SuperEx Educational Series: Stablecoin Attack Types — The Most Dangerous, Most Underestimated Financial Warfare in Crypto

#EducationalSeries #Stablecoin

Stablecoins are nothing unfamiliar to anyone. You could even say they are the financial pillar that supports “faith” across the entire crypto market. Without stablecoins, people’s understanding of crypto would probably still be stuck at the level of altcoins, air coins, and violent pumps and dumps.

So yes — stablecoins are infrastructure in the crypto world, and also the easiest thing to ignore. Before policy tailwinds pushed stablecoins into the spotlight this year, this sector was long overshadowed by altcoin wealth myths and the spotlight of new narratives. Because stablecoins look “too stable,” too everyday, too ordinary — like water, soaking into every single trade.

But you would never ignore water sources in war. And that is exactly what stablecoins are in crypto: the “water source.” When an industry’s “water source” — liquidity, unit of account, risk buffer, trading medium — gets attacked, the entire market often collapses instantly.

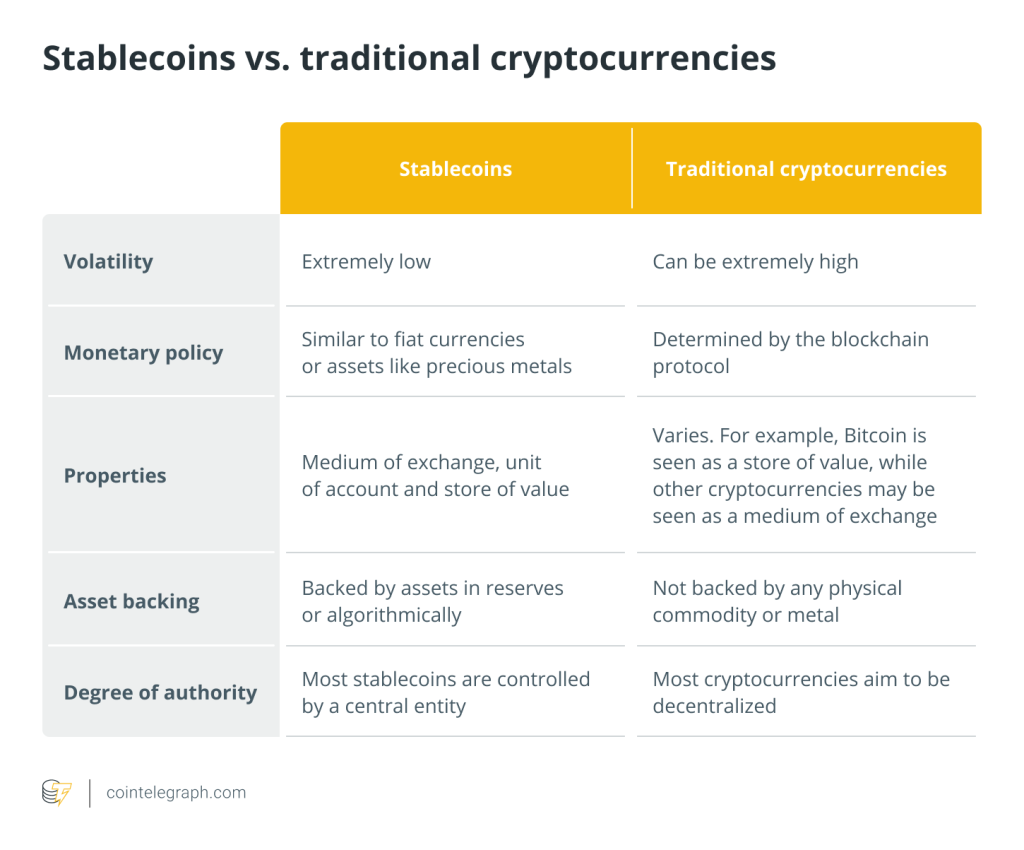

Therefore, a stablecoin is not a simple financial product. It is:

- the “USD substitute” of crypto finance

- the anchor of market confidence

- the core channel of risk transmission

- the stabilizer and amplifier of the crypto system

And precisely because of this, stablecoins have become one of the core battlefields for hackers, short-selling institutions, cross-border arbitrage players, and speculative capital. Today, we will systematically break down stablecoin attack types, and use a deeper lens to understand why stablecoins don’t just “de-peg,” but can also become the “detonator” that triggers cascading industry-wide crises.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Why Are Stablecoin Attacks So Destructive?

— Because this is not a single-point failure, but a system-wide systemic risk.

Why does attacking one stablecoin often cause the whole market to stampede immediately?

Do you still remember the USDe de-peg on October 11? As the world’s third-largest stablecoin, USDe’s de-pegging caused a massive shock across the crypto market. That is the terrifying part of stablecoins: they are usually tied to countless secondary trading pairs.

1. Stablecoins Carry the “Settlement Layer” Function

They are not an asset — they are the “trading engine.” Attacking a stablecoin = draining the “fuel tank” of the financial system.

USDT, USDC, and DAI matter because:

- all trading pairs are priced in them

- all capital flows settle through them

- all risk assets measure value through them

- all long/short positions use them as margin

- all CeFi/DeFi lending treats them as base assets

Once confidence in a stablecoin breaks, it is not “one asset getting damaged” — it is the market’s tradability collapsing instantly.

2. Stablecoin Attacks Get “High-Speed Amplification” On-Chain

Traditional finance has regulators, circuit breakers, market makers, and central bank backstops. But when a crypto stablecoin breaks:

- on-chain liquidation bots trigger automatically

- lending protocols begin forced liquidations

- AMM pools slip with instant slippage

- bridges get drained rapidly via arbitrage spreads

- short sellers further suppress stability

- the market enters a large-scale “de-peg” stampede

So stablecoin attacks are the most typical exponential on-chain financial attacks: fast, heavy, broadly transmitted — almost no financial system can withstand the chain reaction.

3. Stablecoins Have Extreme Information Asymmetry

Attackers can exploit:

- opaque reserve assets

- delayed disclosures

- vague custody banking information

- regulatory gray zones

- audits that cannot keep up with asset changes

- risk-asset exposure that outsiders cannot assess in real time

This makes stablecoins the easiest financial products to be hit by “information warfare + capital warfare” simultaneously.

The Seven Major Types of Stablecoin Attacks: From Shorting and Bank Runs to On-Chain Manipulation — Full Exposure of Systemic Risk

Stablecoin attack methods are far more diverse than most people imagine — and they are becoming more hidden and more financialized. Based on difficulty, cost, and damage potential, we divide them into seven categories:

Type 1: Market Attack

A combined “information war + financial war” using short selling and narrative pressure. This is the most common, lowest-cost, and highest-return approach. Typical tactics include:

- shorting assets related to stablecoin reserves (such as reserve BTC, bonds, etc.) with large capital

- coordinating media or institutions to publish “insufficient reserves, de-peg, bankruptcy risk” narratives

- creating panic on social platforms and guiding panic-driven redemptions

- artificially creating slippage in AMM pools to push de-pegging probability even higher

- closing shorts for profit as panic sentiment amplifies

This is a financial attack — not a technical one, but psychological warfare + capital warfare. A typical example is USDT being repeatedly short-attacked by financial institutions during 2018–2022, and even the well-known hedge fund Citadel was reportedly involved in planning.

Type 2: On-chain Bank Run Attack

Using AMM pools and lending protocols to “rapidly drain liquidity.” This is extremely brutal because on-chain liquidity is naturally fragile.

Main steps:

- attackers pre-position large funds

- dump massive amounts of stablecoins into pools

- cause price slippage

- trigger arbitrageurs, bots, and algorithms to automatically sell

- eventually hollow out AMM pools

- bridges get squeezed

- on-chain protocols enter systemic liquidation

In fact, no stablecoin can escape AMM bank run attacks — including USDT, USDC, DAI, FRAX, GUSD, etc. This is pure “whale-level capital warfare.”

Type 3: Bridge-Based Attack

Attacking through bridges to cause instant price de-pegging. Cross-chain bridges are hacker heaven — we explained bridge attacks in the previous lesson, and hopefully that’s still fresh.

Attack methods include:

- directly attacking bridge contracts

- forging cross-chain messages by exploiting weak light-client verification

- creating de-pegging through bridge liquidity pool pricing mechanisms

- attacking the bridge’s oracle and tampering with exchange prices

Once a bridge breaks, the stablecoin on one chain can de-peg from mainnet prices. Inter-chain arbitrageurs will rapidly drain liquidity, triggering an even worse effect: “local de-peg → network-wide de-peg.”

The bridge problem is not “a bug” — it is that bridges inherently carry “single-point-of-failure” properties.

Type 4: Oracle Manipulation

A familiar concept — we covered it earlier. Oracle manipulation means tampering with price sources so the stablecoin gets a false price. This works because many stablecoin collateral systems depend on oracle feeds, such as: DAI (MakerDAO), FRAX, USDD, LUSD, and various on-chain stable pools.

Attack flow:

- manipulate AMM prices

- feed false data through the oracle

- lending protocols misread collateral value

- stablecoins are massively minted

- collateral is drained

- stablecoin loses its peg

This is a classic combined “on-chain quant attack + oracle-layer weakness” operation.

Type 5: Reserve Attack

A real-world financial offensive targeting centralized stablecoins, and it has become more common in recent years — especially against centralized stablecoins like USDT, USDC, TUSD, etc.

Attackers may:

- short their reserve assets (Treasuries, BTC, gold, etc.)

- question reserve transparency

- expose internal compliance risks

- use rating agencies and regulatory pressure to create tension

- induce redemption runs

The frightening part is: this is not an on-chain battlefield — it is a real-world financial battlefield. Attackers exploit sentiment and compliance pressure, not code vulnerabilities.

Type 6: Audit & Information War

An attack style that weaponizes information asymmetry to destroy a stablecoin through public opinion. Attackers may:

- forge “leaked audit reports”

- spread “reserve violations” narratives

- cite ambiguous regulatory statements to intimidate holders

- fabricate “bank accounts frozen” rumors

- mass-produce FUD (fear, uncertainty, doubt) narratives

In the social media era, stablecoin holders are extremely sensitive. The slightest rumor can trigger dumping, allowing attackers to launch “psychological warfare” at extremely low cost.

Type 7: Regulatory-Induced Attack

Regulators are not attackers, but regulation can produce “attack effects.” Everyone should remember this sentence.

A simple example: when a regulator proposes:

- stablecoins must have banking licenses

- reserves must be 100% cash

- high-risk assets are prohibited

- audits must be public

- custody banks must be disclosed

These policies may be designed to protect users, but they can also become the spark that triggers: panic → on-chain bank runs → stablecoins becoming direct targets. Especially when regulators speak, short-selling institutions often move in sync — turning regulation into an “attack amplifier.”

Three Trends Are Turning Stablecoins Into “High-Frequency Attack Targets”

Trend 1: Stablecoins Are Now Large Enough to Affect the Global USD System

USDT + USDC market cap exceeds $200 billion, and on-chain stablecoins like DAI account for more than 70% of DeFi stablecoin usage. This is large enough to influence cross-border flows. The more important something is, the more it becomes a target.

Trend 2: Stablecoins Are Becoming a “Global Liquidity Black Hole”

Stablecoins have already become:

- major overseas buyers of U.S. Treasuries

- the settlement layer of crypto markets

- capital refuge tools

- USD substitutes in emerging markets

Assets with this profile have extremely high “attack value.”

Trend 3: Traditional Financial Institutions Are Starting to Participate in Short Attacks

Macro capital has realized: “stablecoins are not only attackable — attacking them can be profitable.” This will drive more institutions into the “stablecoin sniper market.”

SuperEx Commentary and Recommendations: The Future of Stablecoins Will Enter an Era of “Strong Regulation + Strong Transparency + Strong Competition”

From an exchange perspective, we believe future competition among stablecoins will no longer be just market cap competition, but:

- who is more transparent

- who is more attack-resistant

- whose reserve structure is more stable

- whose compliance system is stronger

- who can withstand institutional shorting

- who can maintain the peg under black swan conditions

In crypto, whoever can defend the USD peg can defend liquidity and confidence.

The stablecoin war will ultimately decide: who will become the “central bank” of future global crypto finance.

Conclusion: Stablecoin Attacks Are Not Exceptions — They Are the Future Normal

Stablecoins are the real “systemic risk source” of the crypto market. Over the next three years, stablecoin attacks will only become more frequent, more hidden, and more financialized.

You must accept one reality: stablecoins are not stable. They are assets under continuous attack. What truly determines the market’s fate is whether stablecoins can survive the next round of attacks.

For traders:

- do not worship any stablecoin

- diversify holdings

- check cross-chain bridge risk

- understand reserve structures

- track oracle mechanisms

- monitor on-chain pool depth at all times

- avoid large redemptions during panic

This is not pessimism. This is maturity.

Responses