In-depth Interpretation of the July 2025 FOMC Meeting and Its Impact on the Crypto Ecosystem

#FOMC #CryptoEcosystem #FED

The July 2025 Federal Reserve FOMC meeting has just concluded. This time, there was no rate cut, and internal disagreements were exposed. Overall, the tone was hawkish, sending a signal of cautious observation while waiting for more data. For the crypto market, this is undoubtedly an important indicator. Next, I’ll walk you through a detailed analysis of the meeting content and, combined with the current state of the crypto ecosystem, help you understand what this meeting could mean for the future trajectory of digital assets.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Key Takeaways from the Meeting

- The Fed decided to keep the federal funds rate in the 4.25%–4.5% range, maintaining a “moderately restrictive” monetary policy stance. Inflation is still slightly above 2%, the labor market remains solid, but economic growth has clearly slowed down.

- The committee sees high uncertainty in the economic outlook, with a particular focus on balancing risks between inflation and employment.

- Two governors voted against the decision, advocating for a 0.25% rate cut, signaling ongoing divergence within the FOMC on the policy path.

- Chairman Powell emphasized the need to observe employment and inflation data in the coming months, stating that more definitive policy adjustments will be made during the September meeting.

What Does the Fed’s Cautious Strategy Mean for the Crypto Market?

1. Rates remain high, and digital asset markets may stay under pressure

A high interest rate environment usually means higher capital costs and increased attractiveness of traditional financial markets. Risk assets, including crypto, tend to face capital outflow pressure. While expectations for a rate cut still exist, this meeting emphasized the need to maintain “moderately restrictive” rates, further postponing any hopes of short-term easing.

This is a double-edged sword for crypto. On one hand, high rates strain institutional liquidity, putting downward pressure on crypto prices. On the other, a stable policy stance reduces fears of extreme volatility, preventing overreaction in crypto markets.

2. Internal disagreements suggest that the rate cut path is not a straight line

Two governors voted to cut rates, reflecting growing concerns within the Fed about the slowing economy. For crypto investors, this means the market could remain highly volatile in the months ahead. It’s crucial to monitor employment and inflation data closely, as these will directly influence the Fed’s decisions.

Crypto asset prices often amplify the impact of macroeconomic indicators, so this uncertainty makes flexible trading strategies more necessary.

3. Inflation pressure eases slightly, but tariffs and commodity prices remain variables

The Fed remains cautious in its inflation outlook, noting that tariffs are pushing up commodity prices, with a delayed effect. Without clear signs of inflation easing, the Fed is likely to stick to tight monetary policy.

In the crypto space, stablecoins and DeFi protocols are often influenced by macro inflation trends. Persistent inflation means investors will continue to seek crypto as an anti-inflation hedge, which could provide long-term value support.

4. Labor market remains solid, but downside risks are present

Though employment data is still strong and unemployment remains low, the Fed notes that both supply and demand in the labor market are slowing, hinting at downside risk.

This “soft landing” risk calls for flexible monetary policy to avoid premature easing. In the crypto market, enterprise financing and user spending are affected by the labor market. Stable employment supports overall economic health, which is positive for crypto project hiring and investment. But if employment weakens, funding could tighten across the crypto industry.

5. Economic growth slowdown, especially in rate-sensitive sectors

The Fed acknowledged significant GDP slowdown, particularly in rate-sensitive sectors like residential investment and commercial construction. Some crypto projects also rely heavily on venture capital. In times of slower growth, capital inflows slow down, potentially affecting project progress.

However, the innovation- and tech-driven nature of the crypto space gives it some counter-cyclical strength — especially with ongoing breakthroughs in Web3, the metaverse, and Layer 2 scalability. Long-term investment value remains promising.

Other Highlights from the Fed’s Statement

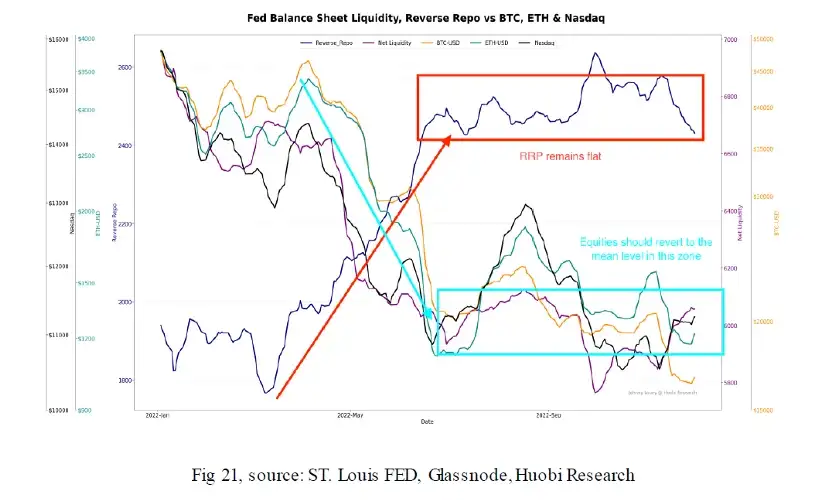

- The Fed will continue to reduce its balance sheet, including Treasury and MBS holdings, indicating a still-tight monetary stance.

- Future policy moves will depend on evolving economic data — there’s no preset path.

- The Fed emphasized its independence and refused political interference.

- Although dollar depreciation was mentioned, it was not a major discussion topic.

- No commentary was given on fiscal policy or government spending — the focus remains on monetary objectives.

Conclusion: How Should Investors Navigate the Current Macro Landscape?

This meeting sent a clear message: the Fed remains committed to combating inflation and is alert to economic slowdown. A rate cut is unlikely in the near term. For the crypto market, this means continued volatility and a somewhat challenging liquidity environment.

But precisely because of that, choosing high-quality projects with strong tech foundations and ecosystem support, holding patiently, and focusing on long-term trends is a more reasonable strategy. At the same time, paying close attention to macroeconomic data and adjusting positions and risk exposure flexibly is critical.

In the coming months, employment and inflation data will serve as crypto market barometers. And the Fed’s “wait and see” posture is a reminder to investors: the market is still waiting for a clearer signal.

Responses