South Korea Breaks 8-Year Ban - Institutional Investors Can Finally Touch Crypto! What Signals Lie Beneath This Move?

#Korea #Crypto #Blockchain

South Korea’s regulatory shakeup just sent shockwaves across the entire Asian crypto scene.

On May 21, the Financial Services Commission (FSC) of South Korea officially announced that it plans to launch a comprehensive set of crypto investment guidelines for institutions by Q3 2025. This means — South Korea is officially lifting its 8-year ban on institutional crypto investment!

Let’s look at the full report:

The FSC stated that starting June 2025, non-profit organizations will be allowed to sell crypto received via donations, and exchanges can liquidate crypto received as user fees.To prevent money laundering, the FSC requires exchanges and banks to strengthen KYC checks on institutional clients’ fund sources and transaction purposes.The Korea Federation of Banks and DAXA will release related guidance within this month.In the second half of the year, the FSC also plans to allow listed companies and professional investors to trade crypto on exchanges, while tightening AML regulations.

This isn’t just a small news drop — it’s a turning point that could reshape the entire East Asian crypto landscape.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

What Kind of Crypto Market Is South Korea?

Don’t be fooled by South Korea’s seemingly low-key presence — it has always been a key player in the global crypto ecosystem.

1. Insanely High User Activity

South Korea has a population of just over 50 million, yet it boasts one of the most active crypto user bases globally. During the 2021 bull run, nearly half of people aged 20–39 in South Korea had traded crypto.

According to global rankings, Korea’s crypto adoption rate is among the top, second only to highly open markets like the UAE and Singapore.

2. Local Exchanges Are No Joke

Exchanges like Upbit, Bithumb, Coinone, and Korbit consistently rank in the global top 10 by volume.Upbit, with its direct fiat ramp via KRW, dominates the Korean market — and can even compete head-to-head with global giants like Binance.

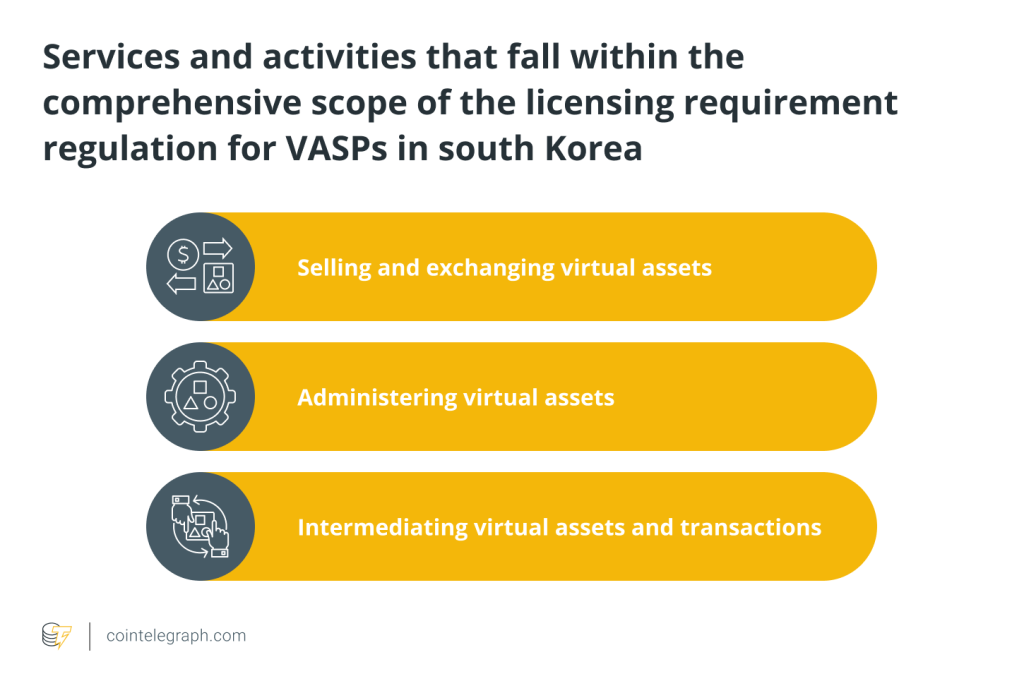

3. Tight but Not Total Ban

Although institutional crypto investment was banned for the past 8 years, Korea never completely shut the door. Instead, it developed a strict but structured regulatory framework:

- Real-name verification since 2021

- Fiat on/off-ramp restrictions

- Mandatory bank partnerships for exchanges

Looks tough, but the reality is — crypto never left the mainstream in Korea.

Why Is Korea Loosening Up Now?

The FSC’s sudden shift actually makes a lot of sense. Here are the key reasons:

1. Legal Infrastructure Is Ready

Starting July, the Virtual Asset User Protection Act will come into force. It provides legal backing for asset custody and trading security.With this safety net, institutional entry isn’t such a risky leap anymore.

2. Global Competition Is Heating Up

Japan already approved multiple institutional crypto funds. Singapore has become Asia’s crypto capital. Hong Kong reopened its gates in 2023.If Korea doesn’t loosen up now, it’ll fall behind.

3. Non-Profits Need Real Solutions

Many universities and charities in Korea already hold crypto — but they can’t sell or invest it. That’s a huge liquidity problem.Even exchanges can’t freely handle crypto collected via fees. This has been a massive roadblock for local institutions.

4. Enterprises Have Been Going Offshore

Plenty of Korean public companies have been quietly investing in crypto through overseas subsidiaries — in blockchain games, NFTs, Layer 1 projects, and more.Regulators have realized: banning crypto only drives local capital abroad.

What Will Lifting the Ban Actually Do?

1. Institutions Can Finally Enter the Market Legally

Before, they had to go offshore. Now? Local banks can work with exchanges, using KYC and AML checks to facilitate compliant, domestic entry.This is a huge green light for institutions — and a new wave of capital for the market.

2. Non-Profit Crypto Assets Will Start Moving

Charities and universities can finally liquidate donated crypto — turning it from “paper wealth” into real, usable funds.This might even encourage more donations in crypto, pushing forward the legit use of digital assets.

3. Local Exchanges Face a New Wave of Competition

Institutional clients won’t go to just any exchange. This will force local platforms to level up their risk controls and compliance.Upbit’s dominance could be challenged, and the industry hierarchy might get reshuffled.

4. Asia’s Crypto Strategy Just Leveled Up

Korea’s regulatory shift isn’t an isolated case — it’s part of a bigger Asian crypto regulation mosaic:

- Singapore: friendly

- Hong Kong: cautious but open

- Japan: conservative but progressing

- Korea: now joining the “gradual unblocking” camp

Asia is entering a new phase: state-backed capital + maturing regulation frameworks.

That’s a massive bullish signal for global markets.Just imagine: once Korea’s doors are open, will local pension funds or insurance giants start allocating to BTC/ETH spot ETFs?That’s hundreds of billions in potential capital.

What to Watch Next?

- 🕒 When the investment guidelines go live:

The FSC says Q3 2025 — but some rules for non-profits may go live in late 2024. Stay tuned. - 🔍 How strict the KYC and AML rules are:

Can institutions easily open accounts? Is capital flow frictionless? This will determine whether they really join in. - 🌏 Will other countries follow Korea’s model?

If this works, expect other East Asian regulators to accelerate their crypto unlocks too.

Conclusion

This time, Korea isn’t playing the “crypto regulation hardliner” anymore.

They’re actively embracing change — and giving institutional investors a window of opportunity.It really looks like they plan to make crypto part of the financial system.

And we?We’re witnessing the opening of a new era for Asian crypto finance — one careful move at a time.

Responses