SuperEx Guide: Quantitative Funds

#SuperEx #QuantitativeFunds

The crypto market has always been labeled in finance as high volatility, high return, and high risk. So while participants enjoy the explosive profit potential of this market, they are also constantly chasing “stable returns.” After all, with such large price swings, relying purely on buying low and selling high makes it difficult to achieve long-term stable profitability.

As a result, the “fund market,” long known for its stability in traditional finance, has attracted growing attention and gradually become popular. In this guide, we will systematically walk you through the SuperEx Quantitative Fund — including its sources of return, operational model, fee structure, and which types of investors it is suitable for.

One-sentence summary of the SuperEx Quantitative Fund:

- The interests of the platform and investors are aligned — the platform only earns a profit share if the strategy generates returns.

- Currently, the highest estimated annualized return is 17.11%.

- Professional management: Strategies and risk models are designed by a quantitative team.

- Safe and stable: Multiple strategy combinations reduce single-point risk.

- AI-powered: Uses data analysis and algorithms to automatically identify market opportunities.

- Smart investing: The system executes trades automatically without relying on manual judgment.

- Professional risk control: Real-time monitoring of positions and risk exposure.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Because of stability, more and more people are choosing quantitative funds

In recent years, the crypto market has gradually shifted from being “speculation-driven” to “strategy-driven,” and the advantages of quantitative investing have gained increasing recognition among investors:

First, reducing emotional trading

Many investors incur losses not because they misjudge the market, but because of:

- Chasing pumps and panic selling

- Overtrading

- Emotion-driven decision-making

Quantitative strategies completely avoid these issues, because trading logic is executed automatically by the system.

Second, improving capital efficiency

Quantitative strategies can:

- Operate 24/7

- Monitor markets in real time

- Automatically execute arbitrage opportunities

Compared to manual trading, efficiency is significantly higher.

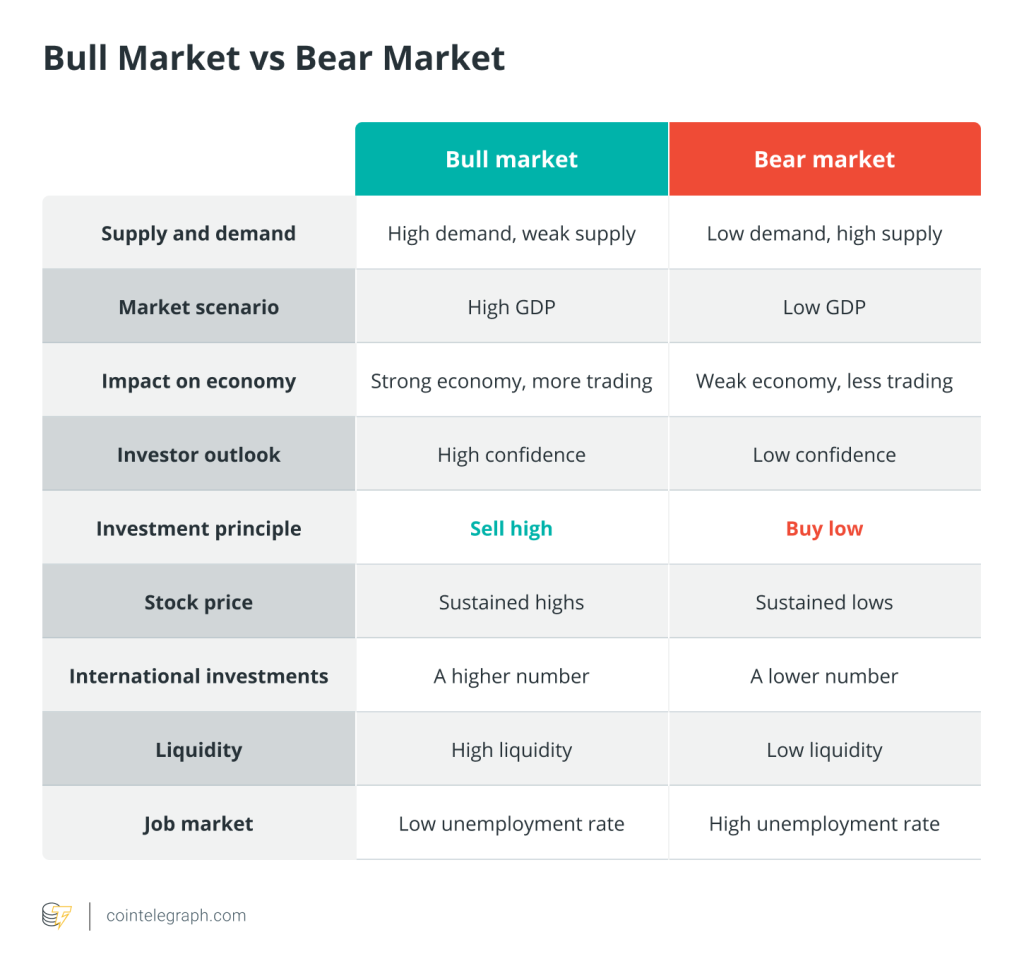

Third, better suited for ranging markets

In reality, markets are not trending upward most of the time, but rather: ranging, retracing, and fluctuating. Quantitative strategies often have advantages in such environments.

What is the SuperEx Quantitative Fund?

The SuperEx Quantitative Fund is an asset management product launched for investors. Its core feature is that trades are executed automatically through quantitative strategies, rather than relying on manual market direction judgments.

The fund’s returns mainly come from three types of strategies:

Neutral arbitrage strategy

By simultaneously going long and short on related assets, this reduces directional market risk and generates returns from price spreads.

Funding rate arbitrage

In the perpetual futures market, funding rates fluctuate periodically. The quantitative system automatically captures funding rate differences to generate stable returns.

Basis arbitrage

By trading on price differences between spot and futures markets, profits are earned during price convergence.

Simply put: the quantitative fund does not bet on whether the market will rise or fall, but instead earns returns from market inefficiencies through structured strategies.

This is why quantitative funds are generally considered to be more stable and less volatile.

SuperEx Quantitative Fund Product Types

Currently, the SuperEx Quantitative Fund mainly offers two types, catering to different investment needs.

Daily Profit

This is a more liquid quantitative fund product.

Key features include:

- Participation using USDT

- Flexible redemption

- Greater capital flexibility

Current reference data:30-day estimated annualized return: 10.83%

Suitable for:

- Investors seeking stable returns

- Those who want to maintain liquidity

- Those unwilling to lock funds for long periods

Many investors treat it as similar to “on-chain flexible savings.”

Quarterly Profit

This is a higher-return but longer-cycle quantitative fund.

Features:

- Participation using USDT

- Subscription and redemption only on a quarterly basis

Correspondingly higher returns: Estimated annualized quarterly return: 17.11%

Suitable for:

- Medium- to long-term capital allocation

- Investors pursuing higher returns

- Those who do not require frequent capital access

This model is closer to traditional finance’s fixed-term strategy funds.

SuperEx Quantitative Fund Fee Structure

One of the most frequently asked questions is how fees are charged.

The SuperEx Quantitative Fund adopts a relatively investor-friendly model: fees are only charged if profits are generated.

Specific rules:

- If the net asset value at redemption is higher than at purchase, the platform charges 30% of the profit portion as a custody fee.

- If the net asset value at redemption is lower than at purchase, users can redeem based on current asset value, and the platform does not charge a management fee.

This means that the platform’s interests are aligned with investors — the platform only earns a share when the strategy generates returns.

Subscription and Redemption Rules

- Subscription: During the open subscription period, users can subscribe at any time. The process is relatively simple and beginner-friendly.

- Redemption: After submitting a redemption request, funds will arrive on T+1.

This means capital liquidity remains relatively friendly, balancing strategy efficiency with user experience.

Net Asset Value Disclosure Mechanism

To ensure transparency, the SuperEx Quantitative Fund regularly discloses NAV data, with different frequencies depending on the stage:

- Before subscription opens: Strategies run using proprietary funds, and the NAV curve is disclosed once daily.

- After subscription opens: User funds and proprietary funds participate together in the strategy, and the NAV curve is updated every 8 hours.

Which Investors Are Suitable for Quantitative Funds?

If you belong to any of the following groups, a quantitative fund may be suitable for you:

First type: Those who do not want to trade frequently — no time to monitor charts but want funds to keep working.

Second type: Those seeking stable returns — not chasing explosive gains, but focusing more on long-term return curves.

Third type: Beginner investors — compared to direct trading, quantitative funds have a lower entry barrier.

Fourth type: Asset allocation investors — many mature investors adopt portfolio strategies such as spot + futures + quantitative funds to balance overall returns.

Conclusion

As the crypto industry gradually matures, investment approaches are also evolving — from simple buy-and-sell trading toward:

- Strategy-based investing

- Systematic investing

- Institutionalization

Quantitative funds are one of the important products emerging under this trend.

Responses