SuperEx Product Guide Series: Contract Copy Trading — Make Trading Simpler and More Efficient

#SuperEx #Guide #Crypto

Since the launch of SuperEx’s contract copy-trading feature, users have naturally split into two camps:

- Observers: watching others lead or copy trades, hesitating about whether to join.

- Revelers: those who’ve used copy or lead trading, praising the simple, efficient experience — and the considerable returns.

Which camp are you in?

Why did copy trading take off? In the contract (futures) market, there are plenty of unavoidable pain points, including:

- Most newcomers aren’t familiar with technical indicators — charts feel overwhelming.

- Even experienced traders can’t watch the market 24/7 and easily miss moves.

- Volatility is intense, and emotional trading causes heavy losses for many.

In other words, contract trading offers big opportunities — but also high barriers and high risk.

So the need for copy trading emerged naturally. For beginners, it means following experienced traders directly; for veterans, it’s a way to earn by sharing strategies; for platforms, it lowers learning barriers and boosts trading activity.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

What Is Contract Copy Trading? Making Expertise Replicable

As the name suggests, contract copy trading lets users in the futures market skip their own trend judgment: simply choose a trustworthy trader and click Follow. The system automatically mirrors the trader’s buy/sell actions — true “hands-off” trading.

- For newcomers with no trading experience, copy trading is a way to “borrow a brain” to earn.

- For busy investors who can’t watch the screen, it’s an “intelligent delegation” experience.

- For strategy-savvy traders who want to become star leaders, it’s a new stage to show skill, build fans, and earn revenue share.

Core Highlights of SuperEx Contract Copy Trading

- Curated Trader Onboarding; real track records, fully transparent

SuperEx enforces strict admission criteria: only traders with stable profitability and strong risk control can go public. All trading data is open and transparent — historical P&L, win rate, max drawdown, AUM, follower returns, etc. — to help users make informed choices. - One-click copy (proportional copy), zero barrier to smart trading

No need for pro knowledge. Pick a trader, set your copy ratio, and the system will mirror operations automatically — no constant monitoring required. You can stop copying with one click and customize copy parameters for flexible risk control. - Isolated/Cross margin modes — choose your risk style

SuperEx supports multiple position-management modes. Choose Isolated copy to manage risk per trade, or Cross to deploy your full balance for larger operations.

You can also set copy capital caps, take-profit/stop-loss lines to control risk scientifically and guard against black swans. - Revenue sharing so leaders and followers win together

On SuperEx, traders (leaders) earn a portion of followers’ net profits. This “I earn only if you earn” model incentivizes leaders to be prudent and responsible in live trading. - Real-time P&L display — funds at a glance

In the copy-trading center, followers can track every mirrored position’s P&L, copy status, share rate, min position, current position, max drawdown, winning trades, and more. Data is transparent and the process is controllable.

The system also sends email alerts at key points (e.g., liquidation risk, large losses) to enhance safety.

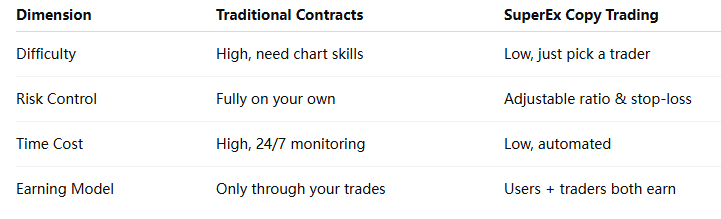

How It Differs from Traditional Contract Trading

Copy trading doesn’t replace trading — it makes it easier, smarter, and more social.

What Copy Trading Means for Different Users

- Newcomers

You can earn without mastering the market first — and won’t be scared off by complex indicators.

- Veterans

Build a following and personal brand (IP), and add a new income stream.

- Institutions

Use copy tools to test strategies, run user education, and even recruit top traders.

Contract Copy Trading FAQ

Q1: What are lead trading and copy trading?

A: In lead trading, an experienced trader creates a lead project; other users can choose to follow their trades. The leader is responsible for opening/closing positions; followers’ trades are executed automatically based on the leader’s actions.

Q2: Can I be a leader and a follower at the same time?

A: Yes. You can create one lead project and simultaneously participate in up to 50 copy projects.

Q3: What earnings can a leader receive?

A: Leaders can receive 10% of followers’ profit share as a reward. The share is transferred to the leader’s spot wallet.

Q4: What is “one-click copy”?

A: SuperEx currently supports proportional copy, where the follower mirrors the leader’s position size by ratio for automated execution.

Q5: Do the copy-trading account and my contract account share funds?

A: No. Each copy project has an independent sub-account, separate from your regular contract account. Funds do not interfere with each other.

Q6: Can I use ET tokens to offset fees?

A: Yes. After transferring ET to the copy project account, the system will automatically use ET to offset fees, under the same rules as USDT-margined contracts.

Q7: Why is my pending share amount frozen?

A: To protect leaders’ rights, eligible pending share amounts may be temporarily frozen and transferred to the leader’s spot wallet after settlement. This freeze does not affect your margin balance.

Q8: How is the pending share amount calculated?

A: Pending share = max( this week’s realized P&L × share rate, 0 ). Only the current week’s P&L counts; historical P&L is not included.

Q9: When will a follower open a position?

A: Two scenarios trigger entries:

- First-time copy: If the leader holds a position and the current price is better, the system opens a copy position.

- Regular entries: The system automatically mirrors the leader’s new entries and copies position parameters proportionally.

Q10: How do followers close positions?

A: The system monitors the leader’s closing behavior and closes proportionally for followers.

Q11: What happens if I close manually?

A: After manual close, the system stops auto-syncing with the leader. For consistency, we recommend allowing the system to manage entries/exits.

Q12: Does copy trading always succeed?

A: No. Failures can result from:

- Insufficient margin

- Leader’s order not filled

- Insufficient market liquidity

- Opening size below the minimum

- Unsynced same-pair, same-direction positions

Q13: What key metrics are shown for lead projects?

A: Realized/Unrealized P&L, ROI, Max Drawdown, Win Rate, Net Inflow, Current Margin, Current Followers, AUM, etc., to comprehensively evaluate performance.

Q14: What is Max Drawdown?

A: The largest peak-to-trough decline on the equity curve — used to measure risk control.

Q15: How is ROI calculated?

A: ROI = (Realized P&L + Unrealized P&L) / Initial Assets. After transfers in/out, calculations will reset and continue accumulating.

Q16: What’s the difference between Total Followers and Current Followers?

A: Current Followers are actively copying now; Total Followers are users who historically followed and executed at least one trade.

Q17: Is profit guaranteed in copy trading?

A: No. Markets are volatile and trading carries risk. Choose leaders with solid track records, size prudently, and practice risk control.

Q18: Why might a follower get liquidated while the leader doesn’t?

A: Possible reasons: the leader added margin or used ET fee offsets while the follower didn’t; or the leader had a profitable position earlier but the follower joined later and didn’t sync the state.

Q19: When is periodic revenue sharing settled?

A: Every Monday 00:00 (UTC) the system settles the prior week’s realized P&L and distributes according to the share rate.

Q20: What is exit settlement (“closing share”)?

A: When a follower actively or passively ends a project, the system calculates the week’s realized P&L and allocates the share accordingly.

Q21: What’s the minimum copy amount?

A: Set by the leader in the project parameters. Each project page shows the minimum copy amount; ensure your input meets or exceeds it.

Summary

Contract trading has high hurdles but huge demand. Copy trading addresses the “afraid / don’t understand / can’t do” problem for newcomers.

SuperEx copy trading is more than duplication — it’s a transparent, flexible, community-driven system. It makes entry easier for users, gives top traders stronger incentives, and helps the platform form a healthy flywheel. In that sense, copy trading isn’t a “small feature” — it’s a major gateway in the SuperEx ecosystem.

Responses