Bitcoin eyes $58K CME gap next as 8% BTC price rout sees longs 'rekt'

BTC price weakness takes the market below $59,000 for the first time since mid-July as "relentless" Bitcoin selling pressure persists.

Bitcoin (BTC) analysis now expects BTC price action to target $58,000 next as long positions get “rekt.”

Bitcoin weekly losses edge toward 10%

Data from Cointelegraph Markets Pro and TradingView shows ongoing sell-side pressure forcing BTC/USD to three-week lows.

As a grim weekend sets up an equally grim weekly candle close, market participants warn that Bitcoin bulls may face more pain into next week.

“Bitcoin has entered the CME Gap, but technically, it can only be filled during TradFi trading hours,” Keith Alan, co-founder of trading resource Material Indicators, wrote in his latest X post on Aug. 4.

Alan referred to the void between closing and opening levels on CME Group’s Bitcoin futures markets.

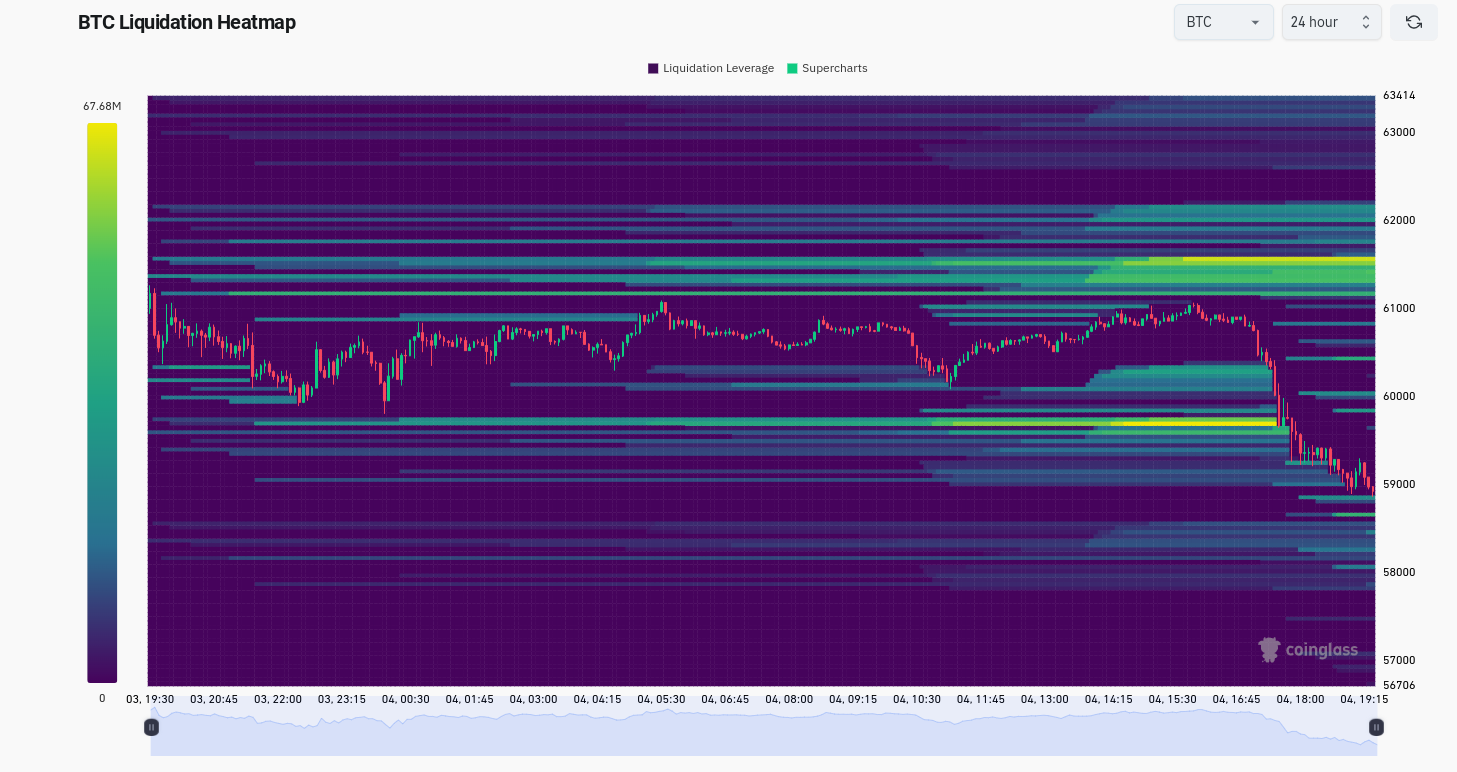

BTC price action tends to either rise or fall to “fill” these gaps after a weekend, and at present, they are turning $58,000 into a near-term target.

“Bitcoin Will be opening with a new CME gap if it trades at its current value,” popular trader Daan Crypto Trades continued in his own post on the topic alongside an explanatory chart.

“We’d open for trading roughly in the green box. We still had a big gap open from last month which sits between $58K-$61K. We’d now make a new gap between ~$60K-$63K. Going to be an interesting week.”

Alan meanwhile predicted that the weekly close, which was set to leave BTC/USD down more than 8% at the time of writing, would not provide lasting relief.

“With that in mind, there is a low probability that we see BTC price recover for the Weekly close, but if we do, I expect it to be short lived,” he concluded.

“Expecting to test support next week and fill the gap. Bulls do not want to see a lower low.”

An accompanying chart highlighted buy and sell signals from one of Material Indicators’ proprietary trading tools.

BTC price volatility “guaranteed”

Adding his own thoughts to the CME gap debate, fellow popular trader CrypNuevo argued that a “flush” to $58,000 would have a cathartic effect on market sentiment.

Related: Bitcoin traders warn of tough Q3 as Nikkei echoes ‘Black Monday’ 1987

“Another thing is that this range between $72k and $60k was very present and clear in all traders’ minds,” part of an X thread on the day read.

“Which means that optimistic traders bought at $60k-$61k. A flush to $58k will scare them enough to get rid off their position. That might be the trick the market needs.”

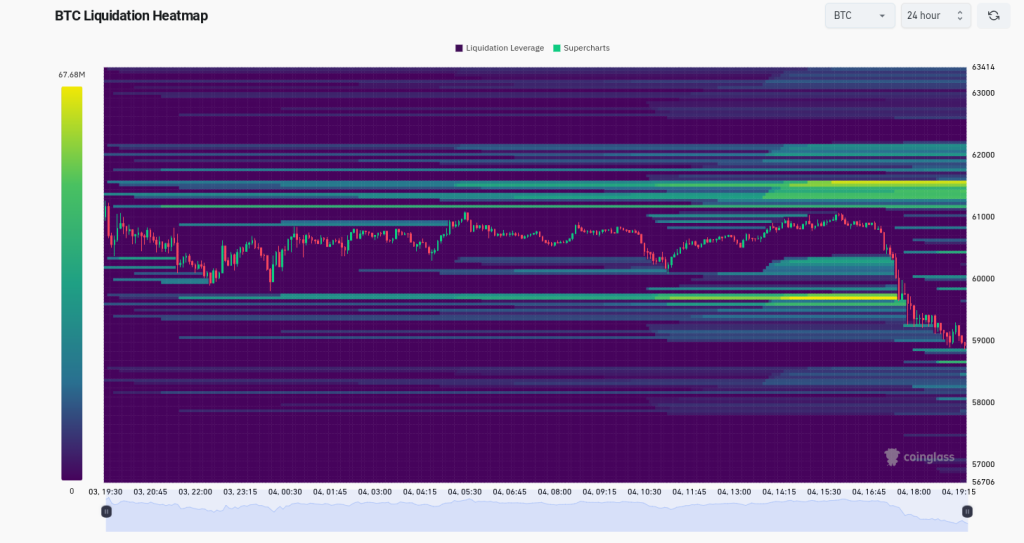

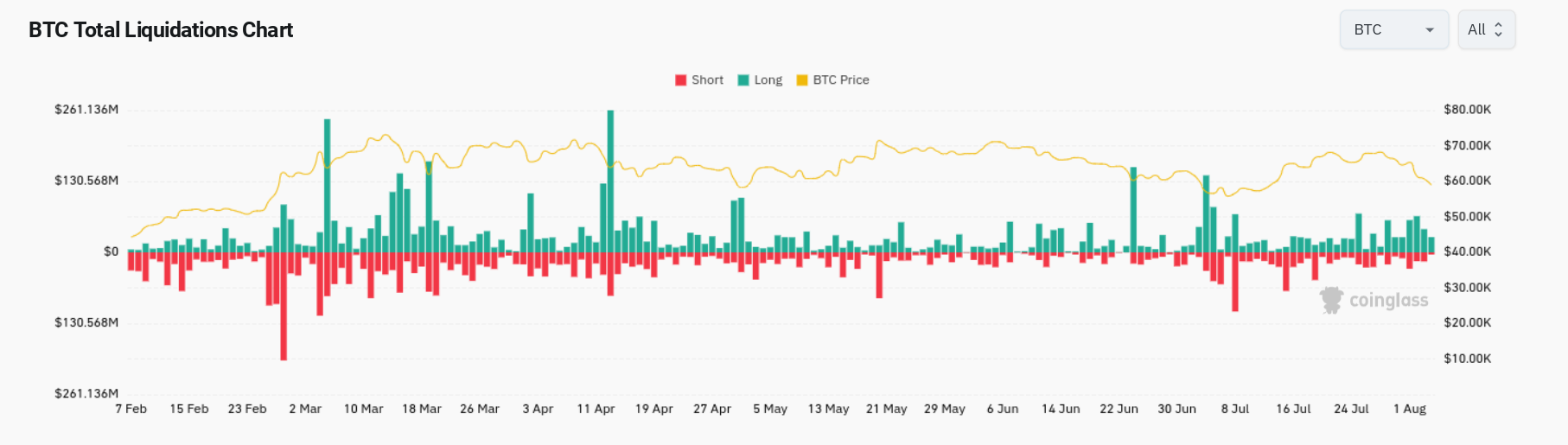

Data from monitoring resource CoinGlass underscores the extent to which long BTC positions have suffered in recent days.

Nearly $200 million of long liquidations have occurred since Aug. 1, with BTC/USD cutting through the bulk of buy liquidity with its drop below $60,000.

“Relentless down trend but a lot of orders starting to show up,” Daan Crypto Trades responded alongside order book data from the BTC/USDT pair on the largest global exchange Binance.

“Long getting rekt, shorts getting in, dip buyers getting in. Volatility guaranteed here.”

As Cointelegraph reported, the $56,000-60,000 range will be the key support to hold for the bulls.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses