Dubai DFSA Releases RWA Regulatory Sandbox Guidelines, Middle East Market Momentum Continues to Rise

#RWA #DFSA #Dubai

On March 17, 2025, the Dubai Financial Services Authority (DFSA) released the Tokenisation Regulatory Sandbox Guide, marking the first time that tokenisation, commonly referred to as RWA (Real-World Assets), has been explicitly incorporated as a regulatory focus. Alongside this, the DFSA introduced the Innovative Testing Licence (ITL) mechanism, paving a realistic, clear, and practically operable compliance pathway.

Recently, the MGX Fund’s large-scale investment in Binance not only heightened market attention but also brought substantial capital inflows into the crypto market. For a market that has been severely lacking in long-term liquidity, such measures are undoubtedly highly welcomed.

As crypto investors from the UAE, Saudi Arabia, and other Middle Eastern regions gradually increase their involvement, a strong trend of speculating on “Middle East concept coins” has emerged. The Tokenisation Regulatory Sandbox Guide clearly demonstrates that Middle Eastern authorities aim to capitalize on this momentum and timing to further enhance and solidify the influence of Middle Eastern capital in the global investment market.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Interpretation of the RWA Regulatory Sandbox Guide

The Dubai Financial Services Authority (DFSA) recently released a new guide, formally incorporating Tokenised Investments into the regulatory framework and clearly distinguishing between two types of tokens:

- Security Token: Tokens representing ownership of assets, similar to traditional securities.

- Derivative Token: Tokens that derive their value from an underlying asset or benchmark.

The implementation of this measure signifies that tokenised assets are no longer in a regulatory grey area, providing a clearer compliance basis and regulatory framework for Real-World Assets (RWA) projects within the Dubai market.

Particularly in areas such as real estate, supply chain finance, commercial paper, and bonds, the DFSA’s policy significantly reduces compliance uncertainties, offering more practical regulatory guidance for institutional investors and startups alike.

DFSA Sandbox Mechanism: Supporting the Compliance Development of RWA Projects

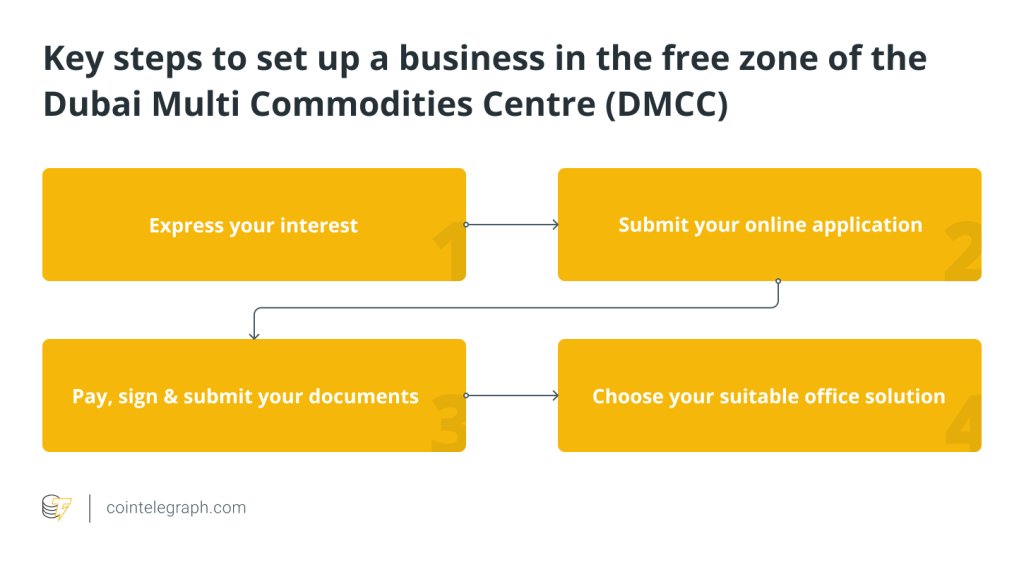

The Dubai Financial Services Authority (DFSA) has introduced a sandbox mechanism tailored for various types of Real-World Assets (RWA) projects, allowing eligible companies to apply for participation. These eligible entities include:

- Companies that issue, trade, hold, or settle tokenised investments (such as stocks, bonds, sukuk, and collective investment fund units).

- Financial institutions that already hold a DFSA financial license and wish to expand into tokenisation business.

- Corporate teams with a deep understanding of applicable legal and regulatory frameworks.

This means that whether it’s a traditional financial institution or a startup team focused on RWA asset digitization, both can leverage the DFSA sandbox mechanism to experiment at a low cost and explore business models.

Especially for small and medium-sized RWA startups, the phase-based regulatory exemption policy offered by the sandbox effectively reduces compliance trial-and-error costs, enabling them to validate product feasibility at an early stage and lay the groundwork for future licensing.

ITL Tokenisation Cohort: A Low-Threshold Innovation Testing Mechanism

Notably, the Dubai Financial Services Authority (DFSA) has introduced an innovative testing license mechanism called the Innovation Testing Licence (ITL) Tokenisation Cohort. This mechanism allows RWA project participants to enter the market without fully meeting capital requirements or risk control obligations. It enables them to test products and business models in a real-world environment before gradually transitioning to a fully licensed stage.

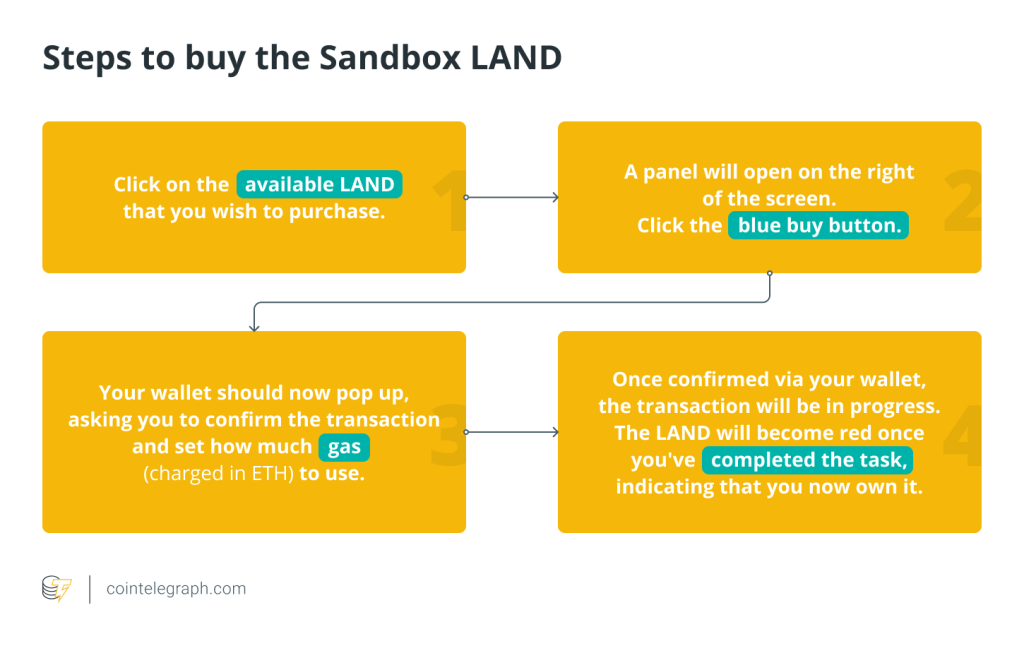

As mentioned earlier, this approach outlines a realistic, clear, and practical compliance pathway, divided into three stages:

1. Expression of Intent Stage

Project participants must submit an expression of intent, outlining their plans to conduct tokenisation business within the Dubai International Financial Centre (DIFC). The DFSA will conduct a preliminary assessment of the company’s background, governance structure, and technical solutions.

2.ITL Testing Stage

After passing the initial assessment, companies enter a 6 to 12-month testing window. During this period, project participants can enjoy exemptions from certain capital requirements, prudential obligations, and reporting duties, allowing them to connect to the real market environment at a low cost. However, the DFSA will continue to monitor the project, ensuring that information disclosure, Distributed Ledger Technology (DLT) system security, and custody arrangements comply with regulatory standards.

3.Licensing and Transition Stage

At the end of the testing period, projects must choose between:

- Applying for a full DFSA license to officially enter the market.

- Exiting the market according to the exit mechanism.

For projects that fail to meet regulatory standards, the DFSA will strictly enforce the market exit mechanism, ensuring the healthy development of the industry.

Scope of Policy: Limited to RWA Tokenisation

It is important to note that the sandbox mechanism introduced by the Dubai Financial Services Authority (DFSA) is strictly limited to the tokenisation of traditional financial assets and Real-World Assets (RWA). It does not cover other types of crypto projects, such as Crypto Tokens and Fiat Crypto Tokens.

This approach reflects the DFSA’s proactive attitude towards the RWA market, while maintaining a cautious regulatory stance on crypto assets.

How Will the New DFSA Policy Impact the RWA Market?

The Tokenisation regulatory framework and sandbox mechanism introduced by the DFSA essentially provide a low-risk pathway from Proof of Concept (PoC) to commercial implementation. Compared to the lengthy licensing process under traditional financial regulatory environments, this mechanism lowers the entry threshold for RWA projects, allowing companies to enter the market quickly, adjust product direction, and gradually move towards full compliance while meeting regulatory requirements.

- For Startups: This means they can test product logic at a relatively low cost in the early stages without immediately bearing high compliance expenses.

- For Traditional Financial Institutions: The mechanism creates space for compliant innovation, enabling them to explore tokenisation business in a controlled environment without compromising the stability of existing financial licenses.

Overall, the DFSA’s initiative not only sends a positive signal to Dubai’s local financial market but also provides a valuable regulatory model for the global RWA market. As the compliance pathway becomes more defined, RWA tokenisation is expected to become an essential bridge connecting traditional finance with the digital asset market.

Responses