Trump Interview: Amid Fed Politics, Tariffs, and Geopolitical Storms - Could Crypto Become the Next Safe Haven?

#Trump #Crypto #FED

Preface

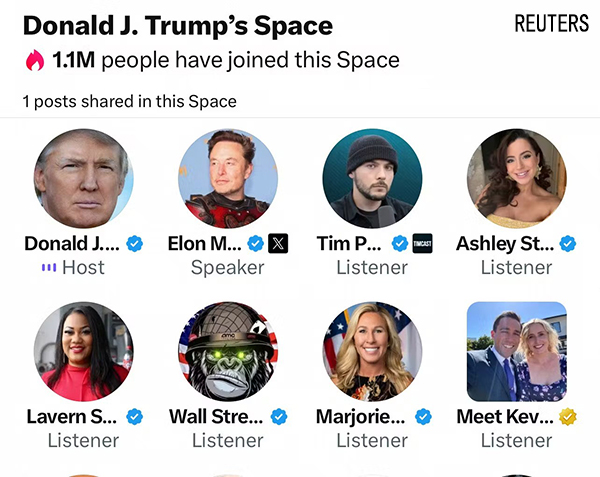

On August 5, 2025, former U.S. President Donald Trump, in an exclusive interview with CNBC’s financial forum, once again pushed a series of sensitive issues — such as the Federal Reserve, trade, banking, immigration — into the spotlight. Meanwhile, the crypto market is quietly brewing a new wave of volatility. This article dives deep into the potential impact behind Trump’s remarks and explores what they could mean for crypto assets like Bitcoin and Ethereum under the current global order and economic policies.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Quick Overview in 30 Seconds:

Here are seven key takeaways from the SuperEx summary of Trump’s speech:

- 🔥 Blasted the Fed: Accused Powell of cutting rates too late; considering a new Chair.

- 🧬 Tariff escalation: Plans to impose up to 250% tariffs on pharmaceuticals; India tariffs may rise too.

- 🌾 Immigration policy shift: Will introduce agriculture-related policies to restrict low-wage migrant labor replacing American farmers.

- 💣 Criticized big banks: Accused JPMorgan and others of discriminating against conservative users.

- ⛽ Pressure on Russia: Energy price suppression seen as a key strategy against Putin.

- 📉 Claimed job data is fake: Alleged labor statistics are manipulated.

- 🎯 Succession hints: VP Vance may be the next MAGA leader.

Let’s Unpack the Interview and Its Deeper Connection to the Crypto Market:

1. Fed Chair Shakeup and the Crypto Safe-Haven Narrative

In the interview, Trump once again criticized Powell for being too slow in cutting interest rates, and revealed he is considering four potential replacements for Fed Chair.

The Fed’s monetary policy has always been a key barometer for the crypto market. In times of high inflation, the market’s biggest concern is the continuation of tightening rate policies. Although the Fed has recently shown signs of easing, Trump’s explicit criticism of Powell as being “too slow” clearly signals he favors a more aggressive easing stance.

If the Fed is taken over by someone more dovish, what would that mean for crypto?

✅ A wave of new liquidity enters the market — crypto assets benefit first

✅ Institutions may become bolder in allocating to high-risk assets like BTC and ETH

✅ Expectations of USD depreciation rise, enhancing crypto’s role as “digital gold”

In short, if the Fed pivots, crypto could be one of the first asset classes to rally.

2. Trade War Reignited, De-Dollarization Accelerates, Digital Asset Value Emerges

Trump announced a planned tariff hike up to 250% on pharmaceuticals and declared that India’s tariffs may be significantly raised “within 24 hours.”

Tariffs are a double-edged sword. Trump’s stance suggests a continuation — or even escalation — of adversarial trade policy. For the global financial structure, this acts as a stress test.

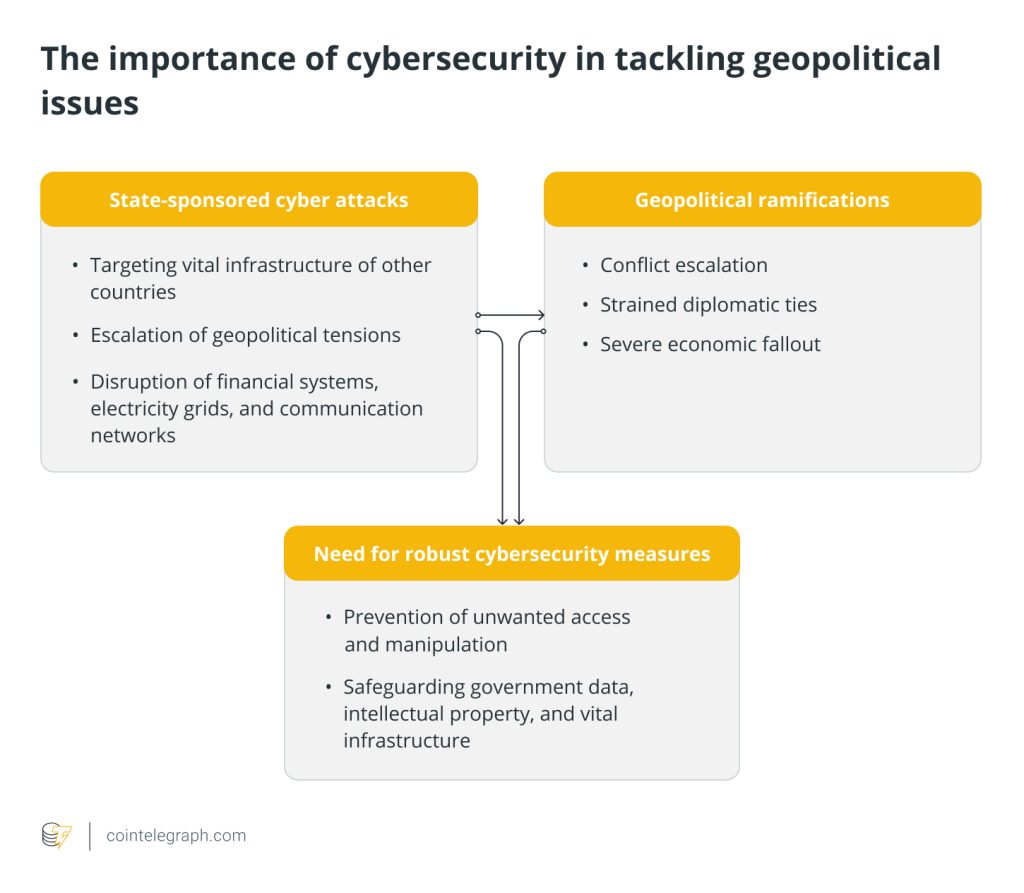

You may not have noticed: Over the past two years, in response to the Russia-Ukraine war and U.S.-China trade tensions, many economies (especially BRICS nations) have begun de-dollarization strategies — India, Russia, Brazil are all exploring cross-border settlement via local currencies or crypto assets.

What does this imply?

- Intensified trade tensions → Accelerated de-dollarization

- States and corporations may seek alternative cross-border payment tools

- Stablecoins and public chains (USDT, USDC, USDL, StarkNet, etc.) come into focus

In other words, crypto assets may explode in usage for both settlement and reserve purposes. Remember yesterday’s article? The race among cross-border giants like VISA in building crypto payment infrastructure is already in full swing — that’s the best proof of what’s coming.

3. Banks Target Conservatives? Crypto Wallets as Alternative Financial Infrastructure

Trump accused JPMorgan and Bank of America of refusing to accept his deposits, implying political discrimination against him and his supporters.

That statement reveals a hidden demand for decentralization within the U.S. financial system.

Imagine this: If traditional banks can shut down your account based on political views, would crypto wallets (like MetaMask, Phantom, SafePal) become the go-to solution for “true financial freedom”?

From this angle, crypto wallets are not just asset managers, but also symbols of financial autonomy:

- No bank account needed for global transfers

- No institutional trust required to control your assets

In effect, Trump is indirectly endorsing the spirit of DeFi: a permissionless, trustless, open financial system.

4. Russia-Ukraine Still Ongoing — Could Energy Prices Link to BTC?

Trump stated that if oil prices drop another $10 per barrel, Putin won’t be able to sustain the war.

Fluctuations in energy markets are not irrelevant to crypto. Historically, every major geopolitical crisis or oil price shock has been closely mirrored by strong BTC price reactions.

Why?

- Falling energy prices → Lower inflation pressure → Easier Fed policy → Bullish BTC

- Rising geopolitical risk → Capital seeks safe havens → BTC favored again

Just like gold spikes during war, Bitcoin, as digital gold, is competing for the same safe-haven status.

5. Claims of Fake Job Data Spark Trust Crisis — Could On-Chain Data Become Mainstream?

Trump accused the Labor Statistics Bureau of manipulating data, and called for more trustworthy data systems.

This is subtle, but important. Have you noticed that in recent years, U.S. unemployment and inflation numbers are frequently challenged — while on-chain analytics tools (Glassnode, IntoTheBlock, Arkham, etc.) are increasingly embraced by Wall Street?

✅ On-chain data is verifiable, real-time, transparent, immune to human tampering

✅ On-chain job flows, capital movement, wallet activity reflect true economic behavior

If trust in traditional data collapses, we may see governments and institutions shift toward on-chain analytics, further accelerating blockchain infrastructure adoption.

6. MAGA Successor Signals Future Policy — Could It Be Pro-Crypto?

Trump hinted that VP J.D. Vance is “most likely” to inherit the MAGA movement, and stated he will not seek a third term. This can be read as a policy preview for the next Republican administration.

Vance has long supported financial decentralization and tech innovation, and has previously expressed favorable views on DeFi and Web3. If he inherits the MAGA mantle, we may see:

- Pro-crypto regulatory environment

- Blockchain technology entering national strategic frameworks

Final Thoughts: This Isn’t Just About Trump — It’s About the Times We Live In

Trump’s remarks may seem emotional, but beneath them lies a deep rupture in the global capital logic and financial trust systems.

Love him or hate him — he is pushing America, and the world, into a new era of higher uncertainty.

In this era, crypto assets are no longer mere speculation — they are the safe harbors within systemic cracks, and the belief assets of the next generation of internet and financial revolutions.

Be careful with this company. It’s a scam. They are blocking users’ funds without providing a clear reason and are keeping the money.