Interpreting the SEC’s Tokenization Statement: Are On-Chain Securities Still Bound by the Iron Rules of Regulation?

In July 2025, the U.S. Securities and Exchange Commission (SEC) issued a rare official statement specifically addressing “Tokenized Securities.” Though the statement may appear understated, it clearly signals the regulatory mindset: regardless of whether your security is on-chain or off-chain, it’s still a security.

This isn’t just a message to the crypto industry, nor is it a gesture of old-school regulatory arrogance. It’s a direct and practical reminder to all market participants: the SEC doesn’t oppose technology, but simply changing the wrapper doesn’t exempt you from following the rules.

So what exactly are the key takeaways from this statement? And how might it impact the crypto industry—especially the emerging sector of “tokenized assets”? Let’s break it down.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Let’s Start With the Original Text: What Is the SEC Actually Saying?

The SEC’s statement is relatively brief, but densely packed with critical points. Here’s a quick walkthrough of the core messages:

-

Blockchain’s Role Is Acknowledged

The SEC opens by acknowledging that blockchain technology indeed enables new ways to issue and trade securities through tokenization:“Tokenization has the potential to facilitate capital formation and enhance investors’ ability to use their assets as collateral.”In other words, the SEC isn’t denying the financial utility of on-chain systems. It even views tokenization as a new type of financial infrastructure that could enhance the efficiency of the securities market.

-

But the Nature Remains Unchanged: Tokenized Securities Are Still Securities

This is the heart of the entire statement:“A tokenized security is still a security.”

No matter how advanced your tech stack, if your token represents equity, debt, rights, or income distribution—and it meets the legal definition of a security—then you must comply with federal securities laws.This single sentence doused cold water on parts of the market and shattered the illusion that “tech neutrality” could mean regulatory exemption.

-

Watch Out for Third-Party Tokenization

The SEC specifically called out one situation:“When non-affiliated third parties hold securities and issue tokens referencing them—or tokenize the holder’s rights in those securities—this may pose unique risks, such as counterparty risk.”We’ve seen many such cases in crypto, where DeFi platforms issue on-chain tokens that represent, say, a U.S. stock portfolio held by a fund, or 1:1 stock-pegged tokens. These aren’t just technical implementations—they raise serious legal and regulatory questions.

-

Disclosure Obligations Still Apply

Even if the project is based on blockchain, the SEC stressed:“Issuers of tokenized securities must consider their disclosure obligations under federal securities laws.”If your token represents company shares, you need to disclose shareholder structures, financial status, compliance processes, etc. Tech form doesn’t justify skipping basic disclosure requirements.

What Is the SEC Really Trying to Say?

Many people saw this statement and immediately thought, “Here comes the SEC to kill innovation again.”But if we move beyond an us-versus-them mindset, we can spot some encouraging signals.

-

The SEC Isn’t Rejecting Tokenization—It’s Emphasizing Compliance

This is a key point. Over the past few years, the SEC has mostly regulated crypto through “enforcement-first” actions, often criticized as “regulation by enforcement.”

But this time, it proactively issued a policy statement, clarified its regulatory rationale, and pointed to paths toward compliance.

This signals a subtle but important shift in tone: not “you can’t do this,” but “you must do it properly.”

If we truly see the crypto industry as the “next generation of financial infrastructure,” then being “brought under regulation” isn’t a setback—it’s actually a first step toward mainstream adoption.

-

No New Legislation Yet, But “Room for Dialogue” Is Offered

Toward the end of the statement, the SEC says:“When the unique characteristics of a technology necessitate adapting existing rules, we stand ready to work with market participants to consider appropriate exemptions and modernize the rules.”

This sentence is worth paying close attention to: the SEC is hinting that if tokenized products truly can’t be accommodated under current rules, it’s open to custom regulatory frameworks or exemption mechanisms.Such openness has been rare in the past few years and may unlock institutional pathways for tokenization.

What Does This Mean for the Crypto Industry?

Let’s now look at how this statement may influence current on-chain practices and players.

-

“Tokenized Stocks” Projects Must Reassess Compliance Boundaries

Recent projects like Robinhood’s Tokenized Stocks on Arbitrum or Kraken’s xStocks system on Solana are examples.If they’re targeting U.S. users, they must reflect on several questions

- Are these tokens considered “securities”?

- Are they involved in unregistered securities offerings?

- Have they disclosed all legally required information?

In particular, Kraken—as a non-traditional brokerage platform—may be precisely the type of “third-party tokenization risk” the SEC is warning about.

-

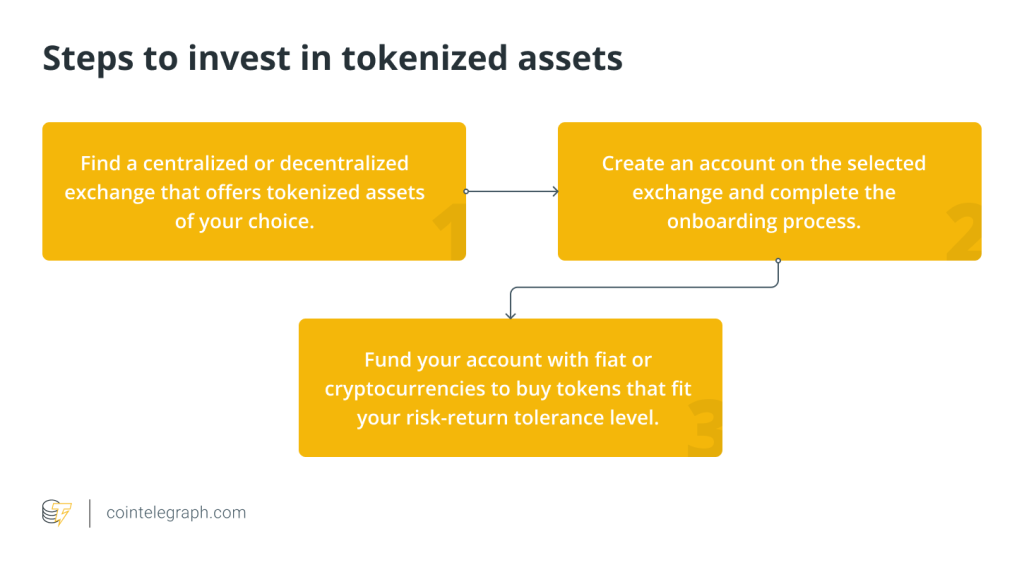

For the RWA Sector, It’s Both a Warning and an Opportunity

Real-World Assets (RWA) have been a crypto hot topic in 2024–2025. If a project aims to tokenize bonds, treasuries, fund interests, or commercial papers—and enable DeFi trading—securities law becomes unavoidable.

This statement is a kind of regulatory marker, letting developers know:

- When to seek exemptions

- When disclosure is necessary

- When registration might be required

On the flip side, if a project manages to achieve full compliance, it might just lead the pack in the RWA race.

-

For Exchanges and Protocols, Compliance Is No Longer Optional

Whether you’re a DEX (Decentralized Exchange) or CEX (Centralized Exchange), supporting tokenized securities means asking:

- Are you licensed for securities trading?

- Do you qualify as a broker-dealer or ATS (Alternative Trading System)?

- Are you improperly accessible to U.S. users?

This isn’t fearmongering—it’s reality.During the FTX era, “stock derivative tokens” became subject to class-action lawsuits simply because they weren’t registered for legal use in the U.S.

But Don’t Be Too Pessimistic—This Could Be Just the Beginning of a Regulatory Dialogue

Some say this statement spells doom for tokenization. But in truth, technological progress and regulatory adaptation have always clashed before reaching harmony.

The SEC’s decision to release a policy-based statement—rather than act through enforcement—and its willingness to offer opinions and mention “exemption discussions,” may signal a turning point for the crypto industry to finally break through its silo.This shows that:

- Regulators recognize the importance of this technology

- They are trying to build channels for dialogue with developers

- They are no longer defaulting to “ban what we don’t understand”

This is a critical shift in tone.

In Summary: On-Chain Securities Are Viable—But You’ll Need a “Compliance Mindset”

The SEC’s tokenization statement may sound tame, even a bit repetitive—but it delivers a crystal-clear message: blockchain is a neutral tool, not a free pass.

If you’re building “on-chain securities,” then you must embody the fundamentals of a securities professional. Otherwise, no matter how fancy your protocol, how hyped your token, or how big your TVL is—it could all disappear under regulatory scrutiny.

In the years to come, tokenization will certainly be a trend.But speed doesn’t beat stability. Teams that truly understand regulatory language will be the ones to survive and thrive in the next phase.

Responses