BlackRock launches Bitcoin ETP in Europe,US capital begins to expand in the crypto ecosystem

#BlackRock ETP #crypto

As the world’s largest asset management company, BlackRock has launched a Bitcoin Exchange-Traded Product (ETP) on multiple European stock exchanges.

According to BlackRock’s product page, the iShares Bitcoin ETP began trading on March 25 on Xetra, Euronext Amsterdam, and Euronext Paris. This launch follows the success of its iShares Bitcoin Trust Exchange-Traded Fund (ETF) in the US market, which currently manages $50.7 billion in assets, accounting for approximately 2.73% of the total Bitcoin supply and holding a dominant position in the US market.

Stephen Wundke, Director of Strategy and Revenue at crypto investment firm Algoz, told Cointelegraph: “The launch of the iShares Bitcoin ETP in Europe may not generate the same reaction as in the US.”

This article will further explore the significance of BlackRock’s Bitcoin ETP launch in Europe, as well as the underlying logic, market impact, and future development trends of the expansion of US capital in the crypto ecosystem.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

The Global Institutional Investors’ Foray into the Crypto Market

In recent years, the cryptocurrency market has experienced unprecedented rapid growth. Evolving from an initial fringe experimental asset to an integral part of global asset allocation, digital assets have gradually shed their speculative label and moved toward institutionalization and standardization. Major institutions worldwide are actively positioning themselves in the crypto market, driven primarily by the following factors:

- Demand for Asset Diversification: As volatility in traditional financial markets intensifies and the low-interest-rate environment persists, more institutions are seeking diversified investment targets. Bitcoin, as the world’s most renowned digital asset, has become an essential tool for asset allocation due to its scarcity and anti-inflation properties.

- Increased Market Maturity: With continuous improvements in digital asset infrastructure, a clearer regulatory environment, and the rapid development of trading platforms, custody services, and derivatives markets, institutional investors’ confidence in crypto assets has steadily increased. This has encouraged more traditional financial institutions and asset management companies to venture into this domain.

- Changes in Regulatory Policies: Some countries and regions have started introducing regulations that favor digital asset development. For instance, certain European countries are actively piloting digital asset-related products while promoting innovative financial regulation, creating a favorable opportunity for global institutions to enter the European market.

BlackRock’s launch of a Bitcoin ETP in the European market not only affirms the potential of the European market but also reflects the global asset management institutions’ confidence in the future prospects of digital assets.

Strategic Depth: BlackRock’s Crypto Empire Blueprint

BlackRock’s recent launch of the iShares Bitcoin ETP in Europe marks a critical move in its global cryptocurrency strategy. The product, registered in Switzerland, covers the German Xetra, Euronext Paris, and Euronext Amsterdam exchanges, with management fees gradually reduced from 0.25% to 0.15%. It directly mirrors the success of its Bitcoin spot ETF in the United States, which has amassed $50.7 billion in assets and accounts for 2.73% of the total circulating supply of Bitcoin. The underlying logic of this transatlantic expansion is essentially the “two-way penetration” of US capital into the crypto ecosystem.

Expanding the Product Line to Meet Diverse Demands

As the world’s largest asset management company, BlackRock’s product line is remarkably extensive. Launching a Bitcoin ETP is not just an extension of its successful US market experience but also a strategic move to cater to European investors’ unique demands. Compared to their American counterparts, European investors exhibit different risk preferences and investment habits. By introducing a specifically designed ETP product, BlackRock aims to better meet European investors’ needs for liquidity, transparency, and regulatory compliance.

Enhancing Market Competitiveness

With an increasing number of asset management companies and financial institutions venturing into the crypto space, the competition among similar products is becoming increasingly fierce. BlackRock’s introduction of the iShares Bitcoin ETP in Europe not only consolidates its leadership in the global digital asset domain but also offers a new breakthrough for differentiated competition. Leveraging advanced product design and robust risk control mechanisms, BlackRock is poised to stand out amid intense market competition.

Demonstration Effect and Market Stimulation

As a giant in the global asset management field, every product launch by BlackRock carries a powerful demonstration effect. The listing of the iShares Bitcoin ETP is likely to boost European interest in digital asset products, possibly encouraging more institutions to follow suit with similar offerings. This would further enhance the overall crypto ecosystem, driving profound changes in trading volume, liquidity, and market participant structure. As a result, the digital asset market could evolve towards a healthier and more mature development trajectory.

The Brand Premium and Low-Fee Combination: A Competitive Advantage

Bloomberg analyst Eric Balchunas noted that BlackRock’s combination of “brand premium and low fees” has a disruptive advantage in Europe’s traditional ETF market, despite European investors generally having a lower preference for high-risk assets compared to the US. Specifically, the following aspects stand out:

- Standardized Product Output: Transforming the ETF structure, proven successful in the US market, into a compliant ETP for Europe while leveraging the same underlying asset (Bitcoin) to maximize capital leverage.

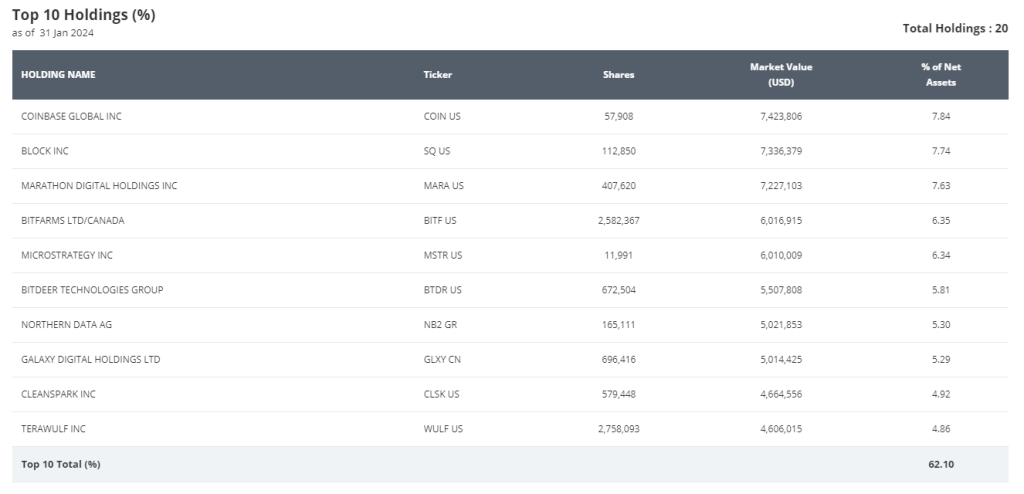

- Liquidity Network Construction: Building a transcontinental Bitcoin liquidity pool through a dual insurance model involving Coinbase custody and BNY Mellon settlement.

- Regulatory Arbitrage Design: Selecting Switzerland as the registration location to both avoid the stringent constraints of the EU’s MiCA regulations and take advantage of the European single market’s radiating effect.

Strategic Expansion of US Capital in the Crypto Ecosystem

In tandem with BlackRock’s strategic layout in Europe, US capital is rapidly expanding its footprint in the crypto ecosystem. In recent years, the US market has demonstrated remarkable performance in the digital asset space, driven primarily by the following factors:

Robust Financial Strength

The United States boasts the world’s most mature financial market, rich in capital market resources. US investors and institutions access digital assets through various channels, propelling the market’s scaled development. Private equity funds, venture capital, and hedge funds in the US are increasingly investing in blockchain technology and digital asset startups, providing the crypto ecosystem with a continuous influx of financial support.

Well-Established Innovation Ecosystem

The US is home to numerous world-leading tech companies and innovative teams, excelling in blockchain technology, digital payments, smart contracts, and more. The dual drivers of innovation and capital have created a self-sustaining ecosystem in the digital asset and related technology sectors. From technological R&D to product implementation and business model innovation, the US market has formed a complete industrial chain, demonstrating high market competitiveness.

Relatively Mature Policy and Regulatory Environment

Although there are some discrepancies among US states regarding digital asset regulation, the overall market benefits from substantial transparency and legal protection. US financial regulators, while formulating relevant policies, emphasize both market innovation and investor protection, thereby offering a relatively stable legal environment for the development of the digital asset market. This foresight and security enhance the strategic positioning of US capital within the crypto domain.

International Influence and Market Spillover Effect

US capital holds a pivotal role in global financial markets, and every move it makes in the crypto space can have far-reaching global effects. Whether it is the successful launch of Bitcoin ETFs or large-scale investments in digital asset startups, each step sends a clear signal: digital assets are becoming an essential part of the global financial landscape. This growing influence not only captures the attention of investors from Europe and Asia but also prompts regulatory bodies worldwide to reassess the strategic positioning of crypto assets.

Conclusion

BlackRock’s introduction of a Bitcoin ETP in Europe not only reflects the global institutions’ unwavering confidence in the future of digital assets but also brings more innovative products and investment opportunities to the market. At the same time, the expansion of US capital in the crypto ecosystem is advancing the evolution of the entire digital asset system through financial, technological, and regulatory enhancements. From product design and market strategy to international cooperation and technological innovation, the current digital asset market is undoubtedly at a critical juncture of rapid transformation and integration.

Responses