Plus Token Ponzi-linked wallet moves $2B ETH after 3.3 years of dormancy

After over three years of inactivity, cryptocurrency wallets linked to the Plus Token Ponzi scheme have moved $2 billion in ETH, potentially impacting the market.

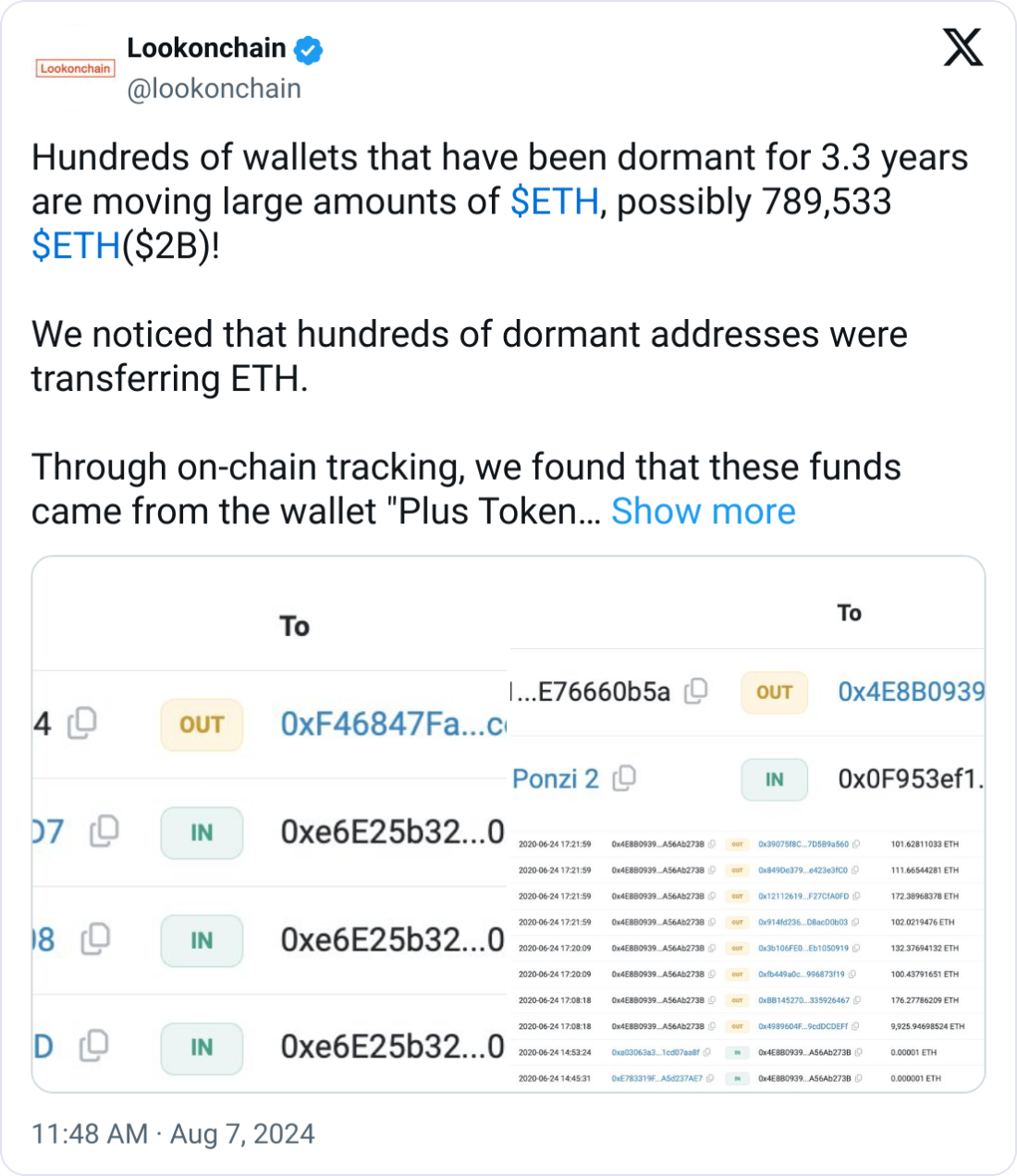

Update (Aug. 8 at 1:48 am UTC): Lookonchain deleted the X post that is the subject of this article after analysts argued the X post was inaccurate as most of the funds had been sold in 2021. A new article covering that latest development can be found here.

Hundreds of cryptocurrency wallets that have remained inactive for over three years have suddenly started shifting large amounts of Ether (ETH).

According to onchain analyst Lookonchain, up to 789,533 ETH was linked to the Plus Token Ponzi scheme and has not been moved since April 2021.

Onchain tracking revealed the tokens were associated with the “Plus Token Ponzi 2” wallet, which dispersed the ETH to thousands of smaller wallets in 2020.

Related: Judge labels 2 obscure altcoins as commodities in $120M Ponzi case

Chinese authority involvement

During the crackdown, Chinese authorities seized around $4.2 billion in multiple crypto assets, including the Plus Token scam.

The assets included 194,775 Bitcoin (BTC), 833,083 ETH, 497 million XRP (XRP), 6 billion Dogecoin (DOGE) and other assets such as Bitcoin Cash (BCH), Litecoin (LTC) and USDT (USDT).

Although the combination of seized tokens was worth around $4.2 billion in late 2020, the total funds are now worth around $13.5 billion as current asset prices are much higher.

Related: FBI busts $43M crypto and Las Vegas hospitality Ponzi scheme

Implications for the crypto market

The reactivation of these wallets and the potential for a sell-off of the seized funds by the Chinese authorities could trigger panic in the market, but this has yet to be seen.

At the time of writing, ETH’s price was around $2,474, up around 1% on the day, and so far, the ETH outflows from the wallets began at 10:17 am UTC on Aug. 7.

Related: New York jury convicts two promoters of IcomTech crypto ‘Ponzi’

What defines a Ponzi?

On July 4, an Illinois district judge sided with the United States Commodity Futures Trading Commission (CFTC) in labeling two altcoins as commodities in a crypto Ponzi scheme case.

The Ponzi scheme defrauded its victims by promising “steady returns” of 15% annually from investments in “digital asset commodities.”

According to the CFTC, the digital currencies involved in the case fell “into the same general class at Bitcoin, on which there is regulated futures trading.”

Magazine: How crypto bots are ruining crypto — including auto memecoin rug pulls

Responses