SuperEx Education Series: A Deep Dive into Crypto Exchanges

#SuperEx #Education #CryptoExchanges

Whether you’re a crypto newbie or a seasoned trader, if you’ve ever traded in the crypto market, you won’t be a stranger to crypto exchanges. But… do you truly understand them in detail?

Some say a crypto exchange is the “Wall Street of digital assets.” Others call it the “first gateway to Web3.” In this explainer, we’ll take it from the top: what a crypto exchange is, its types, mechanisms, security, business models, and future trends.

https://news.superex.com/articles/2910.html

What Is a Crypto Exchange?

Simply put, a crypto exchange is a platform where people can buy and sell digital assets like Bitcoin, Ethereum, and USDT.

It’s like a stock exchange you already know — except you’re trading digital currencies instead of equities. The biggest differences from stock markets are:

- Stocks are traded under the umbrella of a national financial regulatory system;

- Crypto exchanges are mostly global, 24/7 markets that anyone with an internet connection can access directly.

This means an exchange isn’t just a “place to buy and sell” — it’s the liquidity hub for the entire crypto market.

Types of Crypto Exchanges

On the surface, an exchange is just a place to “trade coins.” Look closer and you’ll see a variety of forms — each reflecting different philosophies and incentive structures in the crypto world.

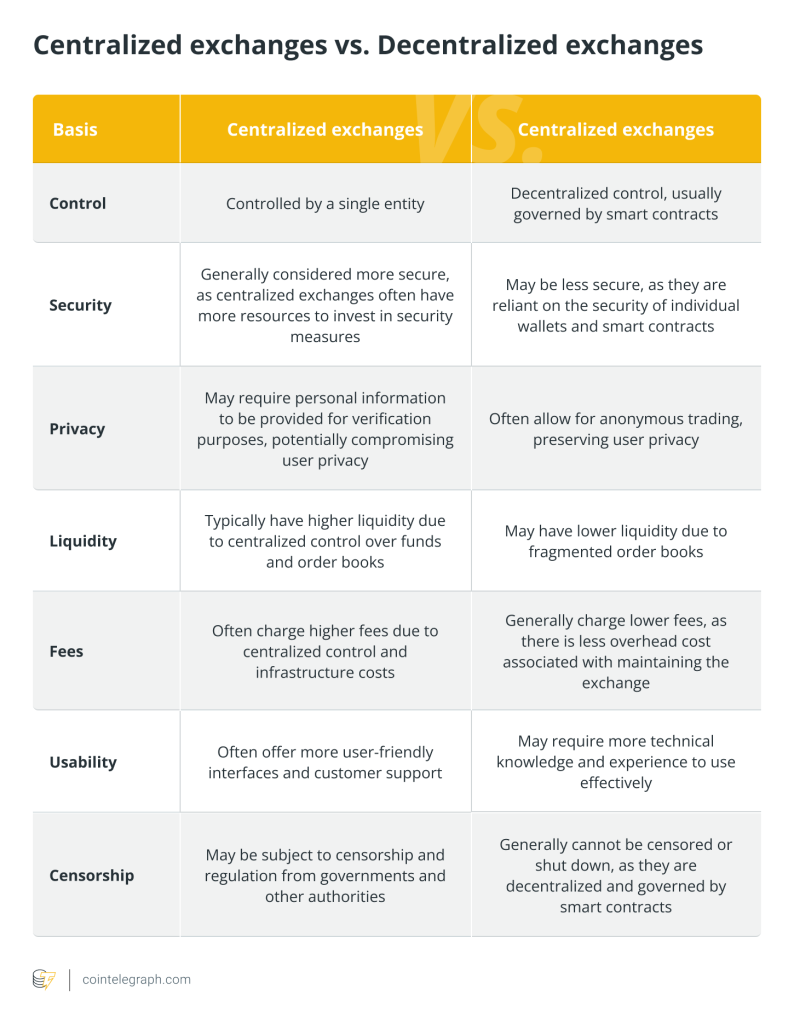

1) Centralized Exchanges (CEX)

CEXs are currently the most widely used. Think of them as a hybrid of a bank and a stock-trading platform for digital assets. Users deposit funds, the exchange custodies them, and an internal matching engine completes trades.

CEX pros:

- User-friendly UI; easy for beginners.

- Strong liquidity; large orders can fill quickly.

- Broad services (derivatives, earn products, etc.).

CEX cons:

- Platform custody risk — if hacked or if the platform absconds, users may lose funds.

- Requires trust in the platform’s integrity and compliance.

Example: Binance is a classic CEX. Its daily volume has topped $70B at times — busier than parts of Nasdaq in certain sessions.

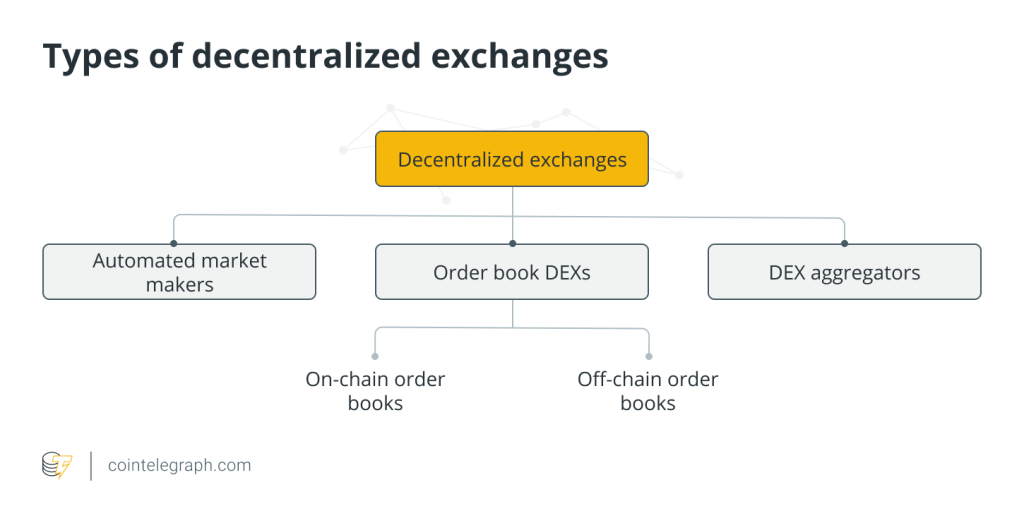

2) Decentralized Exchanges (DEX)

DEXs operate on a different logic: code is law. No intermediary custodies your funds — smart contracts execute all trades.

DEX pros:

- Users always control their private keys; no custody risk.

- Transparent and on-chain; fully auditable.

- Aligns with crypto’s decentralization ethos.

DEX cons:

- Higher UX/learning curve; beginners can get confused.

- Some DEXs have poor liquidity and large slippage.

- Smart contract bugs can still lead to losses.

Example: Uniswap on Ethereum. It uses an AMM (Automated Market Maker) model so users can swap directly from their wallets — no trusted third party required.

3) Hybrid Exchanges

As user needs diversify, the line between CEX and DEX is blurring. Some platforms experiment with “hybrid” designs — offering CEX-like smoothness with elements of DEX self-custody.

4) Localized/Regulatory-Compliant Exchanges

With more jurisdictions finalizing policy, a group of local compliant exchanges has emerged. In the U.S., Coinbase; in Korea, Upbit — they operate under local financial licenses and primarily serve compliant users.

Pros: strong sense of safety and compliance.

Cons: more business constraints, fewer listed assets, slower innovation.

5) New Forms: On-Chain Derivatives Exchanges

Beyond traditional DEXs, platforms like dYdX and GMX offer on-chain derivatives — letting users open leveraged positions and trade perpetuals fully on-chain. This shows that the “DEXs are only for spot” era is over; even high-frequency derivatives trading may move beyond centralized venues.

Core Mechanisms of Exchanges

Understanding exchanges isn’t just about the categories — it’s also about how they work. Like a car, it’s not only the exterior but also the engine and brakes that matter.

1) Matching: Order Book vs. AMM

- CEX order books: buyers post bids, sellers post asks, and a matching engine pairs them. Efficient price discovery, but requires platform ops.

- DEX AMMs: users provide liquidity pools; algorithmic curves set prices. No order book; anyone can be a market maker — but impermanent loss can occur.

Think of it as traditional stock market vs automatic currency exchange machine.

2) Liquidity & Depth

A good exchange largely depends on liquidity. Strong liquidity means minimal price impact when you trade; weak liquidity means “you won’t get the price you want.”

- CEXs rely on a large user base and market makers.

- DEXs incentivize deposits with liquidity mining rewards.

3) Settlement

- CEX off-chain settlement: trades are internally booked first, then batched on-chain. Fast — but you must trust the platform.

- DEX on-chain settlement: every trade finalizes on-chain; transparent, but constrained by network speed and gas.

4) Risk Controls & Security

- CEXs run comprehensive risk systems to monitor anomalies and prevent manipulation.

- DEXs rely entirely on immutable smart contract rules — both a strength and a risk.

5) Special Mechanics in Derivatives

Derivatives are a CEX “cash cow.” Perpetual futures use a funding rate to keep contract prices aligned with spot. This prevents “de-pegging,” but introduces more complex risk management.

6) Incentive Mechanisms

Exchanges design various incentives:

- CEX: VIP fee tiers, referral rebates, etc.

- DEX: governance tokens, LP rewards, etc.

At heart, incentives turn users into stakeholders.

Bottom line: exchange design is a balancing act between efficiency and security. CEXs are faster and smoother — but require trust. DEXs are freer and transparent — but users bear the risks themselves.

Feature Set of Modern Exchanges (Using SuperEx as an Example)

Today’s exchanges are comprehensive financial ecosystems — not just “buy/sell” pages:

- Spot Trading: the core — directly buy and sell coins.

- Futures / Perpetuals: leverage products with higher risk and potential reward.

- Staking: lock tokens to earn yield — akin to “on-chain savings.”

- Super Star (new token launchpad): helps new projects raise; lets users join early.

- Earn / Yield Products: fixed-term earn, yield farms, etc.

- 1usd: join with just 1 USD for a chance to win top prizes (up to a Tesla).

- Stock Market: U.S. Stocks Zone — trade 50+ U.S. stock–mapped pairs with USDT.

The ecosystem is rich; for brevity we won’t expand each item here. You can visit the SuperEx website (www.superex.com) to participate.

Exchange Security

Security is the lifeline of an exchange. History has seen major incidents — e.g., Mt. Gox (2014) lost 850,000 BTC.

Key risks include:

- Hacks: hot-wallet theft is the most common.

- Insider malfeasance: platforms hold user keys; in extreme cases, they could disappear with funds.

- Regulatory risk: compliance issues can force shutdowns.

Top-tier exchanges typically adopt:

- Cold–hot wallet separation

- Multi-signature schemes

- Third-party security audits

- Insurance funds

These are essential factors when choosing an exchange.

Common Exchange Terminology

Spot Trading

Immediate delivery trades — e.g., buy BTC with USDT and it arrives right away.

Futures / Derivatives Trading

Trade contracts based on the price of the underlying. You can go long or short, often with leverage.

Leverage

Borrowing to amplify position size. With 100 USDT at 10×, you control 1,000 USDT — both gains and losses are magnified. (SuperEx supports up to 150×.)

Market Maker

Entities posting buy/sell quotes to provide liquidity so others can always trade.

Taker vs. Maker

- Maker: posts an order and waits (adds liquidity).

- Taker: hits market/standing orders (removes liquidity).

Different fees usually apply.

Order Book

The list of all current bids/asks, sorted by price.

Market Depth

Quantity at various price levels. Better depth = smaller price impact.

Slippage

The gap between expected price and actual fill — common with large or illiquid trades.

Candlestick Chart

Shows OHLC (open, high, low, close) for each time interval.

Liquidity

How quickly you can trade with minimal price movement.

Matching Engine

The exchange’s core system that pairs buy and sell orders.

Limit Order

Executes only at your set price or better.

Market Order

Executes immediately at current market prices (fill-first, price-second).

Perpetual Futures

Futures without expiry; funding rates keep them near spot.

Funding Rate

Periodic fees paid between longs and shorts to maintain the peg to spot.

Liquidation

Auto-closing a leveraged position when losses deplete margin.

Trading Fee

Fees charged by the exchange, often different for maker/taker.

AML / KYC

Anti–money laundering and Know Your Customer — regulatory requirements for identity checks.

About SuperEx

SuperEx holds three industry “firsts”:

- The world’s first Web3 crypto exchange;

- The world’s largest DAO network;

- The first exchange to fully deploy a BTC ecosystem, offering a one-stop solution for BRC-20 trading.

In service, SuperEx advocates “security-first trading and user-centric experience.” It has launched Super Wallet, Super Start, SuperEx Authenticator, the SCS smart public chain, and more — building a safer, more convenient, and more efficient one-stop trading platform.

At the same time, the SuperEx Elite Program is in full swing — offering top-tier commissions and bonuses. More importantly, access to 10M+ registered users and 600K+ social followers provides the best leverage for your growth.

SuperEx Brand Advantages

Web3.0 Ecosystem Layout

SuperEx is committed to Web3.0 ecosystem building, covering multiple fields with one of the world’s largest Web3.0-based DAOs across 20+ countries/regions.

Massive User Base

10M+ registered users and 600K+ social followers across 166 countries/regions; supports 1,000+ spot and derivatives pairs. Seamless synergy with Super Wallet provides decentralized asset storage — combining CEX trading efficiency with DEX-grade asset security.

Transparent transactions, information on-chain

All users’ trades are executed and broadcast on-chain — publicly verifiable and tamper-proof — for secure, transparent trading.

HD Wallet Authorized Login

As early as Sept 2022, SuperEx launched Connect Wallet. Funds are controlled by on-chain wallets with user-held private keys — zero asset risk.

Super Wallet (Fund isolation)

Deep integration with the SuperEx operation system provides asset segregation, ensuring 100% security while enabling CEX-level trading efficiency with DEX-grade storage safety.

SuperEx Authenticator

Adds a second-layer verification for account protection. Access, withdrawals, and other key steps require Authenticator approval — maximizing security across the transaction flow.

SuperEx Product Advantages

SuperEx DAO

One of the largest Web3.0 DAOs globally, spanning 20+ countries/regions. DAO autonomy is in place, and DAO funds incentivize efficient governance.

SCS Chain

An efficient, sustainable blockchain ecosystem based on SRC-20 — resolving scalability and security limits, supporting up to 5,000 TPS, with gas at ~1% of Ethereum.

Super Wallet

A decentralized, multi-chain Hierarchical Deterministic wallet, providing secure storage for large crypto holdings and an open DApp system.

Super Start

An IEO channel for high-value projects — faster listings for quality teams and more early opportunities for users.

SuperEx P2P Trading Platform

Built with third-party providers to offer a zero-fee, easy, and wide-reaching fiat on/off-ramp experience.

SuperEx Academy

A non-profit, decentralized blockchain academy initiated with 20+ SuperEx DAO communities worldwide — offering a systematic, sequential, and complete Web3 education framework.

1USD

An entertainment + shopping module with zero barriers to entry, as low as 1 USD to participate, diverse choices, and 100% fairness and authenticity guarantees.

U.S. Stocks Zone

SuperEx now supports 90+ U.S. stock–mapped pairs. Users can trade iconic U.S. equities using USDT — no cross-border fund conversion needed.

Copy Trading for Futures

A full-featured contract copy trading system — one-click replication of pro traders’ strategies with smart risk controls for simpler, steadier participation.

Summary

Crypto exchanges are the central nervous system of the crypto world. They don’t just handle trades — they shape the industry’s security, ecosystem, and future. Whether you choose centralized or decentralized venues, you should understand how they work and the risks involved.

In this fiercely competitive track, SuperEx offers a unique path that puts users first while embracing decentralization.

Responses