Can Bitcoin price break out after Bank of England interest rate cut?

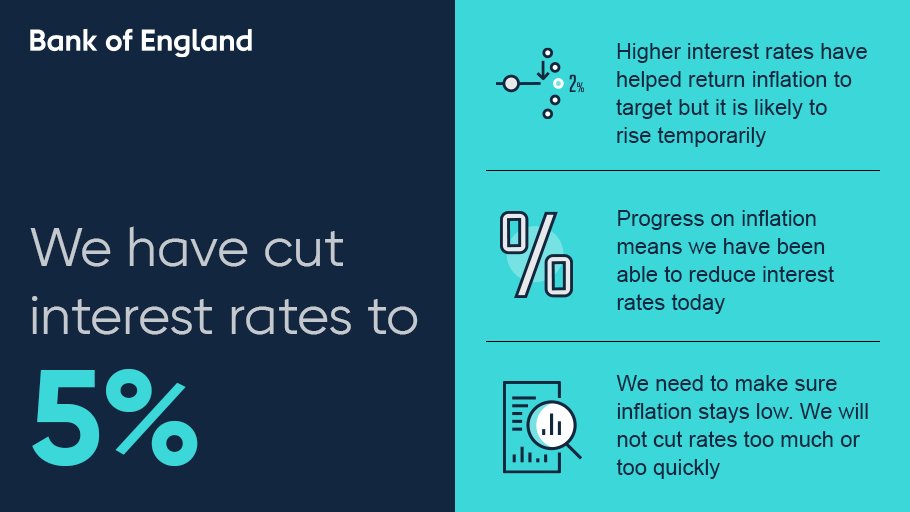

This marks the bank’s first interest rate cut in over four years, with the last rate cut occurring in March 2020.

Bitcoin price could see more upward momentum from the latest interest rate decision of the British central bank.

The Bank of England announced an interest rate cut of 0.25%, to the current 5% mark, on Aug. 1, bringing an end to one of the longest periods of heightened interest rates.

Bitcoin’s (BTC) price could benefit from the surprise interest rate cut since economists were split on whether the bank will cut or hold its interest rates steady.

Easing monetary policy has historically boosted risk on assets like Bitcoin and Gold, yet Bitcoin price remains range-bound despite the interest rate cut.

Related: Bitcoin’s ‘ultimate price’ could surpass $700K based on 3% portfolio allocation — Analyst

Bitcoin price remains subdued under $65,000 due to US monetary policy

The Bitcoin price remains subdued below the $65,000 mark despite the UK’s first rate cut in over four years.

Bitcoin fell 2.4% in the 24 hours leading up to 11:20 am UTC on Aug. 1., to trade at $64,507, after trading mostly flat for the past week, according to CoinMarketCap data.

The sluggish price action could be attributed to the United States Federal Reserve’s decision to hold its key lending rates steady in August.

However, Bitcoin price could see significant new liquidity and upward momentum with a US rate cut in September, according to Bitfinex analysts, who told Cointelegraph:

“A rate cut in September would provide a sense of bullishness and could generally increase liquidity in the market, which will be positive for Bitcoin and other cryptocurrencies as investors seek higher returns outside traditional assets. This could lead to upward pressure on Bitcoin’s price and increased ETF inflows as investors look to capitalise on a more favorable environment for risk assets.”

Related: $35T US national debt could bolster Bitcoin’s adoption as ‘hard money’

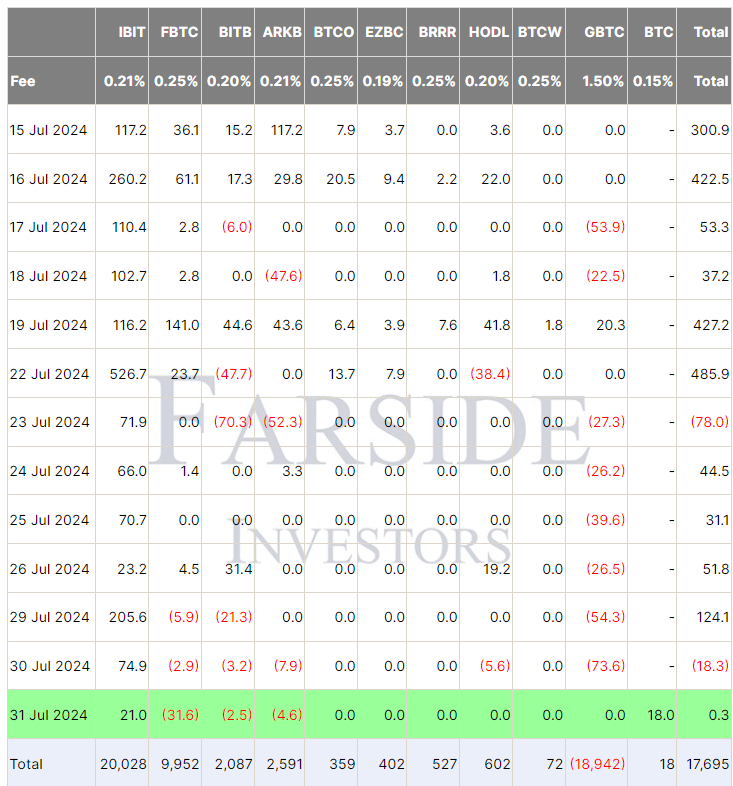

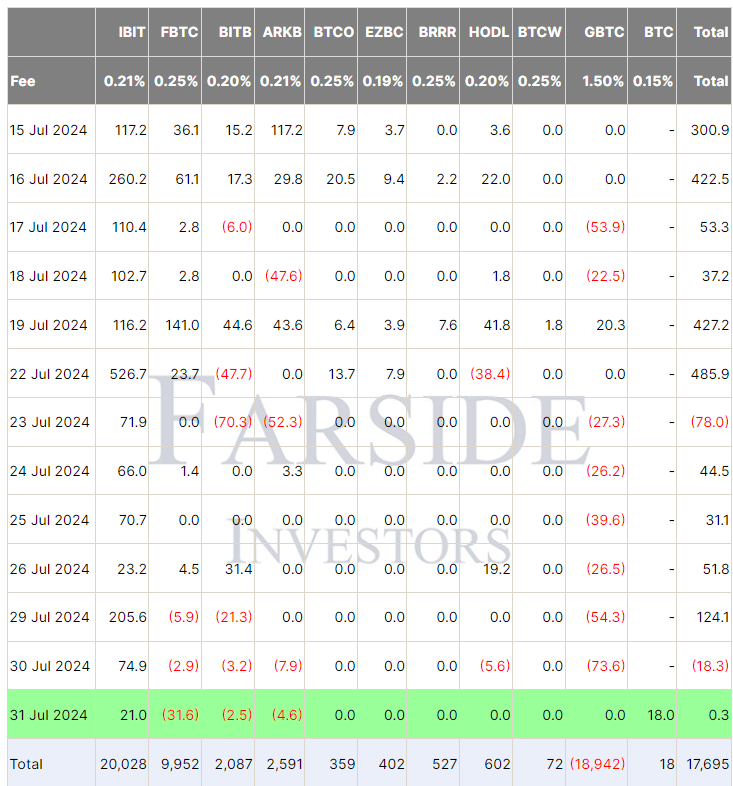

Slowing Bitcoin ETF inflows are pressuring BTC price

The slowing inflows in the US spot Bitcoin exchange-traded funds (ETFs) could also be a reason for Bitcoin’s sluggish price action.

The US ETFs only amassed a cumulative $300,000 worth of Bitcoin on July 31, while they saw over $18.3 million worth of cumulative net outflows on July 30, according to Farside Investors data.

ETF inflows can significantly contribute to a cryptocurrency’s price appreciation. For Bitcoin, ETFs had accounted for about 75% of new investment in the world’s largest cryptocurrency by Feb. 15 as it surpassed the $50,000 mark.

Responses