Will Stablecoins Undermine Monetary Sovereignty? A Deep Global Analysis on the New Financial Power Shift

#Stablecoin

Over the past two days, something very interesting happened: the video game and tech giant Sony Group plans to issue a USD-denominated stablecoin next year, to be used inside its digital ecosystem for buying games and anime. Leaving aside the fact that Japan already has a stablecoin regulatory framework, the question is whether it’s meaningful that Sony is not issuing a stablecoin in Japan, but is instead choosing the United States.

But at the very least, Sony’s move shows one thing clearly: the stablecoin market is continuously expanding. Whether inside crypto or across the global financial landscape, this is a major trend.

You should know that Sony as early as 2021 participated in the $30 million Series A of the NFT marketplace MakersPlace, kicking off early exploration of NFT technology applications in the music field. Afterwards, it expanded exploration across multiple areas including NFT issuance, game development, crypto trading service platforms, Layer2, Meme, and more. And even for a company that pioneered crypto exploration like this, it ultimately still moved into the stablecoin camp.

Logically speaking, the accelerated global penetration of stablecoins is a good thing for the crypto industry — it can push the development of the crypto ecosystem. But another question follows: a professional issue that once existed only inside the crypto circle is now being repeatedly mentioned by the IMF, central banks, multinational corporations, and legislative bodies — will stablecoins weaken a country’s monetary sovereignty?

In the past few years, stablecoins have gradually evolved from an “alternative payment tool” into infrastructure that cannot be ignored in the global financial system. Mobile internet and non-custodial wallets allow them to enter ordinary people’s lives in every country faster and at lower cost than any foreign currency. In many emerging economies and high-inflation countries, they have even become the primary driver of “shadow dollarization.”

And when the IMF publicly warns in its latest report about the potential “currency substitution” risks of stablecoins, when multinational giants like Sony begin proactively issuing USD stablecoins, and when regulators in various countries rapidly propose restriction plans, a sharper question emerges: stablecoins are not tools of the crypto industry — they are a force reshaping the global financial order. Whoever controls stablecoins controls the next generation of international financial influence.

So, will stablecoins really weaken monetary sovereignty? Or is this merely a technological migration that cannot be stopped?

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Stablecoins Are Accomplishing What Traditional Foreign Currencies Never Could: Entering Every Country at Internet Speed

For monetary sovereignty to weaken, the prerequisite is that domestic currency usage shrinks while foreign currency substitution rises. In the traditional financial era, pushing substitution required extremely high barriers

- bank FX accounts

- cross-border clearing systems

- custody of physical assets

- FX regulatory approvals

But stablecoins flatten all of these barriers. Today, a user living in Latin America, Africa, the Middle East, or emerging Asian countries only needs:

- a smartphone

- a non-custodial wallet (such as MetaMask, Trust Wallet)

- a download entry

to immediately use USD stablecoins — no bank, no review, no capital-control access approval. Do you know what this means? It means: the dollar enters the world as an internet protocol, not through banking systems.

Therefore, it is no longer constrained by:

- local banking systems

- FX controls

- capital flow restrictions

- government monetary policy

This “technology bypasses regulation” characteristic makes stablecoins naturally carry a “currency substitution effect,” especially strongly in the following regions:

- South America (Argentina, Venezuela): stablecoin substitution rates for local currencies rise rapidly

- Middle East / North Africa: high-inflation countries prefer using USDT as a store-of-value asset

- Southeast Asia: cross-border freelancer payments heavily use USDC, USDT

- Sub-Saharan Africa: mobile payments are widespread, and USDT becomes a savings asset for young people

This is exactly why the IMF emphasizes in its report: stablecoins are even easier than the dollar itself to enter a country, and this phenomenon is the first of its kind in history — and that is the fundamental source of the monetary sovereignty dispute.

The Success of Stablecoins Comes From the “Failure” of Traditional Financial Systems

To discuss “whether sovereignty is weakened,” you must first answer: “why can stablecoins become so popular?” Fundamentally, what stablecoins replace is not fiat currency, but rather: outdated payment systems, expensive cross-border procedures, poor inflation management, and slow, inefficient monetary transmission mechanisms.

Therefore, the rise of stablecoins has deep inevitability, rather than being “artificially pushed by crypto technology.”

1. They solve the most universal global pain point: cross-border payments

Migrant workers, freelancers, outsourcing industries, esports industries, remote hiring — all are constrained by:

- high SWIFT fees

- long clearing times

- strict reviews

- small-value cross-border transfers being nearly impossible

Stablecoins achieve:

- 24/7 settlement

- near-zero fees

- no threshold

- global reach

For users, choosing stablecoins is not financial speculation — it is: a superior technical path.

2. They function as an “escape route” in high-inflation countries

When a country’s inflation reaches double digits or higher, residents converting local currency into USD is instinctive, but in the past this required black markets or underground banks. Now? You only need an address. This naturally reduces demand for the local currency, and monetary sovereignty gets diluted.

3. They also respond to the need for storing value

In most emerging countries, local currency is not a savings tool — it is a “container of rapidly shrinking purchasing power.” If the national situation is worse, you can even feel inflation viscerally. What does that mean? For example, you can still buy a cup of coffee with this 5 units of money in the morning, but by the afternoon you must spend 6 units — this is the importance of inflation resistance and devaluation resistance.

Until stablecoins appeared, they allowed users in these emerging countries for the first time to have: an inflation-resistant, devaluation-resistant, freely transferable savings method that does not depend on banks — this is a reality that hardly any local currency can replace.

Multinational Corporations Are Abandoning Local-Currency Ecosystems: The Logic Behind Sony Choosing Only a USD Stablecoin

Let’s use Sony as an example to understand the broader trend of multinational corporations building stablecoin ecosystems.

Sony’s choice carries symbolic meaning: Japan already has a stablecoin framework, but Sony does not choose JPY and instead goes to the U.S. to issue a USD stablecoin. Behind this action is the result of global companies voting with their feet: companies do not want to operate in highly restrictive local-currency stablecoin systems, but are willing to run global ecosystems under USD stablecoin regulation.

Why?

1. JPY stablecoin restrictions are too heavy (limited use, must be 1:1 JPY)

Japan’s regulation sets:

- can only peg to JPY

- can only be for domestic use

- for small payments

- cross-border and DeFi are not encouraged

- issuer eligibility is extremely restrictive

This means:

✔ suitable for domestic banks

✘ not suitable for global corporations

2. USD stablecoins have stronger global scalability

U.S. regulation may be strict, but the ecosystem is open:

- can be used for cross-border payments

- can be used for game assets

- can integrate deeply with the crypto ecosystem

- can be used within compliant trust structures

- can be pegged 1:1 to USD

- can be used for new business model design

This is the core reason Sony chooses USD rather than JPY: it’s not that Sony abandoned the yen, but that a yen stablecoin cannot support its global strategy.

3. Stablecoins are not retail currency — they are an operating method for corporate assets

Sony is not doing stablecoins to challenge national currency. Instead, it is:

- lowering payment costs

- building its own payment system

- building a user points system

forming an ecosystem closed loop of games + film/TV + NFTs, moving away from the VISA fee system. This will become a trend for multinational corporations: any company with global users may issue its own stablecoin — and the impact on monetary sovereignty is deeper than crypto trading itself.

You Must Classify the Sovereignty Debate: Impacts Differ Completely by Country

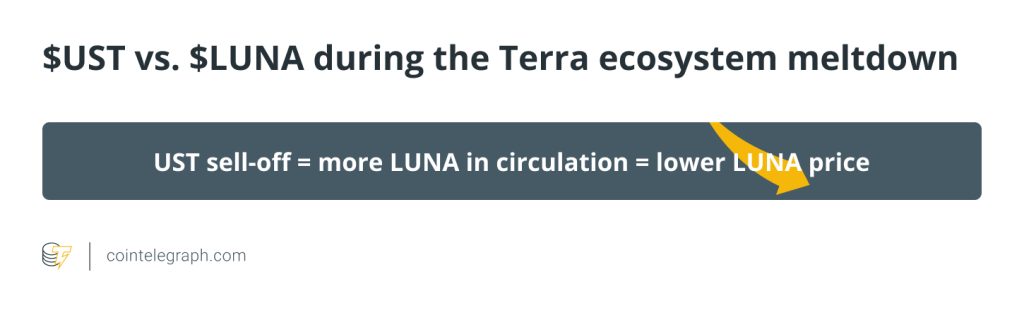

Layer 1: High-inflation countries → sovereignty weakens quickly (highest risk)

There are many such countries, mostly emerging economies, such as Argentina, Turkey, Venezuela, Lebanon, Zimbabwe, etc. In these countries: local currency purchasing power falls rapidly, residents’ savings flee into foreign currency, and stablecoins become substitute savings assets.

Under the dual pressure of central banks struggling to control interest rates and local currency usage declining year by year, these regions may indeed see sovereignty weakening. The most typical example is Zimbabwe, one of the most representative high-inflation countries globally. In 2009, 1 USD could be exchanged for 250 trillion Zimbabwe dollars — more exaggerated than many Memecoin numbers. Even today, 1 USD can still be exchanged for 322 Zimbabwe dollars. In such countries, USD and stablecoins are almost the real currency.

Layer 2: Mid-sized economies → sovereignty faces structural interference (controllable but serious)

For example:

- Indonesia

- the Philippines

- Thailand

- India

- Brazil

These countries’ currency systems are still functional, but cross-border demand is huge. The convenience and low fees that stablecoins bring to cross-border payments and settlement is essentially a dimension reduction strike against fiat settlement. But stablecoins can cause: part of FX flows shift on-chain, further causing central bank statistics distortion and partial interference with monetary policy transmission. However, in these countries, sovereignty will not collapse immediately, but it may be eroded.

Layer 3: Developed economies → sovereignty is basically safe (stablecoins become infrastructure instead)

These are strong countries and economic blocs such as the United States (issuer country), the EU, Japan, South Korea, Singapore. In these countries: strong local currency + stable financial system + controllable inflation, so stablecoins are more used for innovation and fintech. They will not be replaced; instead they benefit from stablecoin ecosystem expansion.

The only exception is Europe, because the euro lacks a product comparable to USD stablecoins, and may face further squeeze from U.S. fintech power in the future.

After Multi-dimensional Analysis, We Can Reach a Structured Conclusion

Conclusion 1:

Stablecoins are a technological force, not an active attempt to erode sovereignty — but the outcome will affect sovereignty

Their essence is not foreign currency, but a more efficient “internet monetary protocol.” Weakening sovereignty is not their intention, but a side effect of natural technological evolution.

Conclusion 2:

What truly gets weakened is the sovereignty of “weak-currency countries”; strong-currency countries face limited impact

If a country has: high inflation + fragile financial system + low currency internationalization + insufficient financial digitalization = stablecoins will become “substitutes.” But if: strong local currency + advanced financial system = stablecoins will only become “infrastructure supplements.”

Conclusion 3:

Stablecoins entering corporate systems (like Sony) is the real sovereignty threat

The significance of enterprises issuing stablecoins is greater than financial institutions:

- direct reach to users

- ecosystem-scale

- closed-loop payment scenarios

- ability to bypass banking systems

In the future, large enterprises and platform companies may become “currency issuers” — this is the core of monetary sovereignty risk.

Conclusion 4:

Stablecoins are unstoppable; the only strategy is “countries must issue their own digital currency and stablecoin systems”

No country can stop technological change. The only realistic choice is:

- build national-level stablecoins

- improve regulatory frameworks

- build digital payment infrastructure

- cooperate with enterprises to co-build ecosystems

Otherwise, they will lose voice and influence in global competition.

Responses