The fourth halving of BTC is coming soon, which will have seven major impacts on Bitcoin

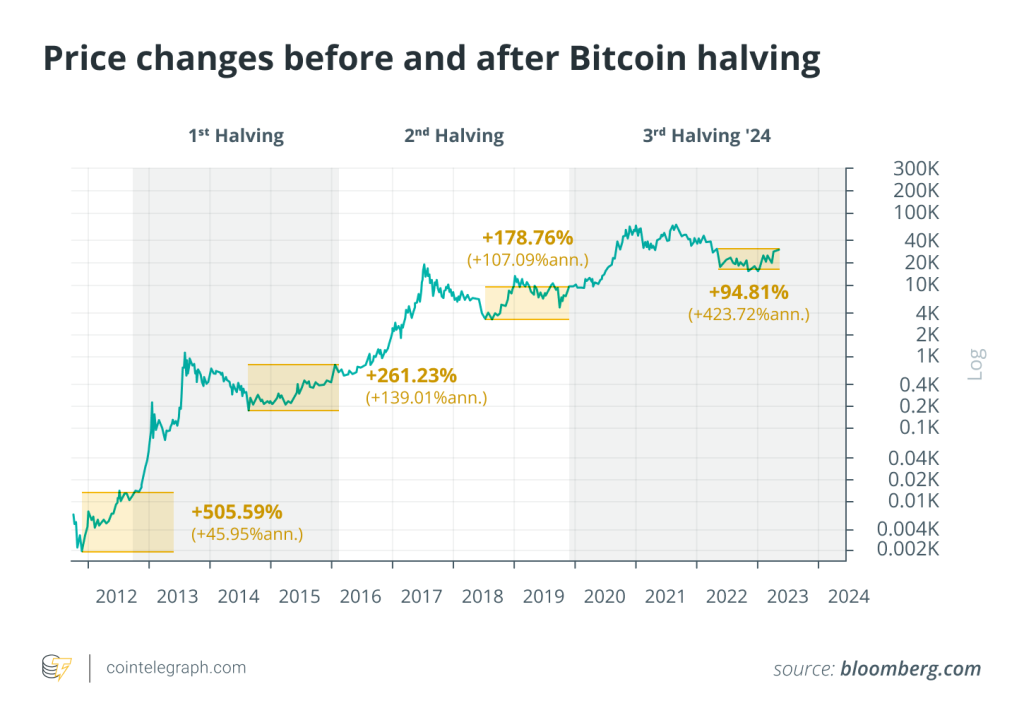

When it comes to halving BTC, I believe that the first reaction of most encryption users is excitement. After all, the first three halving have laid the foundation for the arrival of a bull market. The fourth halving, which is about to start in the middle and late April, is accompanied by a high-profile event such as the launch of Runes runes.

It can be said that the FOMO sentiment of the market has climbed to the peak for the fourth half and the Runes agreement launched at the same time.

Although there are still some skeptical voices in the market, they think that the moderate reduction of supply caused by halving may significantly change the price balance of Bitcoin, but in the face of the market demand stimulated by halving +Runes and the current FOMO sentiment, these small flaws are insignificant.

Looking forward to halving the arrival has become the mainstream trend of thought in the encryption market!

Then, in the face of the fourth halving of BTC, what impact will it bring to BTC? Today we listed seven possible impacts.

The BTC computing power plummeted caused by halving?

Please note that this is a question. At present, whether the fourth halving of BTC will bring about a sharp drop in computing power has been controversial.

According to the mainstream opinion in the market, after the first three halving of BTC, the network computing power dropped sharply, and the computing power plummeted by 25%, 11% and 25% in turn, and the fourth halving will continue this situation.

However, there are still authoritative organizations that will not make overly pessimistic predictions about the decrease of computing power in this halving. For example, Pennyether predicts that the upcoming halving of Bitcoin is expected to lead to a slight decrease in computing power, ranging from 5% to 10%. This prediction is not far from the prediction of 3%-7% of the power index.

The fundamental reason for this disagreement lies in two points:

· The high rate of return brought by the continuous soaring price of BTC will promote the renewal iteration of miners’ equipment, thus offsetting the short-term decline of computing power, and even the recovery period is much shorter than the previous three times.

· The high FOMO sentiment brought by Runes agreement will further focus the market on the fourth halving of BTC, which will be supported by a higher consensus.

Increase supply scarcity

The core of Bitcoin’s attraction lies in its limited supply, with an upper limit of 21 million pieces. The halving mechanism plays a vital role in ensuring this scarcity by reducing the speed at which new bitcoins enter circulation. The scarcity of bitcoin is increasing day by day, and every halving event will aggravate this situation, thus enhancing its digital rarity and demand, and distinguishing it from legal tender that is easily diluted by inflation.

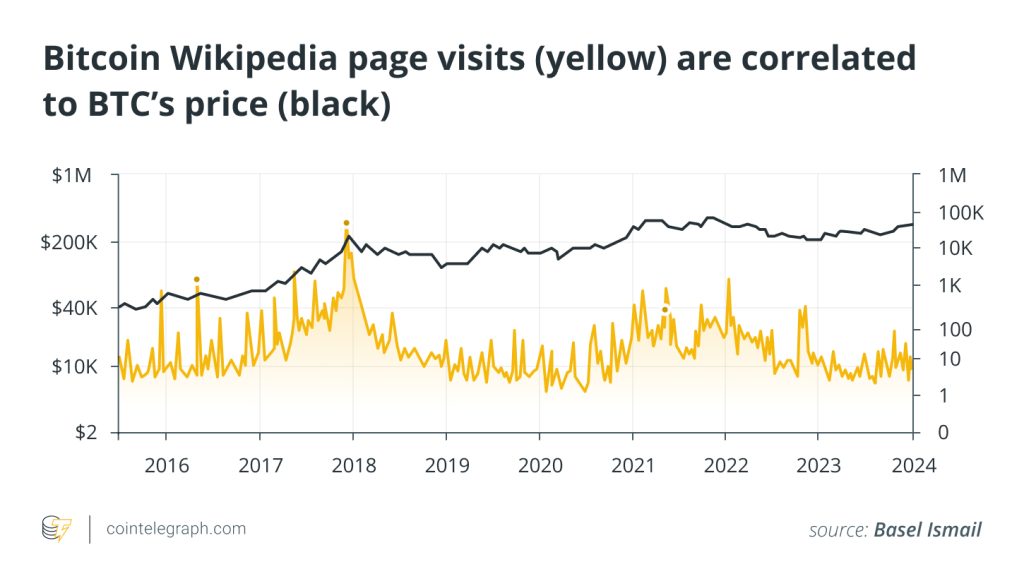

Improve community participation

The period before and after the halving event is characterized by increased community participation and discussion. Expectations surrounding these events have triggered a dialogue among enthusiasts, investors and novices, focusing on the basic principles of Bitcoin, the complexity of blockchain technology and the broader impact of cryptocurrency economics.

The launch of the Runes agreement will further aggravate the intensity of this discussion.

High-cost miners will be forced to upgrade their equipment

CoinMetrics data highlights that most industries are currently using relatively inefficient machines, such as Antminer S19J Pro. These miners need an operating cost of $0.05/kWh or less to maintain a healthy gross profit margin after halving.

However, according to the calculation index, the average custody rate in the United States is slightly lower than 0.08 US dollars/kWh, and many American miners may face cash flow challenges after halving, thus being forced to upgrade their equipment on a large scale. Considering the high custody fees in the United States, this promotion can be regarded as a necessity, not an option.

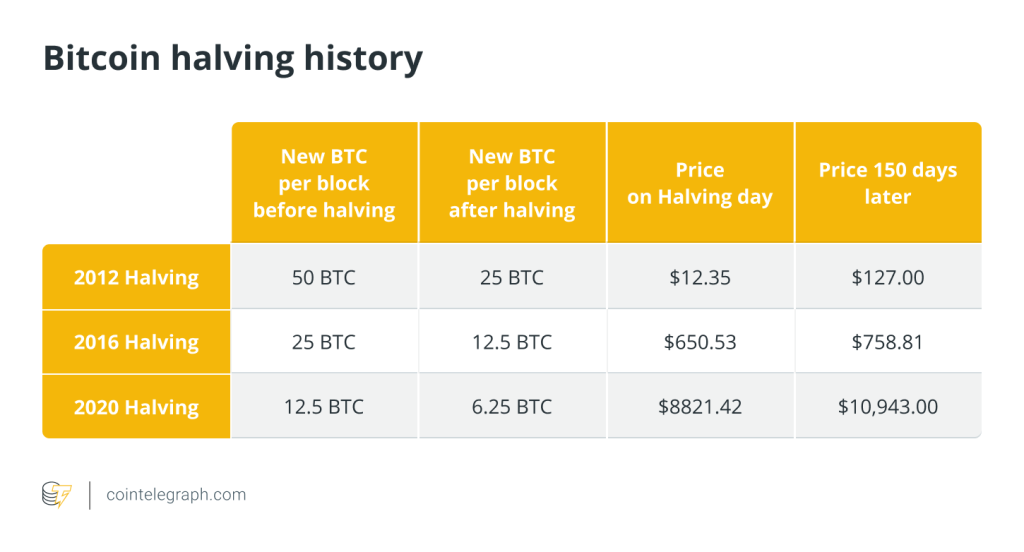

Potential price impact

Although halving is not the main focus of halving, the potential impact on bitcoin prices cannot be ignored. Reduced supply, coupled with sustained or increased demand, may lead to upward pressure on prices. This economic dynamic highlights the attractiveness of Bitcoin relative to legal tender, and the central bank can print legal tender indefinitely, which leads to inflation.

Encourage mining innovation and realize diversified management.

With the reward for mining new blocks halved, miners are forced to find more effective ways to maintain profitability. This necessity fosters multiculturalism, whether it is the development of more energy-saving mining hardware or the exploration of new fields by public miners. This kind of innovation not only enhances the sustainability of individual mining activities, but also promotes the rapid development of diversification trend.

Whether pursuing hardware efficiency to maximize mining returns or innovating profit channels to achieve diversified development, the core idea of miners is to explore new sources of income and effectively supplement the reduced block rewards. However, it is undeniable that this will not only help maintain their operations, but also integrate the traditional mining industry with other financial sectors (such as Defi) to establish a symbiotic relationship and enhance the effectiveness and liquidity of Bitcoin in a diversified market.

Miners will be dispersed from developed areas to the third world.

As mentioned above, whether pursuing hardware efficiency to maximize mining returns or innovating profit channels to achieve diversified development, the core idea of miners is to explore new sources of income and effectively supplement the reduced block rewards.

However, the way to provide benefits is not only to open source, but also to reduce expenditure! It is also an effective channel to increase profits by transferring industries to areas with low electricity tariffs.

At present, the United States occupies a large part of the global computing power, accounting for 40%, while China and Russia are also major players, contributing 15% and 20% respectively. However, driven by the constant pursuit of cost efficiency, especially cheaper electricity, the industry is gradually turning to a more global decentralized model.

For example: emerging mining markets in Africa, Latin America and Asia, where electricity is extremely cheap.

conclusion

The phenomenon of bitcoin halving proves the originality and foresight in the design of the world’s first decentralized digital currency. We must emphasize that the real spirit of Bitcoin lies in its ability to empower holders and provide decentralized alternatives to the traditional financial system.

Each halving event is not only a technical event, but also a critical moment, reaffirming the core principles of BTC scarcity, security and decentralization.

Responses