Nvidia doubles down on AI future as stock market cap tops $2.5T

The semiconductor giant plans to accelerate its AI chip production cycle following a bumper revenue report driven by AI data centers.

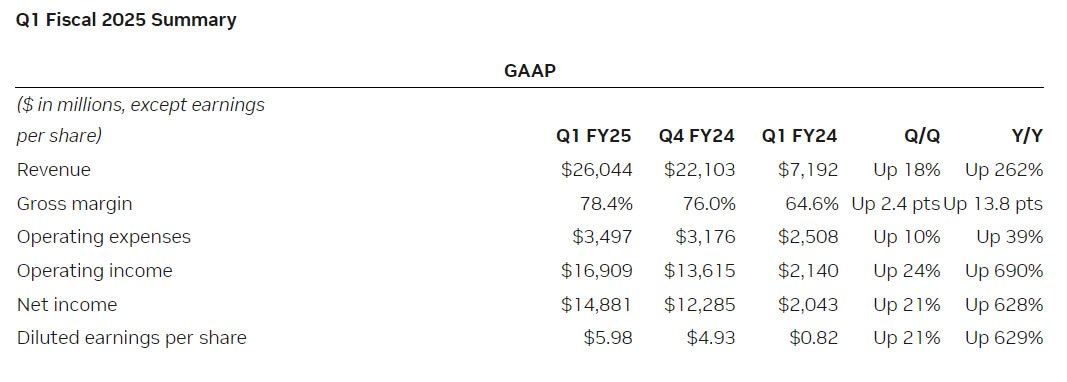

Semiconductor giant Nvidia has no plans to slow its artificial intelligence ambitions following bumper quarterly revenues, netting the firm a record $26 billion for the first quarter.

On May 22, Nvidia released its Q1 earnings report. Revenue jumped 18% from the fourth quarter last year and surged 262% from a year ago, beating analyst estimates of $24.6 billion.

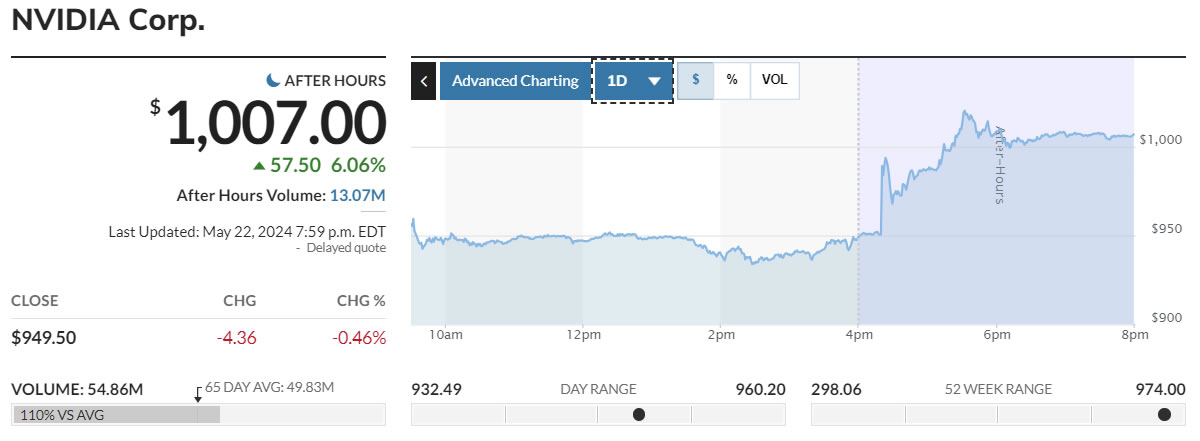

The earnings saw NVDA stock prices surge to an all-time high in after-hours trading on May 22 of just over $1,000, pushing its market capitalization to over $2.5 trillion.

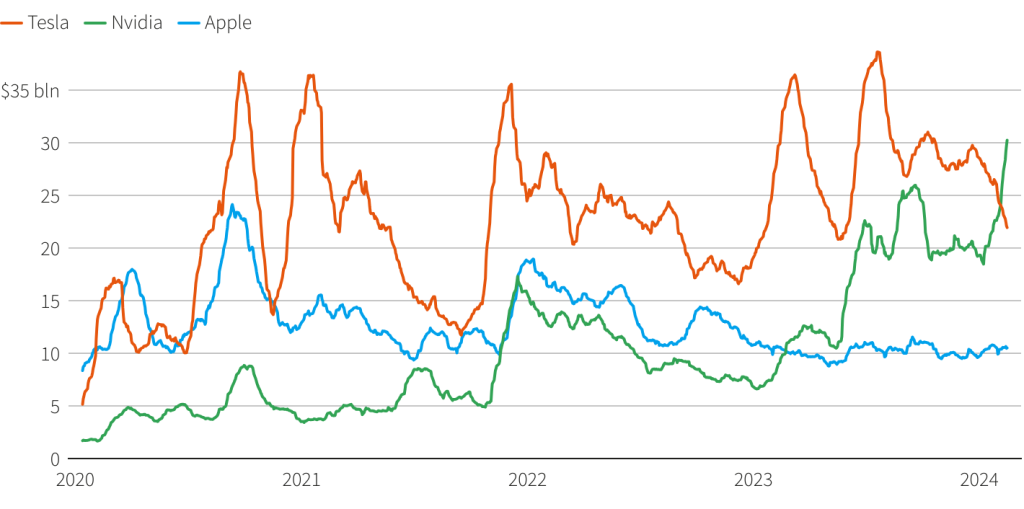

The result is bigger than the market cap of Tesla and Amazon combined, twice that of Bitcoin (BTC), and more than five times larger than Ether (ETH).

Five years ago, Nvidia’s market cap was just $100 billion, but now it is the third largest public company in the world and just 17% away from surpassing Apple.

The firm reported strong growth in data center revenue with $22.6 billion, driven by accelerating demand for generative AI training.

Nvidia founder and CEO, Jensen Huang, said that the next industrial revolution has begun with a shift to new types of data centers — “AI factories to produce a new commodity: artificial intelligence.”

“We are poised for our next wave of growth,” he said before announcing that the new Blackwell platform designed for “trillion-parameter-scale generative AI” supercomputing was in full production.

The firm will now start producing AI chips on a yearly basis, according to Huang, who confirmed the new production cycle at the firm’s earnings call:

“I can announce that after Blackwell, there’s another chip. We’re on a one-year rhythm,”

Until now, Nvidia has produced new microchip architecture roughly every two years, with Ampere in 2020, Hopper in 2022, and Blackwell in 2024.

The firm also revealed expanding collaboration with Amazon Web Services (AWS), Google Cloud, Microsoft, and Oracle to advance generative AI innovation.

New AI performance optimizations and integrations for Microsoft Windows were unveiled to deliver maximum performance on Nvidia GeForce graphics cards and PCs.

Related: Nvidia shares up 15% in 5 days — Will AI crypto tokens follow?

The firm also announced new AI gaming technologies — Nvidia ACE and Neural Graphics — and hinted at exploring AI for more immersive gaming experiences. However, first-quarter gaming revenue was $2.6 billion, down 8% from the previous quarter.

Nvidia plans to continue pushing the boundaries for AI in industries such as automotive (self-driving), robotics, healthcare, and semiconductor manufacturing.

-INDEX-IN-3-MINUTES@2x-1024x576-4.png)

Responses