SuperEx丨Unlocking the Potential of Berachain: The Future of DeFi and Blockchain Innovation

#SuperEx #DeFi #Berachain

In the rapidly evolving world of decentralized finance (DeFi), Berachain emerges as a breakthrough blockchain solution. Unlike traditional blockchains, Berachain introduces the revolutionary Proof of Liquidity consensus model, which not only enhances liquidity but also strengthens the security of decentralized applications (dApps). By focusing on seamless integration with Ethereum, Berachain provides a modular framework that allows developers to build with ease while tapping into powerful DeFi tools like automated market makers (AMM), lending protocols, and perpetual contracts.

As a high-performance blockchain, Berachain is designed to solve major challenges in DeFi, including liquidity fragmentation and scalability issues. Through its decentralized ecosystem, users and developers benefit from a robust and secure platform that makes financial applications more accessible, faster, and more scalable. This integration of cutting-edge features positions Berachain as a key player in the next-generation Web3 ecosystem.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Berachain’s Technological Innovation: Liquidity as Consensus

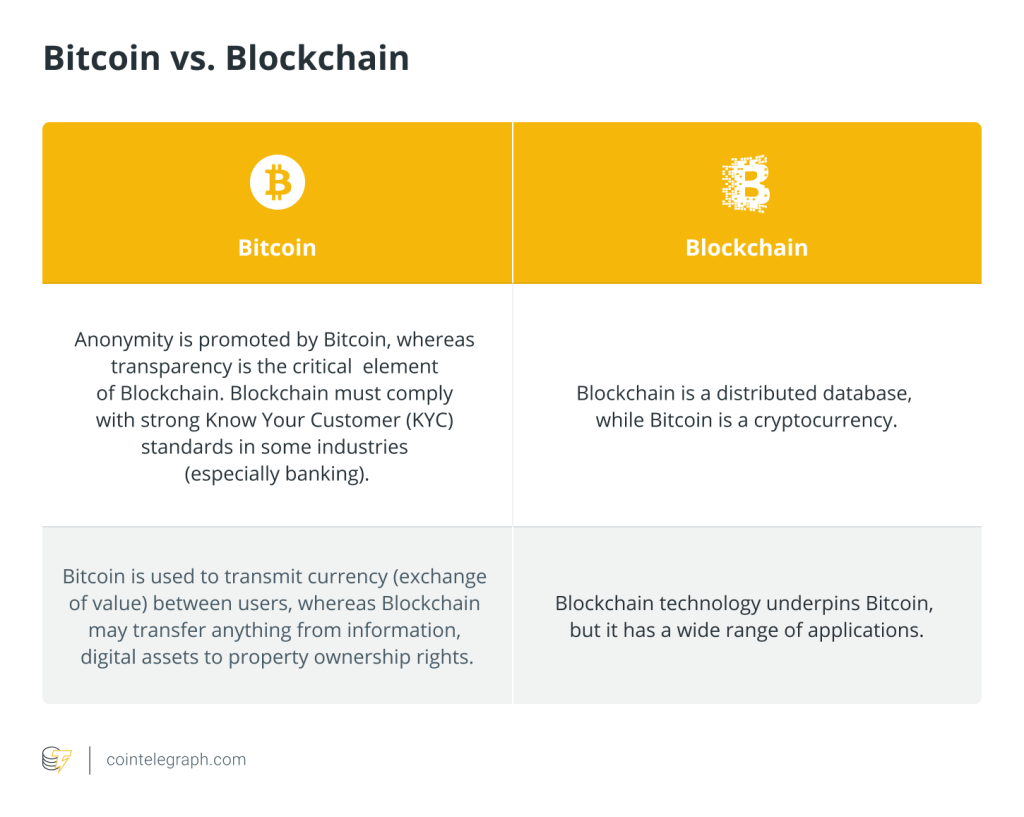

Unlike traditional Proof of Work (PoW) or Proof of Stake (PoS) models, Berachain adopts Proof of Liquidity (PoL) as its core consensus mechanism. This innovative model ensures that liquidity is not just a component of DeFi transactions but a fundamental driver of network security and sustainability.

How does the PoL mechanism work? In the Berachain ecosystem, validators must provide liquidity to gain network consensus rights, rather than merely holding or staking tokens. This means that network security is directly tied to the health of the ecosystem — the more liquidity, the stronger the network.

Advantages of PoL:

- Incentivizes active liquidity: Prevents token hoarding and promotes capital movement.

- Enhances security: Network security correlates with ecosystem activity, reducing attack risks.

- Reduces system inefficiencies: Encourages liquidity provision over passive token holding, unlike PoS.

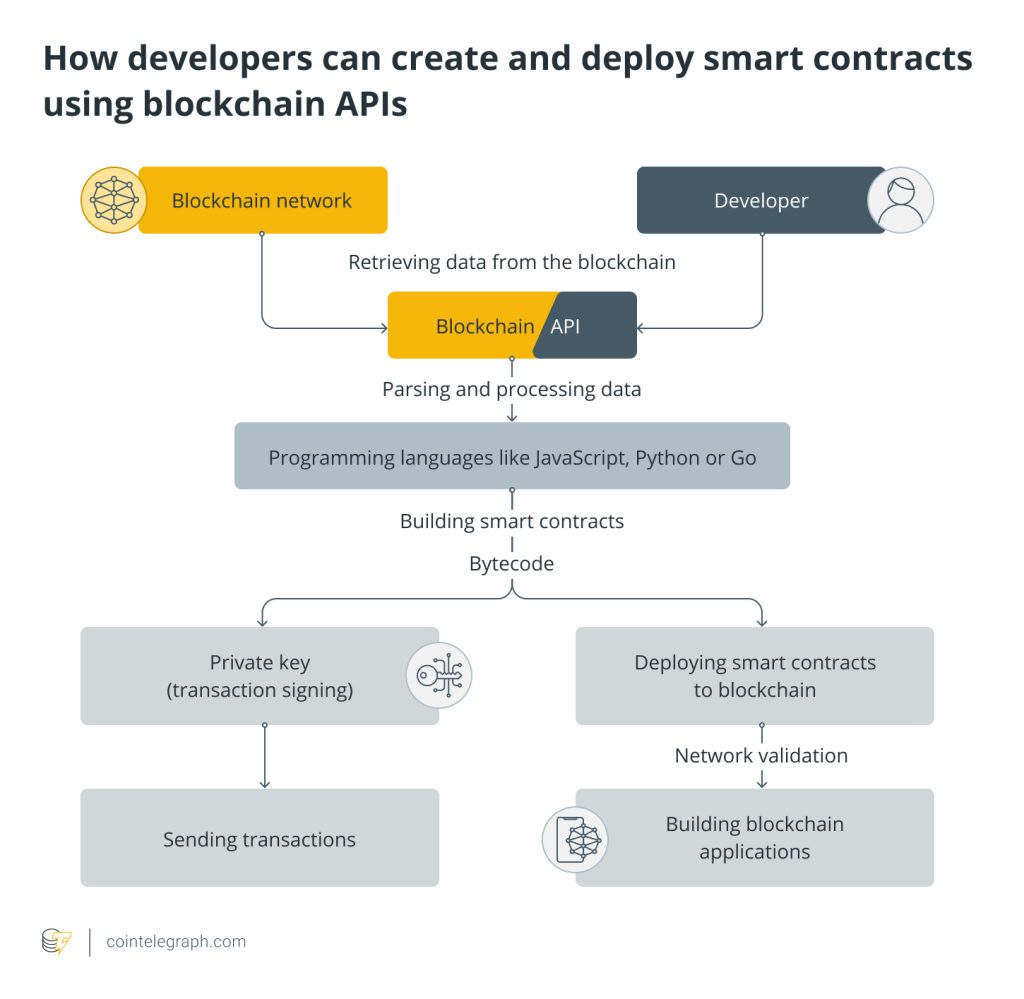

EVM Compatibility: Easy Integration for Developers

Berachain is designed as an Ethereum Virtual Machine (EVM)-compatible Layer 1 blockchain, making it highly accessible for developers.

- Low migration cost: Developers can seamlessly migrate existing Ethereum dApps without learning new languages or adapting to different tools.

- Broad tool support: Works with MetaMask, Hardhat, Remix, The Graph, and other major development tools.

- Seamless DeFi ecosystem integration: Easily connects with Ethereum-based DEXs, lending protocols, and NFT platforms, enhancing composability.

Unlike other emerging blockchains that require developers to rewrite code, Berachain lowers the barrier to entry and accelerates ecosystem expansion.

Berachain’s Core Ecosystem

Berachain is more than just a blockchain — it’s a full-fledged decentralized financial ecosystem. Its core functionalities include:

1. Automated Market Maker (AMM) & DEX Trading

Berachain incorporates AMM mechanisms, providing liquidity pools that allow users to swap assets efficiently, with reduced slippage and better capital utilization.

2. Lending Protocol: Unlocking Liquidity

Users can leverage their assets as collateral to borrow other tokens, maximizing capital efficiency. Berachain’s PoL mechanism ensures a more stable interest rate and a healthier lending market than traditional DeFi platforms.

3. Perpetual Contracts: Hedging Against Market Volatility

For traders and institutional users, Berachain offers perpetual contracts that enable leveraged trading while maintaining on-chain transparency and security.

$BERA Tokenomics: Powering the Berachain Ecosystem

As the native token of Berachain, $BERA plays a crucial role across multiple functions:

- Governance Voting: $BERA holders participate in proposal voting, influencing protocol upgrades and development.

- Liquidity Mining: Users earn $BERA rewards by providing liquidity, incentivizing long-term ecosystem participation.

- Transaction Fees: $BERA is used as gas fees for network transactions, ensuring efficient processing.

- Staking Rewards: Users can stake $BERA to earn additional rewards while reinforcing network security.

This tokenomic structure ensures the long-term sustainability of Berachain while attracting a diverse range of participants.

Market Potential: A Key Player in DeFi 2.0

Berachain is gaining significant attention because it effectively fills critical gaps in the current DeFi landscape:

- Solving Liquidity Fragmentation: Through PoL, Berachain maintains healthier liquidity pools, increasing capital efficiency across DeFi protocols.

- Enhancing DeFi Trading Experience: Reduces transaction costs and increases transaction speeds, benefiting both retail and institutional investors.

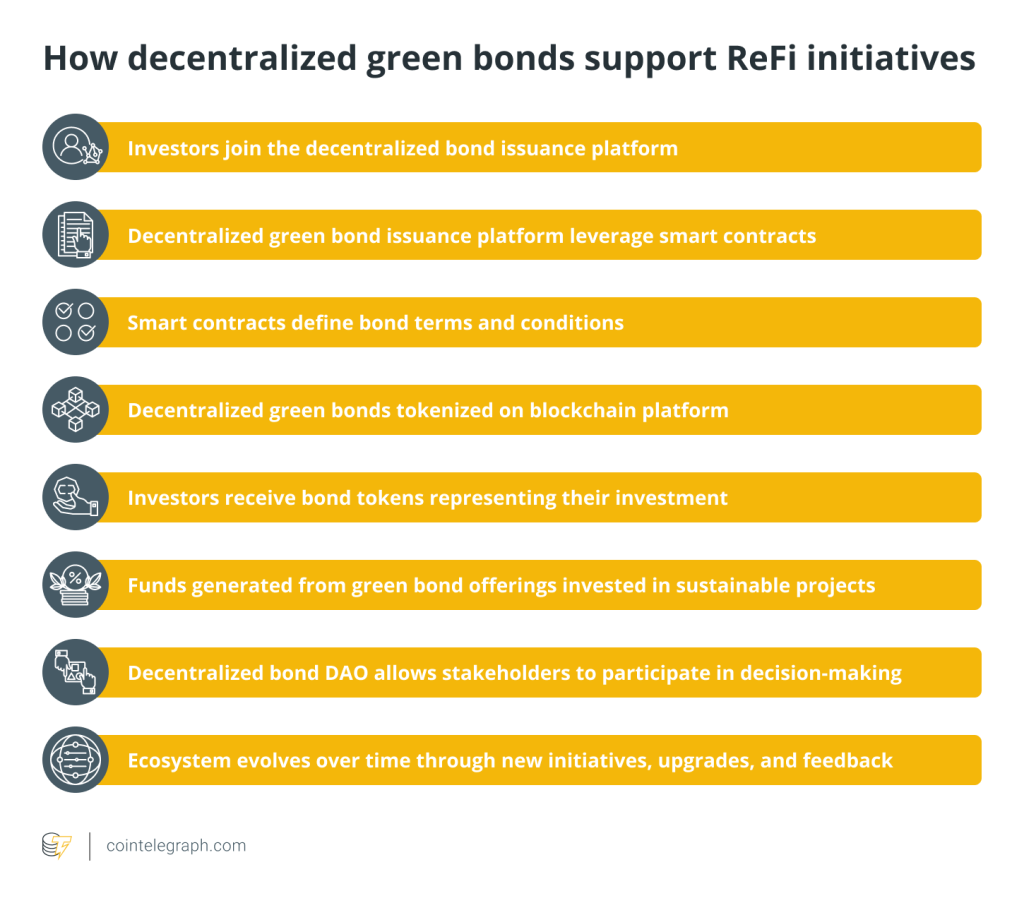

- Decentralized Governance: The introduction of DAO governance ensures that the platform evolves based on community needs, avoiding the centralization risks of CeFi exchanges.

In the Web3 era, a successful DeFi project must possess strong technological capabilities, efficient liquidity management, and an open ecosystem. Berachain meets all these criteria.

Future Outlook: How Will Berachain Drive DeFi Evolution?

Berachain’s future development will focus on:

1. Expanding Ecosystem Partnerships: Collaborating with more DeFi projects, NFT platforms, and metaverse applications to create a diverse decentralized financial landscape.

2. Optimizing User Experience: Enhancing Layer 1 efficiency for faster, cheaper transactions while improving UI/UX to lower entry barriers for users.

3. Strengthening DAO Governance: Empowering the community to shape the platform’s direction, ensuring alignment with user needs.

As a next-generation blockchain protocol, Berachain is redefining the future of DeFi. Whether you are a developer, trader, or long-term investor, Berachain presents an unprecedented opportunity.

Responses