How Sonic Achieved 130% TVL Surge in One Month: The Secrets Behind Its Explosive Growth

# TVL #Sonic #Memecoin

In adversity, miracles are most likely to emerge. The current crypto market is in a narrative vacuum: meme coins have cooled off, Solana’s on-chain activity has sharply declined, and most altcoins have plummeted by over 80% in just three months. Yet, two blockchains have staged remarkable comebacks one after another.

Since mid-March, the daily trading volume of DEXs on BSC has consistently surpassed that of other major blockchains like Solana, Ethereum, and Base, maintaining its momentum for over half a month. Meanwhile, Sonic has emerged as a dark horse, with its TVL surging by more than 130% in a single month, ranking first among all public blockchains.

What exactly is the Sonic blockchain? And what key projects within its ecosystem deserve attention? This article will take you through an in-depth look at the Sonic blockchain.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

What is the Sonic blockchain?

Sonic’s predecessor is Fantom, a Layer 1 public chain launched in 2019, focused on DeFi and dApp applications. Fantom once enjoyed immense popularity between 2021 and 2022, with its TVL peaking at around $8 billion. However, after Andre Cronje (AC) announced his temporary exit from the DeFi industry in 2022, market confidence in Fantom gradually waned. Then, in July 2023, Multichain, a cross-chain bridge partnered with Fantom, suffered an exploit, causing stablecoins issued through its bridging contracts (such as USDC-MULTI and fUSDT-MULTI) to depeg significantly. This severely impacted the ecosystem’s stability and trust.

Against this backdrop, Fantom decided to undergo a systemic upgrade, leveraging an entirely new technical architecture and ecosystem restructuring, ultimately evolving into what is now the highly anticipated Sonic blockchain.

Sonic integrates a series of new features, including 10,000+ TPS transaction processing capacity, EVM compatibility, and a fee monetization mechanism to support DeFi protocols, NFT platforms, and developer incentive programs. The project not only inherits some of Fantom’s characteristics but also introduces new mechanisms to optimize the ecosystem’s sustainability.

Core Features of Sonic Chain

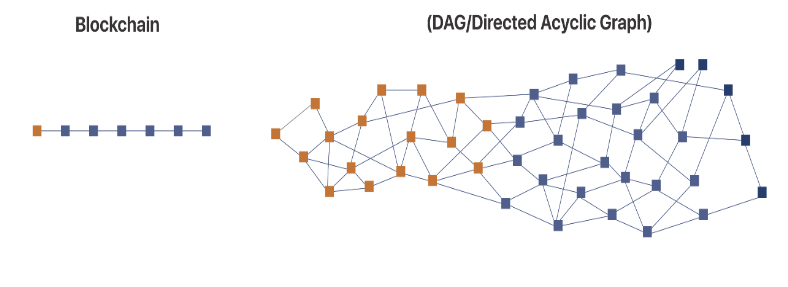

Building upon Fantom’s foundation, Sonic Chain has undergone a comprehensive upgrade, with a focus on enhancing scalability, developer incentives, and system security. As a high-performance Layer-1 blockchain, Sonic aims to deliver faster transaction finality, an optimized consensus algorithm, and a sustainable economic model to support long-term growth for both developers and users.

Blazing-Fast Transaction Performance: 10,000+ TPS with Sub-Second Finality

Sonic employs an advanced architectural design capable of supporting over 10,000 transactions per second (TPS) while ensuring sub-second finality. In comparison, Fantom typically processes transactions in 1–2 seconds and may experience network congestion during peak periods.

By refining its consensus mechanism and transaction validation process, Sonic provides a more efficient and scalable blockchain environment, particularly suited for high-frequency interaction scenarios like DeFi and GameFi.

Full EVM Compatibility: Seamless Migration for Ethereum and Fantom dApps

Sonic offers complete Ethereum Virtual Machine (EVM) compatibility, allowing developers to seamlessly migrate dApps from Ethereum, Arbitrum, Optimism, and Fantom without code modifications. Applications can be deployed directly on Sonic, benefiting from faster transaction speeds and lower gas fees. This compatibility lowers the barrier to entry for developers while expanding user adoption and market reach.

Innovative Fee Distribution Model: Up to 90% of Transaction Fees Rewarded to Developers

Sonic introduces a unique Fee Monetization Model, enabling ecosystem contributors to receive up to 90% of transaction fees as rewards — disrupting traditional blockchain incentive structures. This mechanism enhances developer revenue streams, encourages the creation of high-quality applications, and fosters sustainable ecosystem growth.

Key objectives of this model include:

- Providing an alternative to conventional incentive models, reducing reliance on inflationary token rewards.

- Incentivizing developers based on actual network usage to promote long-term ecosystem development.

- Supporting dApp sustainability by offering developers a stable income source.

- Aligning developer earnings directly with network activity rather than token inflation, Sonic establishes a healthier blockchain growth paradigm where long-term incentives scale with network value.By linking rewards to real usage instead of token emissions, Sonic ensures that developer success and network adoption grow in tandem, creating a more balanced and enduring economic framework.

Popular Projects on Sonic

- SHEEP

SHEEP is a strategic gaming ecosystem on Sonic that combines blockchain asset management, NFT mechanics, and DeFi protocols. Players can buy, mint, protect, and attack assets to build their advantage and earn rewards. - Petroleum City

Petroleum City is an oil-themed blockchain game where players construct, upgrade, and manage pumps to extract crude oil (cOIL) and convert it into tradable $OIL tokens for profit. - Sonic Gateway

Developed by Sonic Labs, Sonic Gateway is a decentralized cross-chain bridge connecting Sonic Chain with Ethereum, enabling seamless interoperability between the two ecosystems. Launched alongside Sonic’s mainnet in late 2024, this critical infrastructure leverages Ethereum’s vast liquidity while harnessing Sonic’s high-speed capabilities — 10,000 TPS and sub-second finality. - Origin Protocol

Origin Protocol, a liquid staking platform, went live on Sonic Chain on January 22, 2025, introducing a powerful tool to Sonic’s rapidly growing ecosystem. As a native protocol, Origin allows users to stake Sonic’s native token while maintaining asset liquidity for use across DeFi applications.

Conclusion

Amid a market lacking strong narratives and subdued investor sentiment, Sonic has emerged as a standout performer, leveraging Fantom’s technical legacy and a systematically upgraded ecosystem. Whether evaluated by its architecture, user experience, project diversity, or community engagement, Sonic has demonstrated strong market competitiveness. The revamped chain has not only addressed trust issues from Fantom’s past but also attracted capital and users through continuous optimization and strategic partnerships.

With a 130% surge in TVL within just one month, Sonic has solidified its position as a focal point in the blockchain space.

Responses