7 new narratives in the first half of 2024

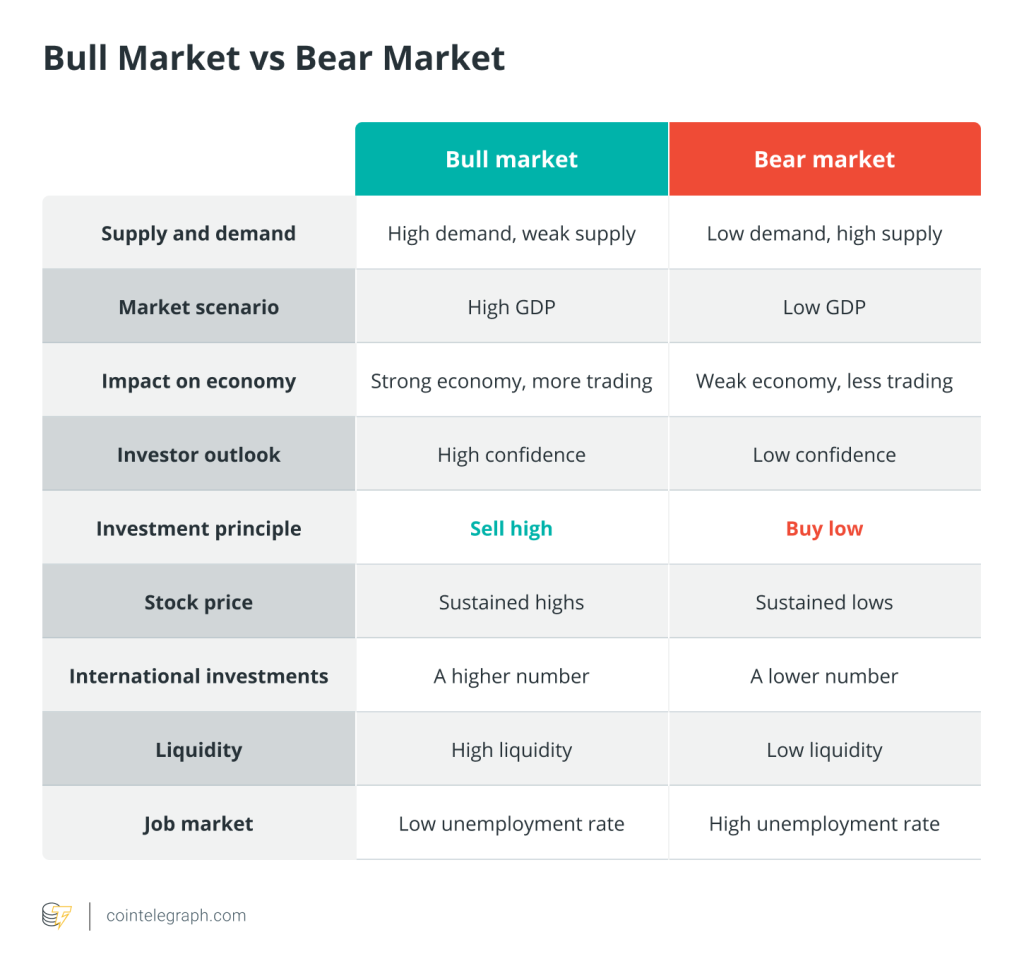

In the first half of 2024, the market is seen as a prelude and a charge for a bull market, a stark contrast to the crypto winter of 2023. Since the 160% growth in crypto market capitalization in 2023, it has surged again from $1.6 trillion at the beginning of 2024 to $2.5 trillion in June. With over 43 million active addresses, this surge is a clear signal that the crypto market is heading towards a ‘cryptocurrency bull market.’ Beyond the overall data rebound, including market capitalization, various segments of the crypto industry have seen different highlights.

‘Narratives’ play a central role in driving the crypto industry. Investment institutions and the market create new narratives, while investors question and understand these narratives. The prosperity of narratives often reflects the overall health of the crypto ecosystem. So, lets take a retrospective look at the new narratives and focal points in the crypto industry for the first half of 2024, focusing on July.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

ETF Approval: Cryptocurrencies Moving Toward Mainstream Finance

Remember when cryptocurrencies were just playthings for a few crypto enthusiasts? Those days are long gone. In the first half of 2024, cryptocurrencies stepped into the mainstream. The turning point was in January when the long-awaited Bitcoin spot ETF was approved. This breakthrough provided Wall Street with a comfortable entry into the world of cryptocurrencies, resulting in the instant launch of 11 ETFs and record-high trading volumes. But that’s not all — the U.S. Securities and Exchange Commission (SEC) also approved eight Ethereum spot ETFs in May, further solidifying the entire cryptocurrency ecosystem and opening the door for broader institutional adoption.

AI and Web3 ecology continue to integrate and collide

Mainstream crypto investment analysts are optimistic about the impact of AI on the cryptocurrency space. The mainstream view is that decentralized open source encrypted networks will democratize AI innovation and make users safer. We will also see more AI being used to improve Web3 user experience and efficiency, and more blockchain technology being used. Serve as the moat and transparent layer of AI.

The market performance is the most obvious. With the integration of AI and Web3 concepts, the AI track has seen a wave of continuous surge in the first half of the year.

Territorial regulation is clearer and more competitive

In 2024, the foundation for cryptocurrency regulation will continue to be established, leading to gradually clearer regulations and greater institutional involvement in the crypto space. One of the major narratives in 2024 will be the ongoing competition among jurisdictions to secure top positions in regulatory oversight.

The United States, which dominates the crypto market, exhibits a notable response to this narrative. On one hand, regulatory agencies are intensifying enforcement efforts, cracking down on cryptocurrency activities. In the first half of the year alone, the SEC filed lawsuits against several major institutions, including Genesis, Kraken, Binance, and Coinbase. On the other hand, the U.S. government holds the largest Bitcoin reserves. This exemplifies the typical approach of refining regulation amidst competition.

DePIN track has huge development potential

DePIN is one of the potential tracks that several encryption institutions are optimistic about. First, they believe that DePIN has the potential for large-scale adoption; second, they believe that “projects that use cryptoeconomics to reduce structural costs will be strong competition for existing Web2 businesses.” By”.

Paul Veradittakit, a partner at crypto investment institution Pantera, wrote in an article discussing the Depin track that the development of DePIN over the past year has had considerable impact and significance on the entire blockchain ecosystem. One of the most important reasons is that “DePIN is a consumer-facing application layer, just like DeFi, gaming, and social, with the potential for mass adoption and the potential to drive consumer demand for the underlying chain or ecosystem.

From the perspective of the larger industry background, Coinbase believes that “DePIN has great development potential, and blockchain technology will play a core role in managing and allocating actual resources in the future.” A big theme in 2024 is “decentralization of real-world resources.

Privacy Track’s New Narrative: Aleo’s Future is Promising

Privacy issues, programmable features, and scalability have always been the “impossible triangle” of blockchain, restraining the rapid development of blockchain, especially DeFi. Aleo, utilizing ZKP technology, particularly zk-SNARKs, has become the world’s first public chain to solve privacy issues using zero-knowledge proofs while ensuring programmable features and high scalability.

Aleo, as a leader in the zero-knowledge proof (zkp) space, is considered a potential dark horse in the 2024 crypto landscape by mainstream investment institutions. Its hundredfold potential has become almost a consensus among these institutions. In the first half of the year, Aleo completed Testnet3 testing and code freezing, and it is currently in the Testnet Beta testing phase, with mainnet launch imminent.

Tokenized RWA will be an important part of the new market cycle

Tokenization is expected to become a crucial part of the new crypto market cycle. In 2024, it will expand beyond the current focus on bond markets to include other financial instruments such as stocks, private market funds, insurance, and carbon credits. Real-world assets (RWA) and equity tokens may lay the foundation for the next generation of financial systems. Projects exploring tokenization in derivative products and securities offer significant opportunities.

Crypto investment firm Hashed believes that RWA and equity tokens are pivotal for the next-generation financial system. While the market currently emphasizes tokenization related to U.S. government bonds and basic assets, there are substantial opportunities in exploring areas like derivative tokenization and securitization.

BTC New Narrative — BTC Ecological Protocol Becomes the Big Winner

The surge in interest around Bitcoin’s ecosystem, fueled by the popularity of inscriptions (symbolized by Ordinals protocol and BRC-20 tokens), has rekindled excitement among crypto users. Once considered “digital gold” and primarily a store of value, Bitcoin is now drawing attention for its development and possibilities within its ecosystem.

In 2023, after a period of relative quiet, the market experienced a resurgence due to the Ordinals protocol and the frenzy around BRC-20 tokens. These developments brought Bitcoin, the oldest and most established public blockchain, back into the spotlight. The launch of inscriptions (or runes) further intensified the market’s FOMO (fear of missing out) sentiment.

The explosive growth of BTC ecosystem protocols has refocused users and builders on Bitcoin’s potential. Whether driven by the desire for fair asset launches or unwavering faith in Bitcoin’s orthodox and decentralized nature, an increasing number of developers are actively contributing to the Bitcoin ecosystem. This momentum is also helping the entire crypto market emerge from the crypto winter.

Summary

In the first half of 2024, the cryptocurrency industry experienced a period of coexistence of challenges and opportunities. Despite continued regulatory volatility, price volatility, and market hype, its pace of adoption and increased institutional interest demonstrate its potential for continued growth. Cryptocurrency has entered the mainstream, and future development will depend on further technological innovation and market acceptance.

Responses