Nvidia’s Q1 results sent its stock soaring 6% but AI tokens barely moved

Nvidia’s strong earnings report didn’t have the immediate effect on AI crypto tokens that traders expected.

The price of artificial intelligence (AI)-related cryptocurrency tokens briefly tumbled despite Nvidia’s impressive Q1 earnings report, contrary to crypto traders’ expectations.

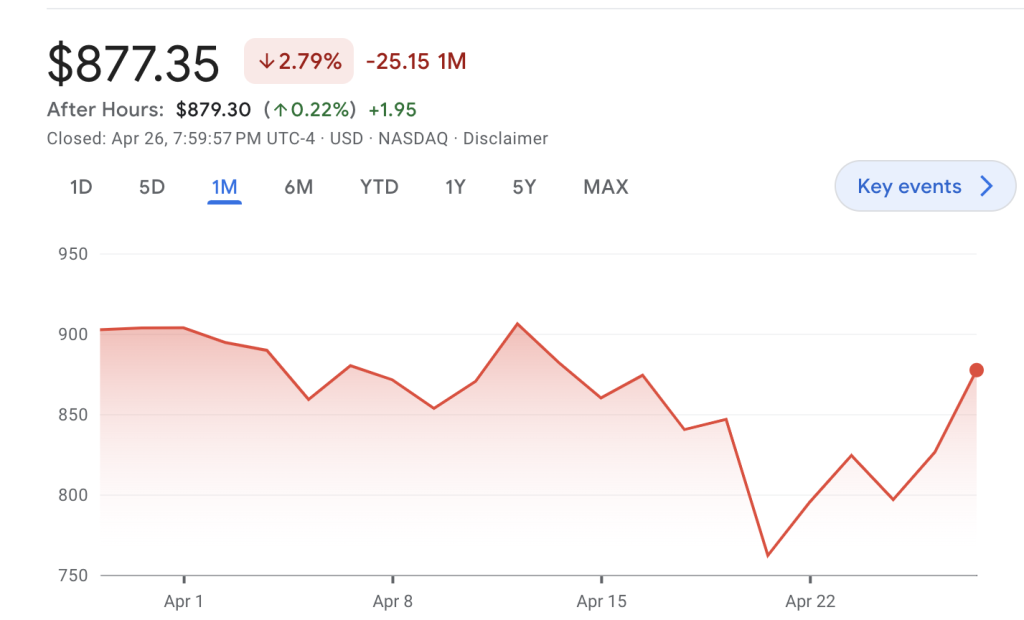

Nvidia — known for powerful chipsets that have pivoted toward AI processing — saw Q1 revenue jump 18% from the fourth quarter last year and surge 262% from a year ago, beating analyst estimates of $24.6 billion, Cointelegraph reported on May 23.

The earnings report was released after the New York Stock Exchange (NYSE) market closed on May 22 — NVDA spiked 6.06% in after-hours trading, reaching $1,007 at the time of writing, according to data from Yahoo Finance.

Some AI token traders appeared disappointed the positive results didn’t lead to a similar bump in AI token prices.

Within just five hours of the earnings report’s release, Render (RNDR), an Ethereum-powered platform enabling decentralized graphics processing unit rendering, saw a 12% decline, with its price plummeting to $10.38, according to CoinMarketCap data.

However, a known “whale” wallet sent around $52.1 million to an unknown wallet today which could suggest large holders were expecting a “sell the news” event, according to data from crypto research firm Santiment.

Meanwhile, pseudonymous crypto trader D0C Crypto pointed out that RNDR didn’t experience a price spike until two days after Nvidia’s last earnings report.

“During the Nvidia Q4 earnings event in February RNDR rose 38% in 48 hours. If history repeats itself, it could mean that RNDR pumps above $15 from the current price within 48 hours!,” they declared in a May 22 X post.

Related: Nvidia shares up 15% in 5 days — Will AI crypto tokens follow?

Other AI-related tokens such as The Graph (GRT), an indexing protocol optimizing blockchain data queries, dipped approximately 4.77%. Similarly, Fetch.ai (FET) declined 6.42%, while SingularityNet (AGIX) recorded a 6.25% decrease.

However, traders remain confident that Nvidia’s results will eventually flow into the wider crypto market and have a positive impact.

“Nvidia just hit 2.5 trillion USD market cap, bigger than the whole crypto space, and you’re not bullish on AI this cycle?” pseudonymous crypto trader Bishara asked their 18,000 X followers on May 22.

“Nvidia did well = stocks will do well = crypto will do well,” added pseudonymous crypto trader Plazma.

Responses