Sen Lummis bill gains swift support with 2,200 letters sent

A proposed decentralized network of secure Bitcoin vaults with robust cybersecurity measures aims to minimize digital asset storage risks like theft and hacking.

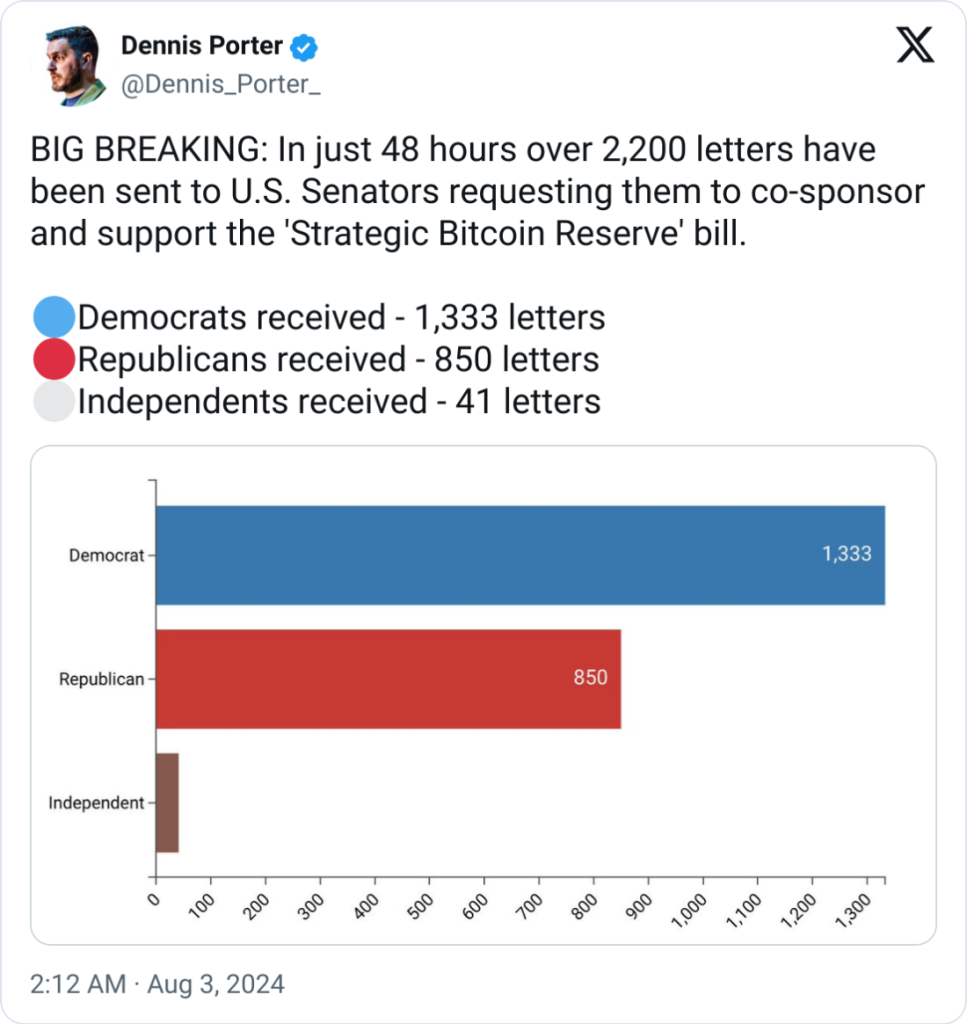

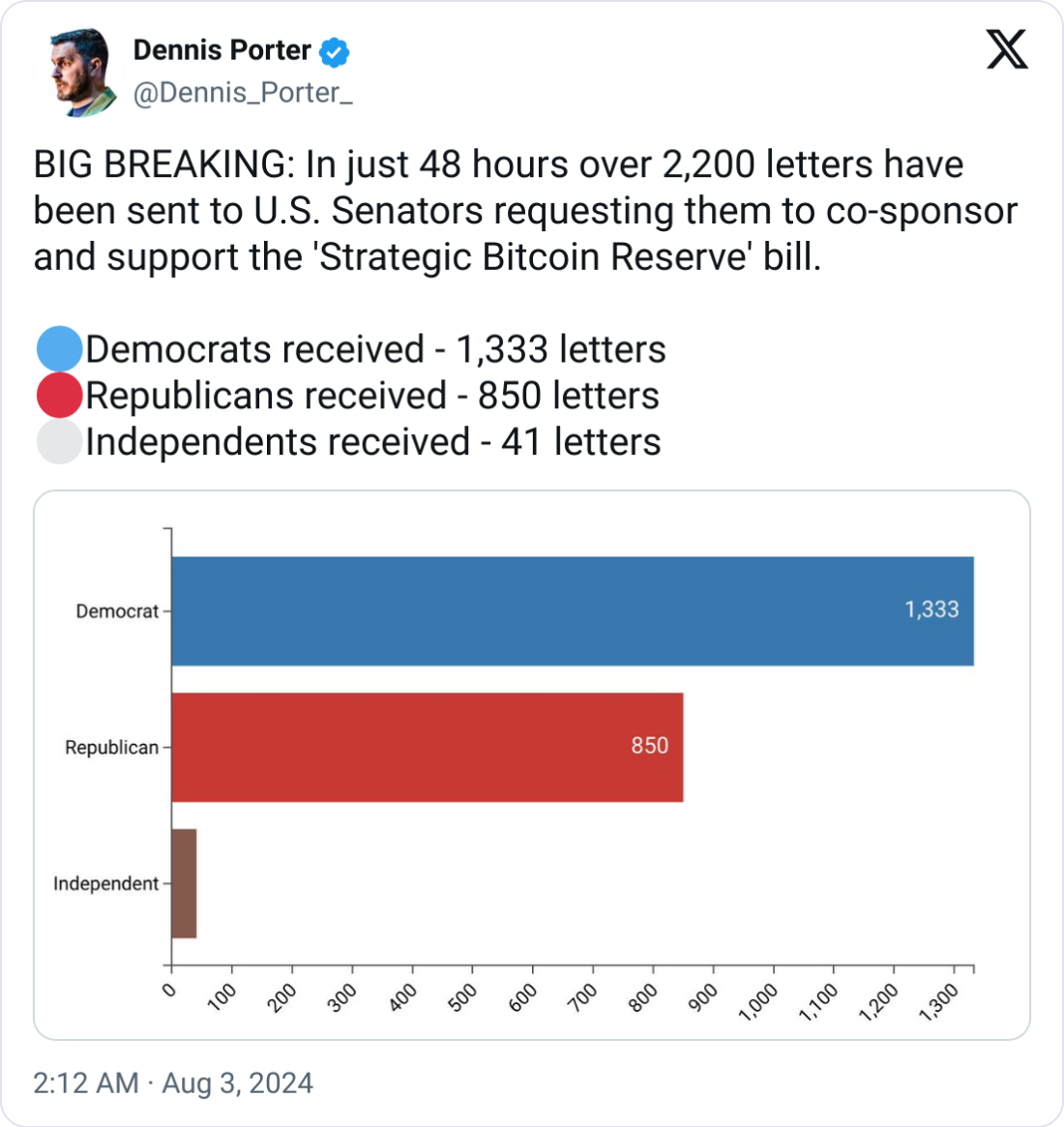

In a remarkable show of support, over 2,200 letters were sent to US Senators within 48 hours urging them to co-sponsor and support Senator Cynthia Lummis’s newly proposed “Strategic Bitcoin Reserve” bill.

According to a post on the X social platform, Senator Lummis expressed gratitude for the support given to the Strategic Bitcoin Reserve bill. The surge of letters sent to Senators reflects a broad spectrum of political support.

Dennis Porter, founder of the Satoshi Action Fund, announced on the X social platform that Democrats received 1,333 letters, Republicans 850 letters, and Independents 41 letters. This bipartisan outreach demonstrates that interest in Bitcoin and its potential strategic value is not confined to a single political ideology but is gaining traction across the board.

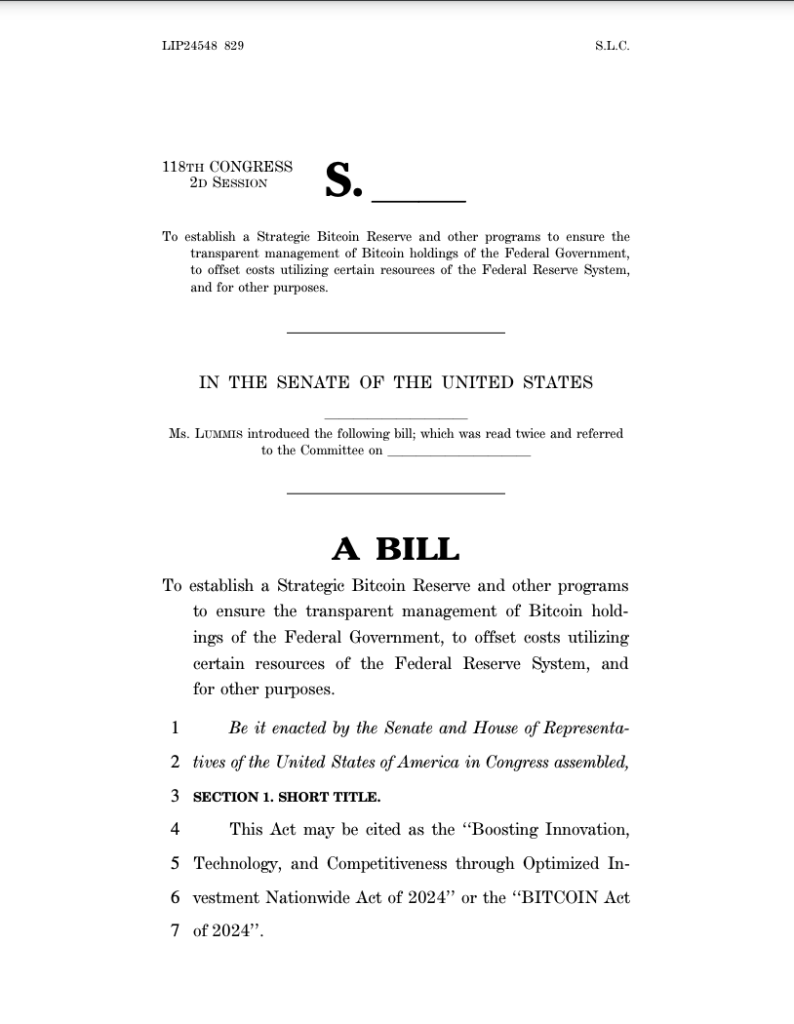

Senator Lummis, a prominent advocate for cryptocurrency regulation, introduced the Bitcoin Strategic Reserve bill on July 31, 2024. The bill aims to establish a national reserve of Bitcoin, positioning the United States as a leader in the adoption and secure management of this digital asset.

The proposed legislation would direct the US government to create a decentralized network of secure Bitcoin vaults managed by the US Treasury, ensuring strict cybersecurity and physical security measures to protect these assets.

Bipartisan support across political lines

Senator Lummis’ proposal includes ambitious goals, such as accumulating 1 million Bitcoin over time, representing approximately 5% of the total Bitcoin supply. The bill suggests using existing US Treasury funds to purchase Bitcoin like the Treasury’s gold allocation.

This strategy aims to bolster the country’s financial reserves with a decentralized asset, providing a hedge against traditional financial instruments.

Related: RFK Jr: Only Bitcoin can guarantee US dollar’s reserve currency status

The establishment of a Strategic Bitcoin Reserve could have significant implications for both the United States and the global cryptocurrency market. By adopting Bitcoin as a strategic reserve asset, the US would signal its recognition of Bitcoin’s value and potential as a store of wealth.

This move could also spur other nations to consider similar strategies, further legitimizing Bitcoin worldwide.

Politicians such as Robert F. Kennedy Jr. and Donald Trump, the Republican Party’s 2024 presidential nominee, have echoed Senator Lummis’ goal of accumulating a significant portion of Bitcoin’s total supply, reportedly aiming for 5%.

Responses