LEARN HASH RIBBON INDEX IN 3 MINUTES ——BLOCKCHAIN 101

SuperEx Academy is the world’s first online academy to offer comprehensive education on crypto-native indicators. It features the most extensive technical indicator tutorials and is the most detailed online learning platform for market technical analysis. Here, you’ll find hundreds of courses on commonly used indicators, along with nearly every known crypto-native indicator tutorial.

Today, let’s dive into one of the most fascinating Bitcoin-native indicators: the Hash Ribbon Index. Even though it sounds complex, by the end of this lesson you’ll know exactly what it means, how it works, and how traders use it to spot big Bitcoin opportunities.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

What Is the Hash Ribbon Index?

The Hash Ribbon is a Bitcoin-specific technical indicator designed to capture the dynamics of Bitcoin mining difficulty and miner behavior. Unlike price-only indicators such as RSI or MACD, the Hash Ribbon uses hash rate data—the computing power securing the Bitcoin network.

The logic is simple:

- When the hash rate is strong, it usually means miners are confident and profitable.

- When the hash rate drops significantly, it often signals miner capitulation, a period when miners shut down machines because mining becomes unprofitable.

Hash Ribbon takes this idea and visualizes it using moving averages of the Bitcoin hash rate. The indicator is often seen as one of the best long-term buy signals for Bitcoin.

How Does It Work?

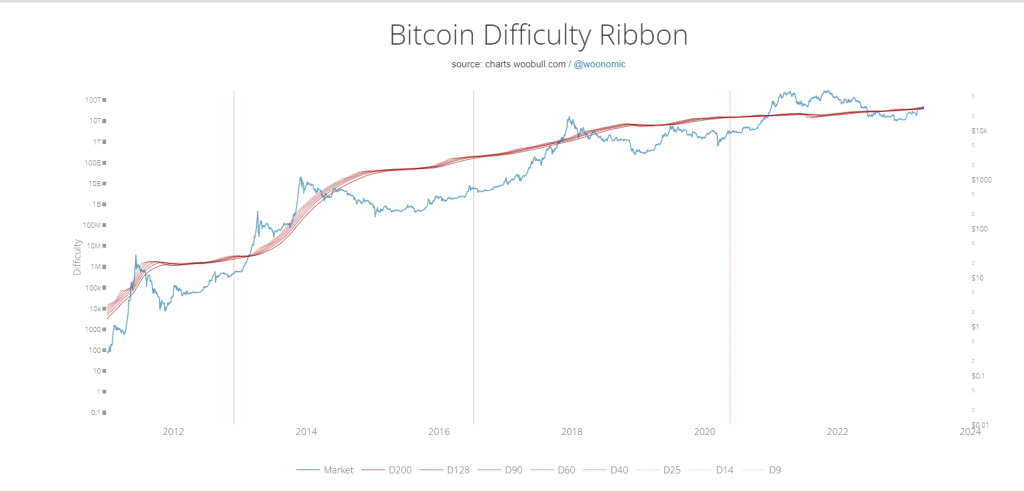

The Hash Ribbon compares two moving averages of the Bitcoin hash rate:

- Short-term hash rate average (30-day)

- Long-term hash rate average (60-day)

When the 30-day MA drops below the 60-day MA, it signals that hash power is leaving the network. This is usually a sign of miner stress or capitulation.

When the 30-day MA recovers and crosses back above the 60-day MA, it suggests miners are back online, competition stabilizes, and Bitcoin may have formed a bottom.

In other words: Hash Ribbon “buy” signal = miners capitulated + network recovery

Why Do Miners Matter So Much?

To understand why the Hash Ribbon is powerful, you need to know how miners influence Bitcoin’s ecosystem.

Miners are forced sellers. They need to sell Bitcoin to pay for electricity and hardware. When Bitcoin price crashes, weaker miners quit, selling their reserves in panic.

Capitulation resets the market. After weak miners leave, the network difficulty adjusts downward, making it more profitable for remaining miners.

This transition often marks the end of bear markets and the start of new uptrends.Hash Ribbon simply translates this miner behavior into a clean, easy-to-read signal.

How to Read the Hash Ribbon

- The indicator generally has three phases

- Capitulation Phase

- Hash rate declines.

- 30-day MA < 60-day MA.

- Often occurs during or after a sharp Bitcoin price drop

- Recovery Phase

- Hash rate stabilizes.

- 30-day MA starts turning upward.

Market sentiment remains fearful, but insiders watch closely.

- Buy Signal

When the 30-day MA crosses back above the 60-day MA, the Hash Ribbon prints its famous “Buy” signal.Historically, this aligns with long-term Bitcoin bottoms.

Historical Examples

Let’s look at how the Hash Ribbon performed in past cycles:

- 2018 Bear Market

After Bitcoin dropped from $20,000 to around $3,000, miners capitulated.The Hash Ribbon flashed a buy signal in January 2019.Bitcoin later rallied above $10,000 that same year.

- 2020 COVID Crash

Bitcoin collapsed from $9,000 to $4,000. Miners turned off machines due to unprofitability.Hash Ribbon signaled a buy in late April 2020.Within months, Bitcoin surged past $12,000 and eventually hit $60,000 in 2021.

- 2022 Crypto Winter

Following the Terra/LUNA collapse and FTX bankruptcy, Bitcoin miners capitulated hard.Hash Ribbon gave a buy signal in early 2023, right before Bitcoin doubled from ~$16,000 to over $30,000.

Why Traders Love the Hash Ribbon

- Long-term accuracy:It doesn’t give signals often, but when it does, they tend to align with macro bottoms.

- Fundamental + technical: Unlike pure chart indicators, the Hash Ribbon is rooted in real-world mining economics.

- Psychology reset: By identifying capitulation, it shows when fear is at its maximum and opportunity may be greatest.

Limitations of the Hash Ribbon

No indicator is perfect, and the Hash Ribbon is no exception:

- Not for short-term trading:It’s a long-term signal, so don’t expect day-trading entries.

- Mining centralization risk:If mining power is controlled by fewer entities, the indicator may become less representative.

- Lagging nature:Since it relies on moving averages, the buy signal often comes after the bottom has already formed.

Still, despite these drawbacks, many professional traders keep the Hash Ribbon on their charts as a macro trend confirmation tool.

How to Use Hash Ribbon in Your Strategy

Here are a few practical approaches:

- Long-Term Holders:Use the buy signal as an opportunity to accumulate Bitcoin for the next cycle.

- Swing Traders:Combine Hash Ribbon with price action (e.g., support/resistance) to time mid-term entries.

- Portfolio Managers:Treat the Hash Ribbon as a risk-on / risk-off switch—when it prints buy, increase BTC exposure.

Conclusion

The Hash Ribbon is not just another flashy crypto indicator—it’s a powerful window into miner psychology and network health. By analyzing hash rate dynamics, it helps traders identify moments of deep market capitulation and long-term buying opportunities.

- When miners capitulate → fear is at its highest.

- When miners return → recovery begins.

- When Hash Ribbon prints “Buy” → history shows it’s often one of the best times to accumulate Bitcoin.

If you want to trade Bitcoin with a fundamental edge, the Hash Ribbon is an essential tool to master.

Responses