Bitcoin traders warn of tough Q3 as Nikkei echoes ‘Black Monday’ 1987

Bitcoin faces traditionally challenging months, while Japan sees stock sell-off unmatched in nearly 40 years.

Bitcoin needs to hold $60,000 for a shot at fresh all-time highs as traders voice concerns over BTC price performance.

Bitcoin price steadies as stocks sell off

Data from Cointelegraph Markets Pro and TradingView shows Bitcoin (BTC) bouncing from fresh two-week lows of $62,235 on Aug. 2.

Bitcoin continues to tease a breakdown toward $60,000 as risk assets see a period of flux to start the month.

Stock markets worldwide are in the middle of an extended sell-off, and while crypto has yet to copy the extent of their volatility, concerns over the immediate future remain.

On Aug. 1, Japan made headlines as the Nikkei fell 6% — its biggest single-day drop since the global stock market crash of 1987, known as “Black Monday.”

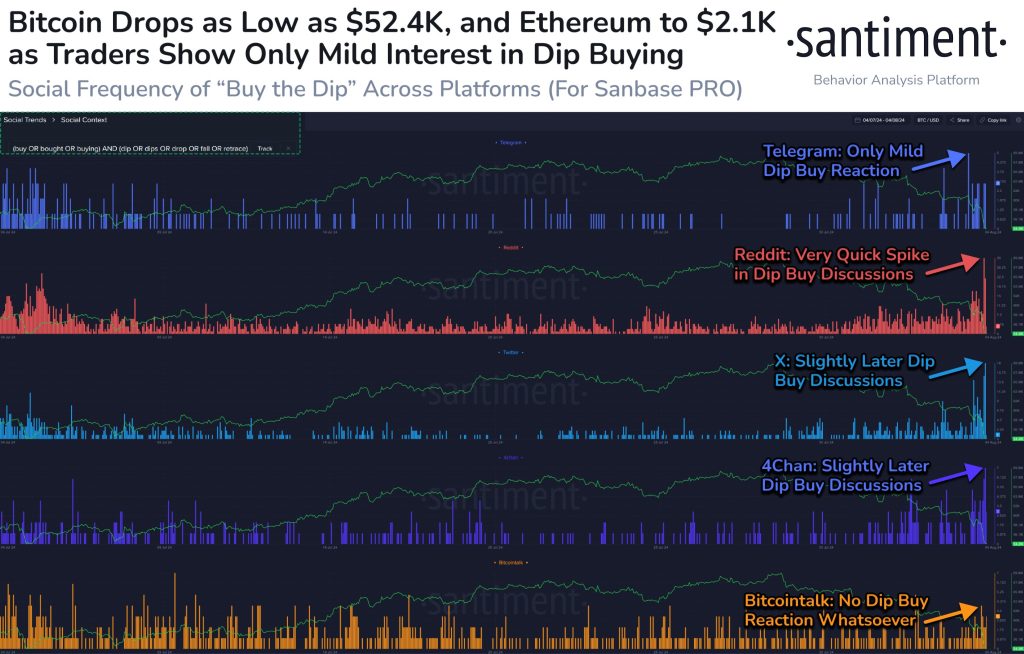

Traders note that traditionally, the second half of Q3 is a difficult time for Bitcoin. Data from monitoring resource CoinGlass underscores the fact that both August and September have been “red” months in recent years.

In August 2023, BTC price action saw a flash downtrend briefly take the market to $25,000 — lows that have held since.

“Bitcoin closed July in the green, gaining 2.95%,” popular trader Jelle reacted to the data in one of his latest X posts.

“Historically, the market tends to struggle in the remainder of Q3 — but really starts moving higher once October comes around. Let’s see what we get this time around.”

Michaël van de Poppe, founder and CEO of trading firm MNTrading, sees the key support test coming in the form of $60,000 — a theory echoing others currently circulating on social media.

“Bitcoin needs to hold above $60-61K and then we’re going to be seeing a continuation towards the all-time high,” he predicted.

“Historically, August & September are bad, however, I’m expecting that from mid-August the momentum starts to change. New ATH in September/October.”

BTC price breakout “getting closer”

As Cointelegraph reported, other concerns currently focus on the series of lower highs and lower lows being printed by Bitcoin on daily timeframes.

Related: Bitcoin ignores 100% Fed rate cut odds as BTC price taps 2-week lows

Since hitting $73,800 all-time highs in March, price action has been characterized by sellers maintaining control of the market above the old 2021 record of $69,000.

Jelle, however, is among those unfazed by the months of consolidation and support retests that have come since.

“Bitcoin is still trading inside the channel we’ve spent the past months inside of, but holding above key supports,” he continued this week alongside an explanatory chart.

“Looks like a breakout is getting closer by the day. Patience, until then.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses