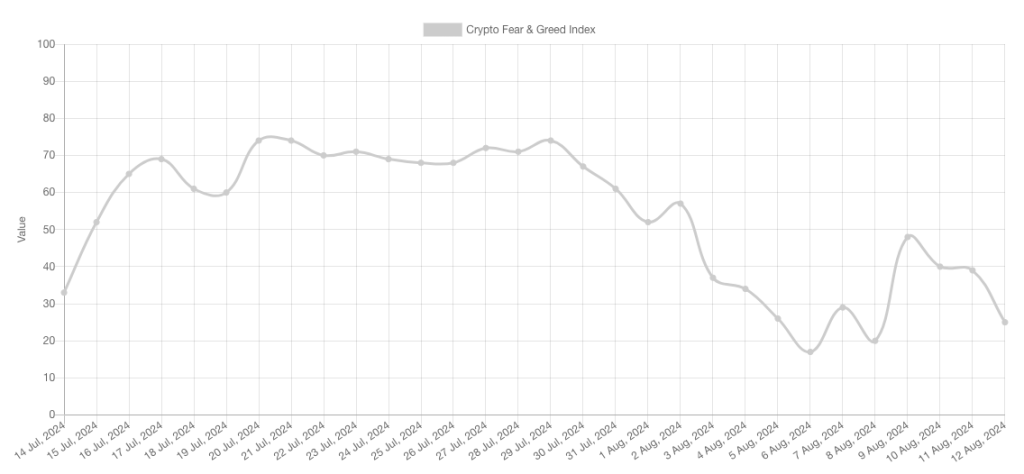

The latest figures from the Crypto Fear & Greed Index make for unusual reading, with large swings echoing the fickle nature of market sentiment.

On Aug. 6, Fear & Greed hit lows of 17/100 — marking its deepest level since July 2022 and even surpassing the reaction to the FTX meltdown at the end of that year.

The subsequent BTC price rebound shifted sentiment from “extreme fear” to neutral in days, hitting 48/100 before reversing down once again.

Thus, as of Aug. 12, crypto is back in “extreme fear” despite the absence of a corresponding price downturn.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses