Why Does Trump Always Want the Federal Reserve to Cut Rates?An Analysis of the Reasons Behind His Public “Pressure Campaign” on the Fed

#FED #Trump

Trump’s drama of pressuring the Federal Reserve to cut rates plays out every few days, and the content is very rich. First he repeatedly and publicly called on the Fed to cut interest rates. After getting no response from Powell, he seemed to lose patience and directly launched a personal attack on Fed Chair Powell, calling him “Mr. Too Late.”

Even more theatrically, when even the personal attacks failed to provoke much reaction from Powell, Trump publicly stated a few days ago that he regrets having nominated Powell as Fed Chair in the first place. This could almost be called one of the best political shows in the United States in 2025. The audience has gone from initial shock to eager anticipation — waiting to see what even more exciting lines will come next.

Sure enough, just yesterday Trump said that the Fed’s latest decision to cut rates by 25 basis points could have been “at least doubled.” That comment was still within a somewhat acceptable range, but then Trump continued to crank up the sarcasm. He called Fed Chair Jerome Powell a “stubborn person” who approved a “rather small” rate cut, and even said rates should be cut to the lowest in the world.

As we said in our analysis article a few days ago on candidates for the new Fed chair, Trump does not need a particularly capable Fed chair — he needs one who stands on the same front line with him. But by this point, many people likely have a question: why does Trump keep demanding that the Fed cut rates, even at the cost of breaking the historical norm that “the president must not interfere with the Fed’s independence”? Is it simply because rate cuts are good for finance — mainly crypto finance? Or are there deeper reasons?

We will not talk about political power struggles here, only economic and financial reasons.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Reason 1: “Massaging the numbers” — yes, exactly what internet operators often do

Trump has never been a traditional politician. His logic is more like that of a businessman: “everything is results-oriented.” And rate cuts are the fastest and most direct tool for making economic data “look better.”

1) U.S. mortgage rates are too high, and public resentment is strong

In 2024–2025, U.S. 30-year fixed mortgage rates once broke above 7%–8%, making it simply impossible for a large number of middle-class households to buy a home. For Trump: home prices are highly correlated with expectations of household wealth; excessively high mortgage costs = public dissatisfaction = political risk.

If interest rates fall quickly:

- mortgage rates come down with them

- the housing market warms up

- the middle class’s sense of wealth improves

- consumption and employment data both look much better

In other words, rate cuts can directly stabilize Trump’s most important voter base: the middle class.

2) Rate cuts can make the stock market “spit fire”

The United States has a national trait that is different from many other countries: the performance of the stock market during a president’s term is seen by Americans as a symbol of governing ability. This is why one of the things Trump said most often while in office was: “Look at the stock market!” He knows very well that as long as the stock market is rising, his approval rating, policy maneuvering room, and media momentum will all rise in sync.

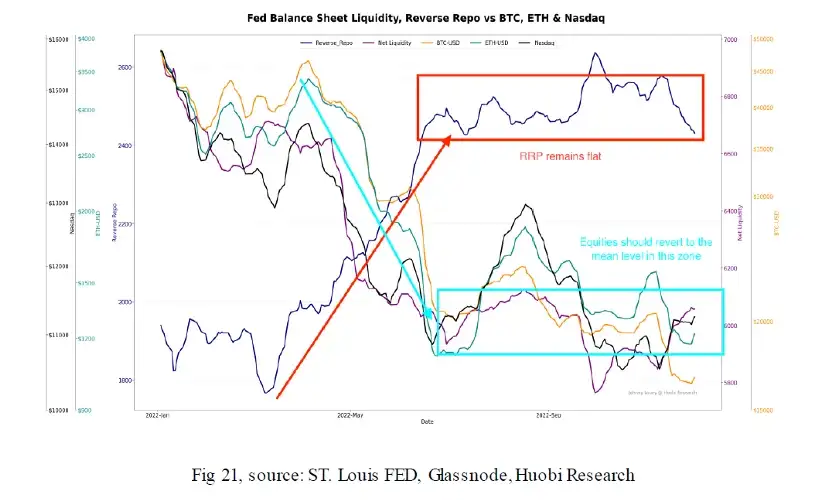

And what is a rate cut? A rate cut = injection of blood = an amplifier for the stock market. Especially in sectors like tech, AI, chips, and crypto assets, the gains brought by rate cuts are even more exaggerated. For Trump, who relies heavily on “capital market sentiment,” rate cuts are an irresistible shot of adrenaline.

Reason 2: Tariffs and inflation as joint drivers

What sets Trump apart from other presidents most is the ultra-high tariff policy he has implemented since taking office. Tariffs push up import costs and increase inflationary pressures. Corporations are forced to pass costs on to consumers, which suppresses consumption confidence and investment willingness, and can even drag down economic growth.

Therefore, Trump wants to use rate cuts to reduce borrowing costs, stimulate corporate investment and household consumption, and thereby partially offset the impact of tariffs on the economy. According to the Federal Reserve’s own projections, tariffs in the short term will weaken investment, confidence, and growth, but in the long term may intensify inflation.

Trump advocates stimulating economic vitality through rate cuts while trying to avoid runaway inflation risk. However, Fed Chair Powell emphasizes that tariff policy has in fact pushed up inflation expectations (the core inflation forecast for 2025 has been revised up to 2.7%), so he remains cautious about cutting rates.

Reason 3: Rate cuts are the only “short-term solution” to repair the U.S. debt structure

This is something very few people talk about — but it is the most critical piece for Trump. U.S. government debt has exceeded 35 trillion dollars, and high interest rates are rapidly worsening the government’s debt-servicing pressure. If interest rates stay around 5% for a long time, the federal government’s annual interest payments will grow like cancer cells.

This means:

- it becomes harder to reduce the fiscal deficit

- pressure on Treasury issuance increases

- government budgets are devoured by interest payments

- political polarization in Congress deepens

And rate cuts are almost the only way to make this debt pressure drop sharply in the short term.

Trump knows very well that if he wants to deliver on his promises of tax reform, infrastructure plans, and manufacturing reshoring, all of that requires a massive fiscal budget. High interest rates make fiscal operations extremely constrained; rate cuts are equivalent to unlocking the shackles on fiscal policy.

So Trump is not “willfully demanding rate cuts” — he is fighting for fiscal breathing room for the next four years.

Reason 4: Rate cuts help push “on-chain U.S. assets” and the fintech strategy

Trump is a firm supporter of crypto finance — this is beyond doubt. It is also consensus that rate cuts are positive for crypto finance. But beyond this surface-level reason, today’s piece of breaking news is thought-provoking:

U.S. Securities and Exchange Commission (SEC) Chair Paul Atkins said in a live interview with Fox News that he expects the entire U.S. financial market to transition to blockchain technology supporting Bitcoin and cryptocurrencies within the next two years. Atkins said, “The world is going to be like that, it might not take 10 years, maybe as soon as two years. The next step will come with digital assets, market digitalization and tokenization, which will bring huge benefits in transparency and risk management.”

From this perspective, rate cuts do indeed help promote “on-chain-ization of U.S. assets” and the fintech strategy. Remember, the Trump camp strongly emphasizes:

- capital markets on blockchain

- tokenized Treasuries, stocks, and real estate

- using on-chain transparency to enhance the competitiveness of U.S. finance

But on-chain finance (RWA, tokenized assets) has a deadly rule: the higher the interest rate, the harder it is for on-chain finance to develop. There are three reasons:

High interest rates mean high off-chain returns, reducing the appeal of on-chain assets

For example:

- Treasury yields at 5%

- stablecoin yields only at 3%

- then capital will obviously flow back to traditional markets.

High interest rates push up DeFi borrowing costs and dry up liquidity

On-chain asset issuers need financing, and high financing costs mean growth is constrained.

High interest rates make the dollar stronger, making it harder for capital from developing countries to flow into the on-chain asset ecosystem

Trump wants to promote a “U.S.-led global digital asset system,” but the premise of that system is: dollar liquidity must be loose, not locked up by high rates.

- Rate cuts = accelerating the on-chain-ization of U.S. assets.

- Rate cuts = making on-chain Treasuries easier to promote.

- Rate cuts = supporting the growth of RWA and the Web3 financial industry.

The Trump camp is very clear on this.

Reason 5: Rate cuts are the best stage for creating an “economic miracle”

Trump is very good at storytelling, and even better at creating “dramatic effects.” The scenario he most wants is: “Trump takes office → rate cuts → capital markets explode → the U.S. economy becomes great again.” This is a narrative with extremely powerful symbolic meaning:

- “See? The moment I took office, the economy came back to life.”

- “The American economic miracle was created by me.”

- “The Democrats wrecked the economy; I brought it back.”

And rate cuts are the fastest, most perceptible “catalyst” for an economic miracle.

Of course, the reasons are not limited to these four, for example:

- rate cuts are a strategic need to counter China’s manufacturing and global competition;

- rate cuts pave the way for Trump’s 2025 policy agenda;

- and there are also elements of political maneuvering and power extension.

As we said at the beginning, this article discusses only economics and finance, so political and geopolitical power games are beyond our scope.

Conclusion: Trump’s pressure campaign for rate cuts is not just about finance, but also strategy, narrative, and power layout

When you connect all the pieces, you will find that Trump’s demand for rate cuts is not an emotional outburst, but an integrated strategy: political votes → capital markets → debt pressure → Web3/on-chain assets → manufacturing reshoring → media narrative → electoral chances.

These factors interact and reinforce each other. So in the coming months, you will continue to see Trump relentlessly “pushing for rate cuts,” possibly with ever-increasing firepower. Because for him:

- rate cuts are not policy, they are a weapon.

- rate cuts are not finance, they are part of the election battle.

- rate cuts are not emotion, they are strategy.

As for whether the Federal Reserve can withstand the pressure, and what Trump’s next move will be — this show is far from over.

Responses