Wall Street sounds AI bubble alarm — Will crypto AI projects survive?

After Black Monday, the stock market fears recession and Wall Street predicts an AI bubble burst, with Nvidia and tech stocks under pressure. Will crypto AI projects survive?

Wall Street’s recent fears about an impending artificial intelligence bubble burst could spell disaster for a number of AI-related crypto projects.

Since generative AI made its mainstream debut with the launch of ChatGPT, investors have flooded capital into AI-related projects like a modern-day gold rush.

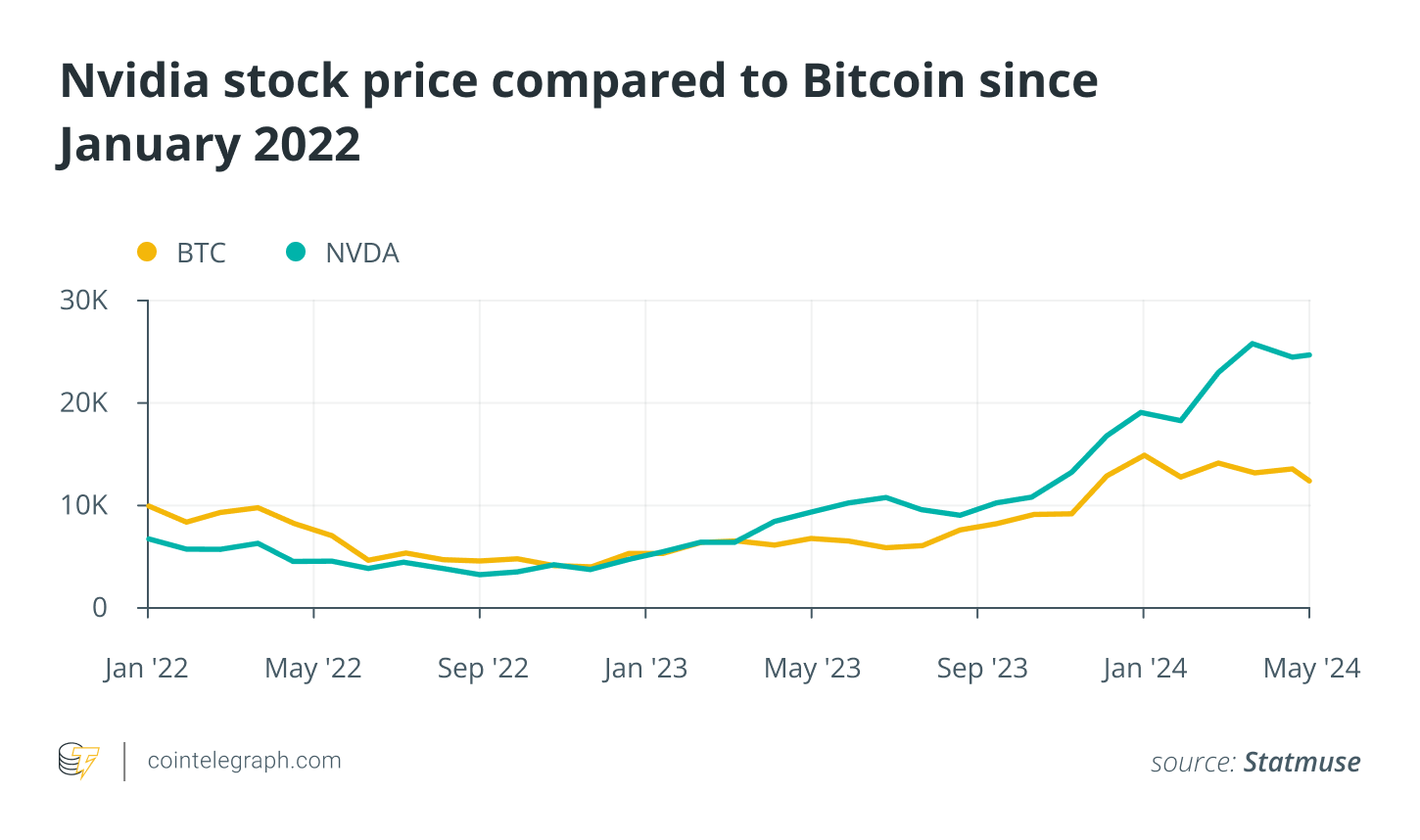

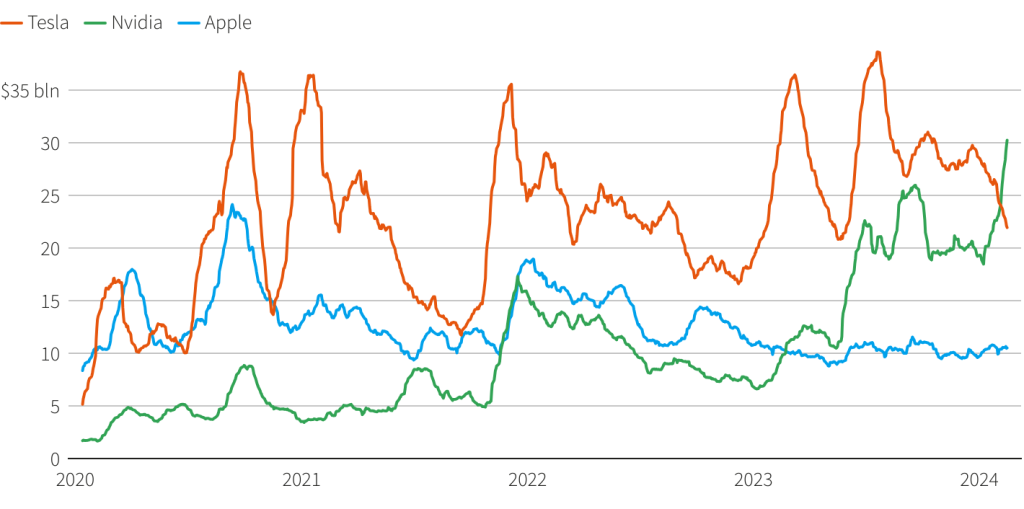

Graphics processing unit manufacturer Nvidia has emerged as a prominent player in the AI sector, with its stock experiencing exponential growth that has outpaced even Bitcoin (BTC).

However, the latest market shock related to the Japanese yen’s carry trade, combined with the delay in manufacturing AI chips due to a design flaw, halted and corrected Nvidia’s stock price, which lost $430 billion in market value.

The correction fueled the growing wave of skepticism on Wall Street, suggesting that the AI bubble may have peaked and could be on the verge of bursting.

Wall Street’s main concern stems from the disconnect between the substantial investments in AI models and the revenues they generate, as underscored in a June 25 report from Goldman Sachs.

Recent: Memecoin casino: $100 bet on Pump.fun has worse odds than roulette

Morgan Stanley analyst Keith Weiss said during a Microsoft earnings call that “there’s an industry debate raging around the [capital expenditure] requirements around generative AI and whether the monetization is actually going to match with that.”

These trepidations raise significant questions about the resilience of crypto AI projects, which have enjoyed a tailwind from the AI hype.

Namely, will they be able to withstand a potential downturn in the market?

Solid fundamentals are critical to survive a crypto AI bubble burst

The meteoric rise in Nvidia’s valuation, fueled by the AI narrative, has spurred a surge in crypto AI projects.

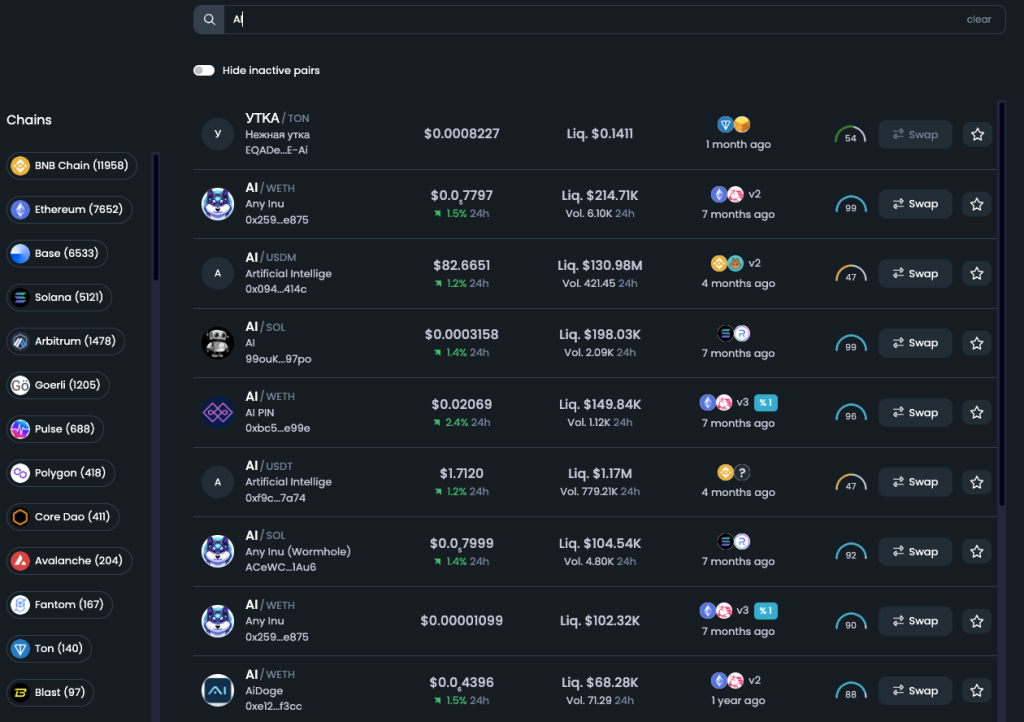

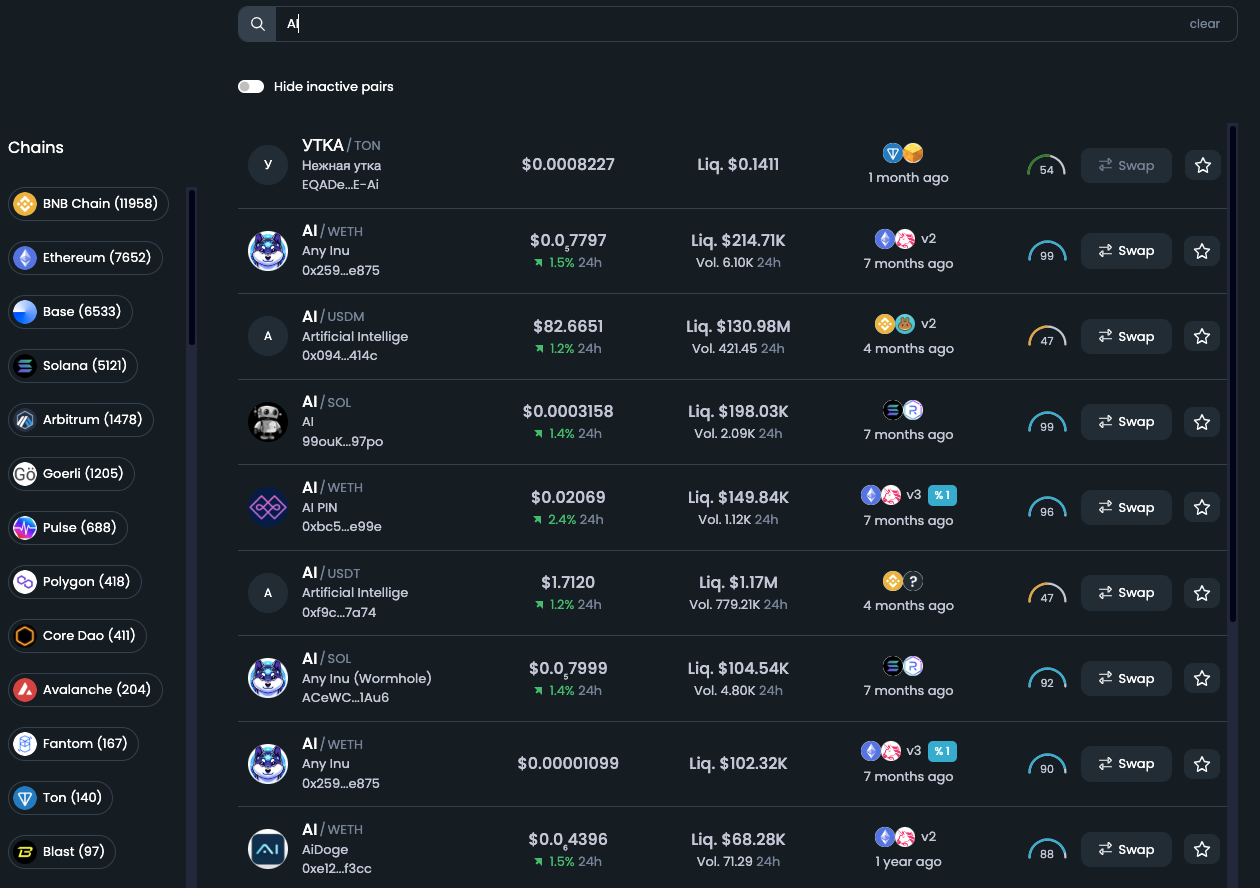

This enthusiasm is evident in the proliferation of over 30,000 exchange pairs featuring the keyword “AI” across various blockchains.

Mirza Uddin, head of business development at decentralized finance (DeFi) platform Injective, told Cointelegraph that most crypto AI projects lack solid fundamentals.

Uddin believes that AI in crypto is “largely a fad correlated to the performance of major stocks, such as Nvidia.” He argued that “under the hood, there was little to no actual AI in production within the cryptosphere.”

He remarked that while some builders are genuinely trying to build real AI applications, he would be “dubious if that percentage exceeded even 5% of development.”

“Most ‘AI applications’ in crypto today are nothing more than basic ChatGPT wrappers or lofty white papers that will likely not produce real products for years to come.”

Basel Ismail, CEO of analytics firm Blockcircle, told Cointelegraph that the majority of crypto AI projects are abusing the terminology and exploiting it for their own financial gain.

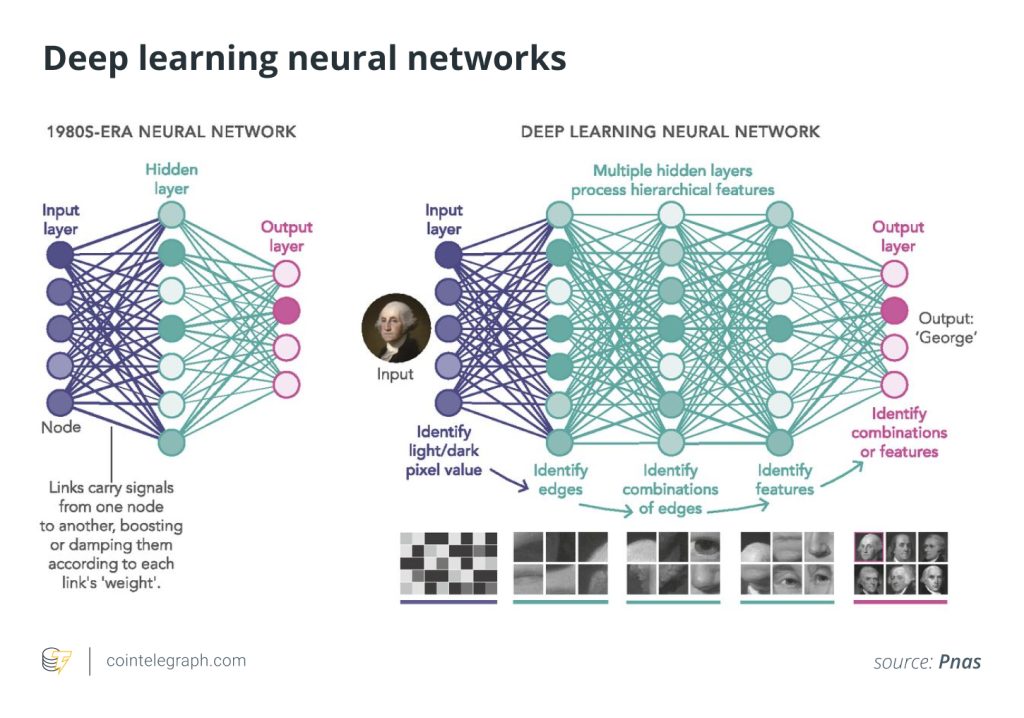

He noted how fields like machine learning and data science have been renamed and merged into “AI.”

Uddin explained that the trend among many projects and founders to adopt popular themes to drive PR results is not exclusive to AI. However, within that fad “lie a number of startups that are truly building innovative use cases that can become industry juggernauts.”

Uddin referred to the dot-com bubble when myriad companies failed while firms such as Amazon, eBay, PayPal and Google emerged victorious. He anticipates that the same will happen with AI in the crypto space, where “we will surely witness real applications for artificial intelligence across crypto, and those projects will be the ones to survive and thrive in the long run.”

Solid fundamentals are the key factor to consider. Tegan Kline, CEO and co-founder of Edge and Node, the initial team behind The Graph — a blockchain indexing protocol — said, “Projects with fundamental infrastructure and a solidified vision in AI will thrive and see long-standing benefits beyond an AI bubble.”

She explained that there’s a difference between projects that superficially highlight the use of AI by using the term but don’t successfully integrate it into a productive utility. At this point, there will be a “real divide between those who want to be a part of the hype and those who want to build toward sustaining innovation.”

“Projects that simply ‘AI wash’ themselves to catch the hype of a bubble will be the first to go in any bubble correction.”

Deep pockets and valuable data is crucial

If the AI bubble bursts, Ismail anticipates “significant collateral damage” to the crypto AI markets. In such a scenario, having substantial financial backing will be essential for projects to survive an “AI winter.”

Uddin warned that many of these projects “do not have the funds to survive.” He said that raising a small seed round or even a Series A, as some crypto companies have managed, “isn’t enough to develop meaningful, sustainable use cases in the long run,” given that training models and developing new applications in this emerging field is a highly expensive undertaking.

However, he said that truly well-intentioned developers and projects would be able to survive and raise new funding regardless of the AI narratives since the actual technology — when applied correctly — can improve processes in a number of sectors.

Proper funding is relevant, but it is not the only factor for a project’s survival. Kline believes there are other important factors to consider, such as preexisting access to robust, decentralized and fresh data that can be built upon easily. Additionally, those with preexisting networks of communities, users, partners and developers will fare better during any slowdown.

The potential of AI in the current macro market

Weak macroeconomic conditions and geopolitical shifts could precipitate the burst of the AI bubble.

However, the market is conscious of a possible deceleration. Ismail noted that disappointing US tech reports are expected as the economy continues to contract and Federal Reserve restrictions on money flow point to an end of easy access to capital.

Recent: Blockchain-based elections a real option with zero-knowledge tech

Despite the non-ideal short-term conditions for AI development, Uddin believes the synergies between real AI and crypto can profoundly impact the world at large.

He said that automated trading could be entirely driven by AI-powered systems, taking DeFi to an entirely new level. He also noted scenarios in which asset tokenization on blockchains could be entirely driven by artificial intelligence without the need for any human intervention.

“The possibilities for what real applications of AI in crypto can accomplish beyond the current fad is truly limitless.”

Responses