Bitcoin slips below $65K as Fed holds rates, hints at September cut

Bitcoin dropped below a key price point after the US Federal Reserve decided to hold rates steady, and tensions flared up in the the Middle East.

Bitcoin has fallen below $65,000 following a decision from the United States Federal Reserve to keep interest rates unchanged, along with reports of escalating conflicts in the Middle East.

On July 31, Bitcoin (BTC) dipped to $64,549, the first time it has fallen below $65,000 since July 25, according to CoinMarketCap data. It briefly spiked to $65,075 before falling back again but hasn’t crossed the key level since. It’s currently trading at $64,470.

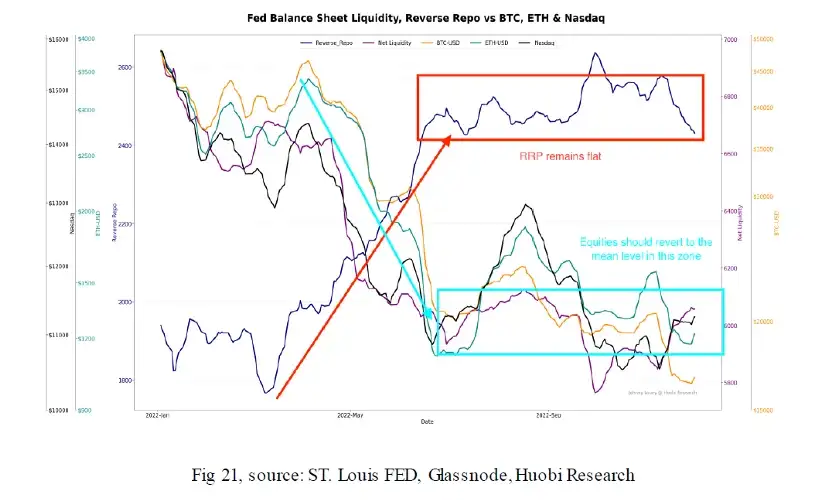

The price movement followed the Federal Open Market Committee’s (FOMC) decision to leave interest rates at 5.25% to 5.5%, which was an expected outcome.

Fed Chair Jerome Powell said the economy is expanding at a “solid pace” with positive signs for GDP growth and Private Domestic Final Purchases (PDFP), though consumer spending growth has “slowed,” in line with its plans to reduce inflation.

“Inflation has eased substantially from a rate of 7% to 2.5%, we are strongly committed to returning inflation to our 2% in support of a strong economy that benefits everyone,” Powell said in a July 31 speech following the announcement.

Prior to the announcement, markets did not expect the FOMC to alter rates until September.

However, pseudonymous crypto commentator Seth notes that the relative strength index (RSI) for Bitcoin — which is used to spot the overbought and oversold levels on any asset — is “now oversold,” a potential buy signal.

“The FOMC is used to liquidate Degen Retails that don’t know how to trade and use way too high leverage,” Seth stated in a July 31 X post.

Related: Bitcoin’s price rally to $70K could lure buyers to XRP, KAS, STX and JASMY

The price plunge also comes after reports that Hamas leader Ismail Haniyeh was assassinated in the Iranian capital Tehran, according to a July 31 Reuters report.

It is not the first time that Bitcoin’s price has declined following rising tension in the Middle East. On April 19, Iranian state media reported that explosions had been heard at Isfahan airport in central Iran. Within two hours, Bitcoin dropped 5.44% to $59,698.

Observers optimistic of September rate cut

“While Fed Chair Powell has not confirmed a September rate cut, he sounds more optimistic,” trading resource The Kobeissi Letter wrote.

“Ultimately, the Fed awaits the next 2 months of inflation data. Further declines in inflation open for a September cut,” it added.

Moody’s Analytics chief economist Mark Zandi expects the inflation data to match the Fed’s forecast, making a September rate cut likely.

“The inflation data must cooperate for the Fed to follow through, but all indications are that it will. Global investors are cheered by this – stocks are up a lot and bond yields are down,” Zandi wrote.

Meanwhile, MN Trading founder Michael van de Poppe believes Powell’s “dovish tone on the future” is only good news for Bitcoin and altcoins.

Responses